If the 393 employees of payment fintech GoCardless wanted to play a prank on their boss, Hiroki Takeuchi, they would all take a morning off. He would think they had all jumped ship.

“I still feel this level of imposter syndrome; I’m worried that everyone’s going to stop turning up to work one day,” says Takeuchi, who founded the business in 2011 with Tom Blomfield, now founder of digital bank Monzo, and Matt Robinson, who now runs proptech startup Nested. “It’s kind of weird — you start this thing with a couple of friends in your bedroom, and then you build a team of people and an organisation that follow you on this journey — it feels quite foreign.”

I still feel this level of imposter syndrome; I’m worried that everyone’s going to stop turning up to work one day.

“So sometimes I turn up at work, and if the sales and marketing team have an offsite, I’m like, ‘Oh my god, it’s happened’.”

Takeuchi should have less to fear than most founders; he’s one of the most widely-respected leaders in London’s startup ecosystem. Employees, former employees, investors and other founders all speak highly of him.

A direct debit platform to rule them all

Over the eight years he has led GoCardless it has grown to serve over 50,000 businesses around the world, opened offices in France, Germany, Australia and the US, and raised $122m from a list of top investors.

It’s also built a new network, launching today, which Takeuchi is pretty excited about; a platform that lets companies receive recurring payments from multiple countries without the need to open bank accounts in those locations. Fellow London fintech TransferWise will provide the foreign exchange.

“When we first started we built this thing on direct debit in the UK — and it was always kind of annoying because it only worked in the UK, which was quite limiting,” explains Takeuchi over brunch at Shoreditch’s Hoxton Hotel. “We were struck by how all of these systems existed around the world, similar ones, but they didn't talk to each other and they worked in very different ways. In the early days that was kind of a hindrance — we want to be able to serve customers everywhere — but then over the last couple of years we've been building this network that plugs them all together.”

From startup to scaleup

GoCardless is now firmly in scaleup mode. Gone are the days when the three original founders would take bets on when they’d first process a million pounds a month (they missed their target — the forfeit was “quite embarrassing” and is “never going to be on the record,” says Takeuchi). Gone are interviews down the pub. Gone are unlimited holidays (“a terrible idea — typically, the better the employee the less holiday they took”).

Unlimited holidays are a terrible idea — typically, the better the employee the less holiday they took.

Now the company has processes and big clients and “grownups”; seasoned executives like chief operating officer Carlos Gonzalez-Cadenas, previously chief product officer at Skyscanner, chief people officer Yvonne Agyei, who previously held the same role at Booking.com, and chief financial officer Catherine Birkett.

“Up until that point we were all learning on the job,” says Takeuchi, who had a brief stint as a management consultant before founding GoCardless. He began running the company solo in 2015 when Robinson left. “I'd never even managed anyone before I started this company.”

The organisation OS

The transition from small to medium-size company hasn’t been easy; it can’t operate as it once did and neither can the leadership.

“We need to be a bit more prescriptive about how we work together,” says Takeuchi, who’s thought a lot about how to set “operating principles” for the company recently: how meetings are run, how decisions get made, how people communicate. “I'd always avoided doing that because I felt a little bit uneasy about the idea of trying to control people's behaviour too much.”

“But we have all these different people coming in with different backgrounds, and lots of things are breaking, like the way we run meetings — everyone's got a different approach.”

“In the early days, we were just so against the idea of any kind of process that we just didn't have anything,” he adds, while tackling a tough piece of toast which has arrived underneath some smashed avocado. “But as you scale you realise that that doesn't really work, and it just becomes really chaotic and everyone gets really unhappy.”

“What makes people even less happy than not being involved in a decision is no decision getting made.”

“We're in that stage of the life of our company where a lot of it is still quite organic, it's great. And what I think we need to get right in the next phase, is how do we set the foundation of that in a slightly more concrete way? So that as the company scales across countries and becomes bigger and bigger, we don't rely on purely organic means to create that great culture because it's very easy for it to get lost. And that's something I worry about a lot.”

“I worry a little bit more about the things that will kill us slowly than the things that will kill us fast,” he adds: culture being one of them, big shifts in technology being another. There's also the chance that bigger payments companies like Stripe and Adyen encroach on GoCardless' territory.

Founder vs. chief executive

Takeuchi hasn’t always figured these things out for himself. He’s worked with several coaches over the years and learned even more from the people he’s worked with at GoCardless.

I always say I'm the least experienced person in the organisation.

“I always say I'm the least experienced person in the organisation because I've never run a 400-person organisation before, and I didn't run a 50-person organisation before we got to 50.”

Surprisingly, one of the things he found most difficult to embrace was the role of the founder.

“As the company scales the role of the founder becomes more about being the heart and soul of the company. That founder story is incredibly powerful and that was something that I personally found very awkward because I don't really like being the centre of attention,” says Takeuchi, who had more or less stayed clear of press until having a life-threatening bike accident in 2016. “The CEO role is more like a professional job.”

Part of the role of the founder is also to set, and stand for, the company’s values. GoCardless has four — Start with why, Take pride, Be humble, Act with integrity — and it’s easy to see where they came from.

Takeuchi isn’t one to brag. He says the months he spent in the US on the Y Combinator accelerator back in 2011 were difficult. “I really struggled in San Francisco, to be honest with you. There is a bit of a culture of that ‘We're killing it, we're crushing it’ kind of thing. I find it tiring. I don't really like that. I prefer to be a bit more honest.”

Of course, he’s had to repeatedly pitch a big vision for the business, but these days investors focus more on execution and numbers than jazz hands. “Especially as it gets to the later stages, the business speaks for itself.”

He also doesn’t strike me as someone who takes shortcuts. “I personally am someone that cares a lot about how you get somewhere, not just where you get to,” he says, finishing off his overdone eggs and avocado. “I don't really want to build a big successful company if we're lying, cheating, stealing to get there. I don't believe the ends justify the means.”

The GoCardless mafia

There are some things Takeuchi misses about the early days. “Knowing everyone on the team — having much more of a peer relationship with everyone you work with — that’s the thing I miss the most,” he says. “As the team grows, I can't know everyone as well, which is kind of a weird feeling.”

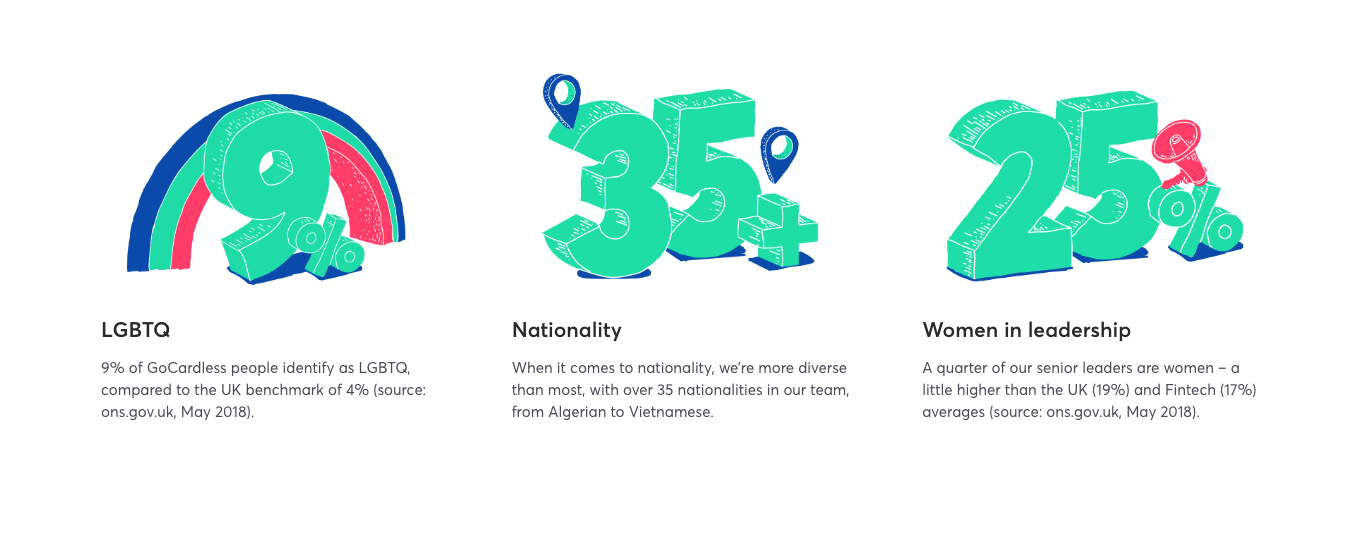

As a case in point, when I ask about GoCardless’ diversity targets — it’s aiming to have a 45% female workforce by 2020, with 18% of tech roles and 25% of leadership roles taken by women — Takeuchi draws a blank. “I didn’t even know we’d done that — but I think it’s awesome,” he says. “If we’re trying to hire engineers, it’s always going to be easier to hire a guy than a girl because there’s a lot more in the market — [unless] we set ourselves some fairly meaningful targets to aspire to and are quite public about that.”

GoCardless’ influence spreads beyond its current employees; there’s a growing GoCardless “mafia” too — ex-employees who’ve gone on to start their own companies, like Duffel, Shipamax and Dependabot.

“It’s one of the things that makes me really proud,” says Takeuchi. “Of the early employees, probably 50% plus were people who I thought were probably going to start companies one day.”

“This is what is really going to define the success of London as an ecosystem in the long term,” he says. When GoCardless launched, running a startup was not a normal thing to do after finishing a degree. “All of my friends thought we were unemployed.” Now GoCardless is a role model in a booming fintech scene.

“Seeing [London] grow as an ecosystem — people getting experience in one place, and then going and starting the next things — that’s something I’m really excited about.”

What next?

Takeuchi doesn’t seem like one of those founders always on the hunt for the next big thing. Unlike fellow fintech founder Taavet Hinrikus, now an active angel investor, Takeuchi says he's not looking to move on — despite having a burgeoning “mafia” on his doorstep that he could turn to. “I’m just focused on what we’re doing right now.”

He’s also not planning life after GoCardless just yet. “I don’t think about it a huge amount; my wife probably thinks about it more than I do.” After all, he’s got a global payments network to build first.