For European healthtech startups, Germany should be the promised land. It has the largest healthcare system in Europe (and the second largest in the world), the continent’s strongest economy and a population of 83 million people.

Yet it has been something of a dinosaur when it comes to digital health — with a ban on video consultations, no national digital patient records, and no e-prescriptions, digital innovation has stalled.

“The healthcare system is one of the biggest in the world, but it has been lacking digital advancements. Germany has been very slow to adopt,” says Filip Dames, founding partner of Berlin-based venture capital firm Cherry Ventures.

But now change is coming — and with coronavirus, telemedicine startups are on the frontline.

The new era

Late last year Jens Spahn, Germany’s energetic health minister, managed to get his Digital Healthcare Act approved by parliament. It would allow doctors to prescribe digital health apps to patients, offer online video consultations and write e-prescriptions — and be reimbursed for doing so.

It wouldn’t just be the doctors that would be paid to use digital innovation. More interestingly, the new regulation also means that telemedicine startups and app manufacturers at last have a way to get paid by someone other than their patients.

Whilst patients have been able to pay for video consultations out of their own pockets for a couple of years, or via private health insurance, until now they have not been covered by statutory health insurance — which covers 73 million Germans.

Digital Healthcare Act in short:

- Electronic patient records will be mandatory in pharmacies and hospitals as soon as possible, for the benefit of patients. The new act will also encourage electronic sick leave notices, e-prescriptions and other services that can be prescribed electronically.

- Online video consultations will become routine, and doctors will now be allowed to provide information on such services on their websites.

- Healthcare apps, like those tracking blood sugar levels, will be available on prescription. Statutory health insurance will pay for them.

Eyes on the prize

It’s especially good news for Swedish healthtech company Kry (also known as Livi), which opened an office in Berlin in early 2019 — before it could even roll out its services to all Germans.

“The reason why we launched in Germany at all was that we were pretty sure the system would change — but we didn’t think it would happen so soon,” says Kry chief executive Johannes Schildt.

We were pretty sure the system would change — but we didn’t think it would happen so soon.

At first, Kry’s video consultations were, by law, only available for those with private insurance or patients paying out of their own pocket. (Just 8–10% of Germans have private health insurance.) It was only in early August this year that the startup was given the thumbs up by the statutory health insurers. “This has been a huge step for us,” says Schildt.

Change is coming — but slowly

Still, telemedicine consultations haven’t taken Germany by storm just yet. TeleClinic, the leading telemedicine provider in Germany, has only hit 100,000 consultations since it started in 2015, despite being the first company to be accepted to treat patients on statutory health insurance.

In Sweden, by comparison, telemedicine startups provided more than 1 million consultations in 2019.

That’s partly because it isn’t actually that hard to get an appointment with a doctor in Germany (with the exception of Berlin). Back when Kry launched in Sweden in 2015, it was a different situation: the waiting times for seeing a doctor were long and patients’ frustration pushed them towards telemedicine startups.

But it’s also a question of getting to know the product. Since video consultations with doctors were only allowed two years ago, most people in Germany haven’t yet embraced them — or even learned that they exist.

“It is early yet in Germany,” says Schildt. “We saw this in Sweden too where we had a pretty long time of market education. This is exactly where we are in Germany today.”

Kry does not want to say how many consultations it has held in Germany to date, nor the number of doctors in the country that are using the platform. Even if the numbers are small, the telemedicine startup is not lacking capital since raising a whopping €140m at the beginning of the year.

The coronavirus crisis has also helped it expand its user base. In Sweden alone, Kry increased its consultations by 97% between February and March this year.

Coronavirus kickstart?

The coronavirus crisis has pushed both doctors and patients to seek digital solutions to replace physical consultations — and many startups jumped to offer free software solutions.

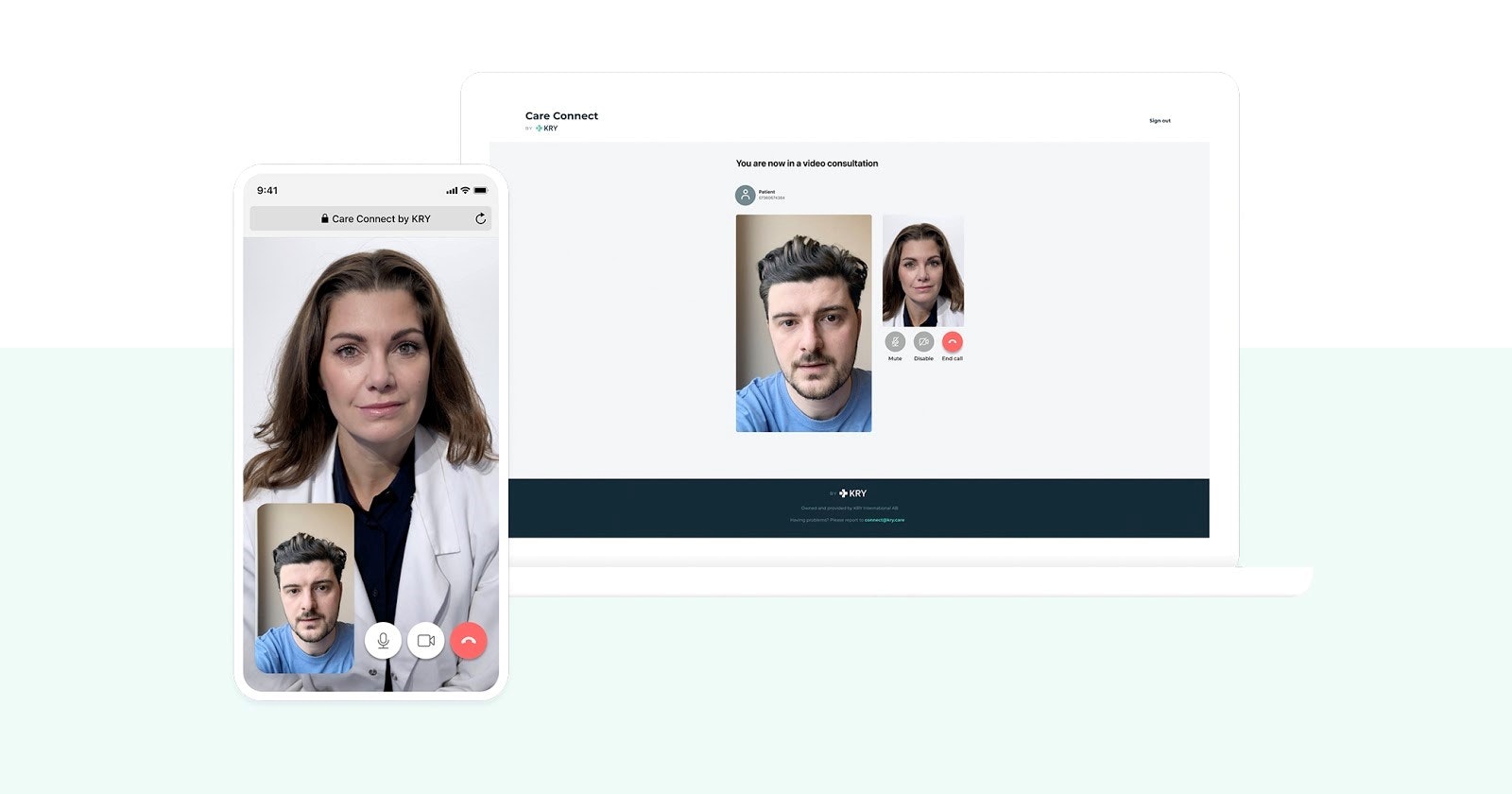

Kry launched a free online video consultation platform, Livi Connect, for doctors and nurses to use anywhere in Europe.

Doctor booking platforms like French Doctolib and German Jameda — and even UK-based telemedicine platform Zava — also began offering free video services to doctors in Germany during the coronavirus.

But not all are convinced that the telemedicine market in Germany has seen the upturn it needs to become an important part of the German healthcare system.

I think Germany will be our biggest market within three years.

“We are not there yet. The coronavirus has been a driver for it but it remains to be seen how it will continue,” says Eckhardt Weber, managing partner at the newly formed Berlin-based healthtech venture capital firm Heal Capital.

“Is telemedicine going to see linear growth or will something else push it to a level of being a relevant element of healthcare provision at a later stage? At the moment, I am still a bit sceptical,” he says.

Weber points out that the largest local actor TeleClinic, has had a tough ride. It raised just €9m since launching in 2015, and was acquired by the large Swiss digital pharmaceutical Zur Rose in July.

Still, even if digital health has yet to infatuate the German people, the goal of the Digital Healthcare Act is to make digital solutions a core part of the federal healthcare system. And the Kry chief executive doesn’t think it will take too long.

“Germany has the biggest healthcare system in Europe and is one of the most important ones for us. I think it will be our biggest market within three years,” Schildt says.