During the past five years, financial technology startups have been some of the most hyped, fastest-growing and best-funded in Europe.

But as the coronavirus pandemic begins to weigh on the economy, fears are growing that financial startups will be hit hard, as investors invest less and consumer spending slows.

Yet fintech is a broad sector, making it hard to generalise about the impact of coronavirus. So we've analysed how the different sub-sectors within fintech might fare in the short to mid-term amid virus shock and a potential recession.

An overview: Fintech during coronavirus

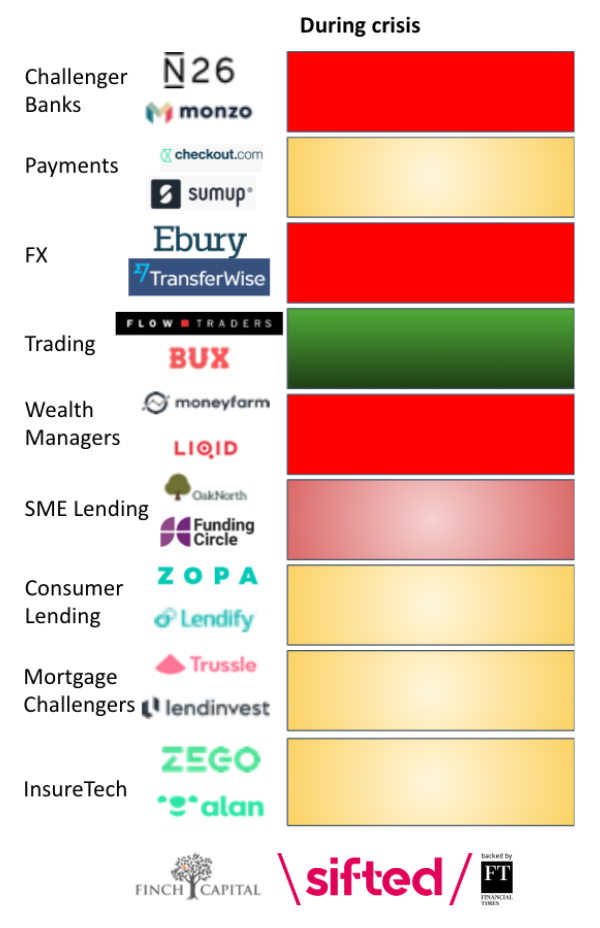

The graphic below summarises how each sub-sector will be affected for the duration of lockdown, according to an analysis by Sifted in collaboration with Finch Capital. It is a short-term analysis and not a projection of what the post-Covid-19 impact will be.

Those marked in red are predicted to see a steep (15%+) drop in growth, yellow indicates the sector will see minimal growth/slight degrowth, and green indicates a strong (15%+) uptick in revenues or sticky users.

Our thesis is that digital banks, foreign exchange (FX) companies, wealth manager apps and small and medium-sized enterprise (SME) lenders will struggle the most in the next six months and are likely to see a decline in revenue and users.

It's worth noting that, of course, these sub-categories aren't everything; the fate of companies will also depend hugely on the stage they're at, their market fit and their cash reserves. For some, the crisis will also breed opportunity; particularly cash-rich, lean startups.

Nonetheless, by explaining the logic behind our core conclusions, we hope to help you make sense of how the next six months might play out.

Challenger banks

Such as: Monzo (UK), Monese (UK), Bunq (Holland), N26 (Germany)

Digital banks are still plagued by a trust gap, demonstrated by the fact most users still use them as secondary accounts. A financial crash could amplify that trust gap, leading to fewer users moving their salaries into their challenger accounts, or even causing existing users to withdraw the bulk of their deposits into 'brick and mortar' accounts. This could have an impact beyond the immediate crisis, worsened by reduced-interest rates, further reducing the margins they make on their remaining deposits.

Meanwhile, in the short term, payments are declining as consumer spending falls due to the global lockdown. Given the likes of Monzo make a portion of their money on interchange fees, this is a problem.

Digital banks that charge for their accounts, like Monese, N26 and Revolut, are also likely to see a dip in subscription openings, especially amid a crackdown in travel.

N26 cofounder Maximilian Tayenthal confirmed that the Berlin-based bank has already seen this. “Our customers' card sales in March have so far declined. In certain markets we’re seeing a 10% drop in account openings,” he told Bloomberg.

Moreover, if the crisis spills into a recession, investors expect business-to-consumer (B2C) challenger banks to be an obvious target for opportunistic M&A, assuming valuations dip to a more affordable level.

"[A recession] will especially hurt challenger banks," concluded Rosenblatt Securities, a US brokerage company, in an analyst note, highlighting these companies' high burn rate, reliance on marketing and incumbent players' advantages in a crisis.

Nonetheless, Angelique Schouten, chief commercial officer of cloud-banking platform Ohpen, argued that incumbent banks will face greater pressure during the lockdown because of "the number of processes that are still human and/or paper-driven and initiated". Indeed, digital banks at least have the benefit of digital onboarding and an existing infrastructure for mobile-only banking.

To this point, Speedinvest partner Stefan Klestil told German media Finance Forward that the lockdown will highlight the benefits of digital banking and could trigger a "growth-spurt" in future. He also argued that "existing investors will continue to support their good companies [like N26]", countering theories that digital banks will see down-rounds if the turmoil exists.

This may well help N26 and Revolut's early efforts in the US; however, bank branches have already seen a gradual decline in footfall in Europe, so a better digital interface alone is unlikely to sway local users.

Payments

Such as: Checkout.com (UK), SumUp (Germany), Modulr (UK)

In the payments sector, we are unlikely to see startups crash and burn because of coronavirus. Payments has proven itself it be a fairly resilient industry during past crises, leading the Mercator research group to predict "lower growth...rather than negative growth." Yet how hard individual firms get hit depends on a couple of key differentiators.

Those will a big online exposure should be ok. There has been a surge in e-commerce payments in the lockdown as people order online, which should help mitigate for the general downturn in consumption, transactions and cross-border payments.

Business-to-business (B2B) payment companies which automate invoices, for instance, are also better insulated because they enjoy long term contracts.

However, Visa and MasterCard have warned that sales will fall short this quarter by 2-4%, which will also trickle down to merchant acquirers (like Worldpay, which process your card details).

Purely offline payment services, like German startup SumUp, will be worst hit during the lockdown.

'Many fintech founders have never worked through a recession, so have little experience of how to ride a crash.'

FX

Such as: TransferWise (UK), Azimo (UK), TransferGo (UK)

Currency exchange startups are one of the sectors predicted to be 'in the red' overall.

Looking at the drop in share-price of public companies in this area, like Alpha FX, can also be a helpful indicator. Part of this assumed vulnerability is linked to the way these firms lock in large trades ("forwards") with their clients, which may now be completed at a weaker price.

Meanwhile, for money transfer startups that serve business clients, payments are likely to stall amid the lockdown given business is slowly grinding to a halt.

In particular, startups serving the remittance market are likely to see a decline in volumes in the near future, with the World Bank predicting a 20% drop in volumes in 2020. Money sent back to workers' families largely flow from West to East, but incomes for millions of people in the West are currently uncertain. Therefore it's likely the stream of cash sent home by blue-collar workers will reduce for processors like Azimo and World Remit.

Nonetheless, even if volumes are hit, Azimo co-founder Michael Kent says they're seeing user-numbers grow as customers move to digital transfers. He also expects the unemployment rate in Europe (where Azimo is focused) to drop less than in the US, based on population distribution.

Trading

Such as: Bux (Amsterdam), Freetrade (UK), Trade Republic (Germany)

Uncertainty breeds volatility and volatility is gold dust for trading companies, as each trade executed provides a small revenue cut.

Digital trading startups like FreeTrade and Bux have reported a boom in volumes in recent weeks as traders attempt to “buy-the-dip”, so for now, it’s good news for the sector, which has taken on incumbent players with cheaper fees. Indeed, Germany's Trade Republic has extended its Series A this week to attract new investors hoping to profit from the uptick.

Having said that, the likes of US-based Robinhood may have seen too much trading, given their system has collapsed several times in recent weeks due to technical overload.

And the biggest gains will come if Europe's "zero-commission" startups can retain new users and sell them more lucrative products than basic single-stock UK trading. It remains to be seen if they will be able to convert customers in this way.

The other short-term winners will be fintechs providing trading infrastructure.

Wealth managers/ Robo advisors

Such as: tickr (UK), Liqid (Germany), Wealthify (UK)

A wave of digital wealth managers have emerged in recent years to attract Europe's millennial traders (notoriously reticent retail investors). Wealth managers differ from trading apps in that they do not encourage "buy-and-sell" behaviour, but rather long-term investing. With their friendly interfaces, pre-packaged stocks and low fees, they've managed to gently lure in a new audience.

However, a financial downturn could be damaging for wealth managers, as investors get scared and withdraw their deposits.

"Severe volatility and the lack of recovery in public stocks may scare away investors, especially millennials... Investors using robo advisors... may gravitate away towards established wealth management shops (Charles Schwab, Fidelity Investments, Morgan Stanley) who have matched the 'zero commission' model of e-brokers and also offer the comfort of human advice," the Rosenblatt report highlighted.

This is bad news as robo-advisors largely make money from fees on their assets under management. That means the smaller the uptick in assets, the less money they make. Nonetheless, the economic effects of coronavirus are still under debate, so many users are reportedly holding their nerve.

'We are still growing positively despite the worst financial market in over 30 years. User behaviour has held up despite the environment," the cofounder of ethical trading platform tickr, Tom McGillycuddy, told Sifted.

No more hiding behind slow and lazy incumbents

Alternative lenders

Such as: Lendify (Sweden), Funding Options (UK), OakNorth (UK)

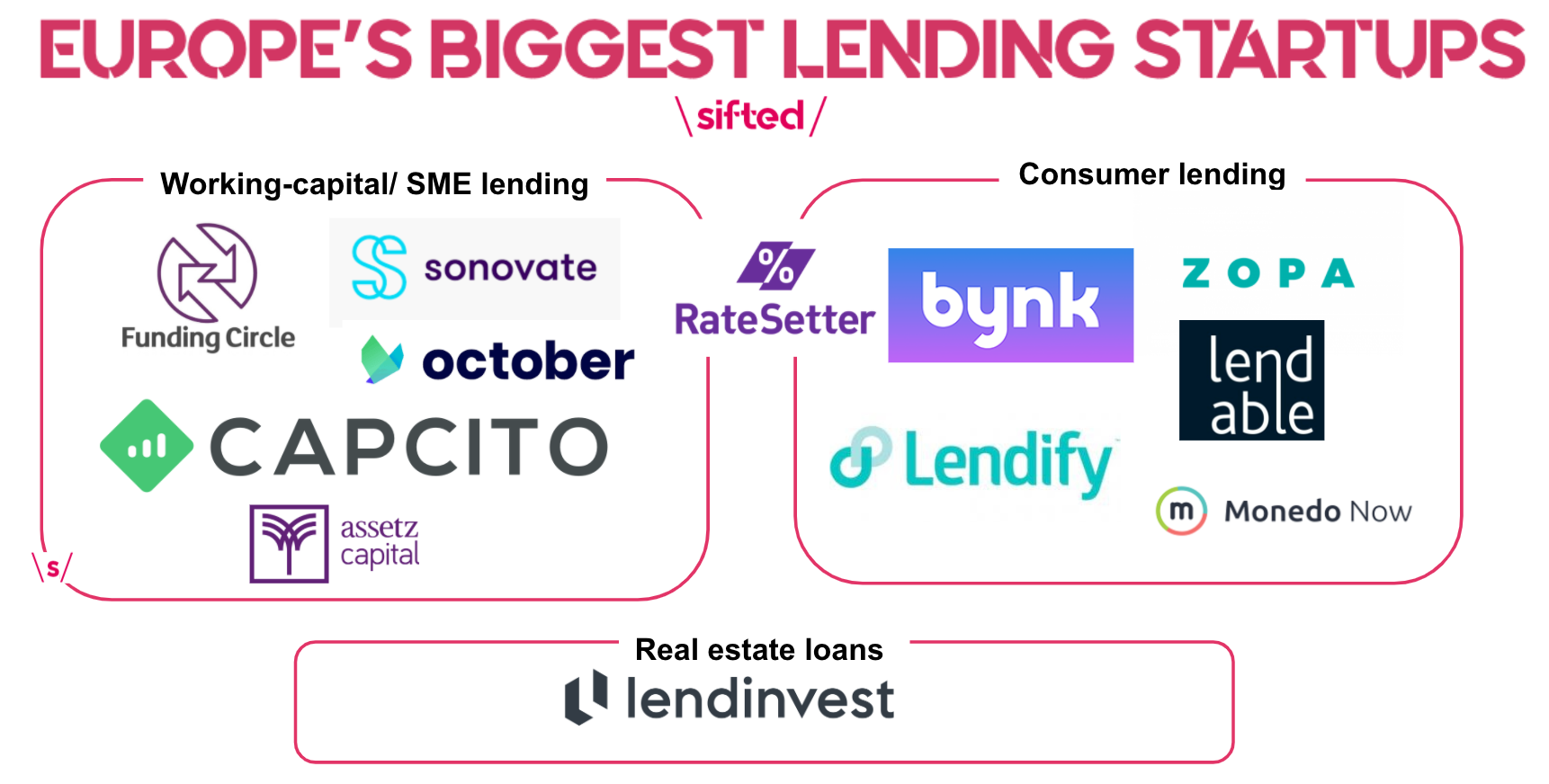

Digital credit providers have boomed in recent years (see below). Indeed, Europe's lending fintechs are estimated to have funded $9.6bn in loans by the end of 2020.

But an economic downturn would clearly be bad for these companies. Despite the need for loans going up in a crisis, lenders' risk appetite goes down.

Things are particularly tight for "distribution" platforms, who connect lenders and borrowers (called peer-to-peer, or P2P, lending) instead of issuing loans from their own balance sheet but instead. Although P2P lenders don't take on as much risk, they have no way to make a margin if they can't fill the loan request. That applies to the likes of Lendify, Zopa and Funding Circle.

It's also not easy for balance sheet lenders like OakNorth, which directly absorb the risk of people failing to pay back their loans.

"We're being tighter on credit," says David Chan, the chief executive of online consumer lender Monedo (formerly Kreditech). "This sector will definitely contract; it's simply risk aversion," he says, noting that issuing fewer loans means less revenue in the immediate term.

The SME lending sector is also likely to be worse hit, given the size of the loans they need compared to consumers. As a result, the government tends to step in here as the primary lender.

Nonetheless, this could be a big opportunity for the new sector of lenders dedicated to gig-economy workers and sole traders. This includes Steady Pay, Wollit (which is due to launch) and Mansa, which launched in Paris two months ago with a novel credit-scoring system.

"There's risk but this [downturn] is also an opportunity to build your brand," Mansa’s cofounder Ali Rami told Sifted.

A crisis also allows for opportunistic pricing, which can help offset losses, and for users to experiment with the benefits of digital-based lending.

Nonetheless, Monedo's Chan — who spent a decade at Barclays — warns that many fintech founders are too young to have had experience in riding a crash, and could misjudge the risk.

Insurtech

Insurtech has various verticals within it, so it's another mixed bag.

The virus should broadly create an opportunity for insurtechs focused on B2B analytics or software startups that provide tools to handle insurance claims.

"Insurers that haven’t fully digitised the claims process to date will come to the conclusion they have to," predicts the team at Finch Capital.

However, an economic slump could reduce demand for consumer-facing companies like Brolly and GetSafe that provide gadget insurance. Switching health providers is also generally not a priority. Moreover, business-to-consumer (B2C) insurtechs in the travel space, like Pluto, may also face issues with squeezed underwriting partners.

The exception to this will likely be gig-worker insurance provider Zego, which focuses on covering food-delivery workers (a sector which is seeing a boost). In the event of sickness, Zego's chief executive told Sifted that the sector's ability to be "flexible and nimble" in these times would prove its competitive advantages over incumbents.

More broadly, in the aftermath of a financial shock, the insurance sector tends to get a boost in demand. As a result, insurtechs should broadly emerge stronger in the post-crisis world, with both renewed investor and consumer attention.