Who doesn’t fancy the idea of having access to your own money as soon as you’ve earned it, rather than waiting until the end of the month? That’s the bet that an increasing number of European startups are making.

Across Europe, startups are tapping into the potential of creating platforms that give us ready access to our wage packets, with little or no fees, and no interest. A steady stream of funding announcements in recent months suggests that investors are also embracing the technology and what it can offer.

Salary on demand

Variously called flexible earned wage access (FEWA) or salary on-demand, the basic concept is simple: workers are able to access their money as soon as they’ve earned it, often down to the hour or minute. No waiting until the end of the month for a pay cheque, or struggling in those final days of the month to make ends meet.

“If you look at the prevalence of payday loans, that whole industry exists because people lack cash flow between pay cycles. Overdraft fees, credit card debt, a lot of that is generated by people having a lack of liquidity,” Peter Briffett, chief executive of London-based Wagestream, tells Sifted.

Wagestream, which was founded in 2018, instead allows employees to draw down a percentage of their earned wages, for a flat fee of £1.75. The company has so far raised a total of £65m (most recently a £20m Series B round in July), and has over 300,000 customers. It aims to double its staff of 72 over the next 12 months and hit 10x growth in terms of revenue and clients.

Briffett says that 55% of UK households don't have £250 in savings, meaning that if they have an emergency expense during pay cycles their only recourse is often to get a loan — “and if you are depending on your credit rating that loan may have horrible APR [annual percentage rate]”.

“If you have access to your earnings you can take that money without any interest at all, use it for something you need and then you don't have to go into debt,” he says. “It's the cycles of debt and payday loans that are very hard to recover from.”

Playing catchup to the US

When it comes to earned wage access, the US is still considered to be far ahead of Europe. In a July 2019 study, research and advisory firm Gartner predicted that by 2023, 20% of US companies with a majority hourly paid workforce would deploy flexible earned wage access solutions as part of efforts to improve employee experience, engagement and retention. However, adoption in the rest of the world would be less than half of that, it concluded.

“The US is a few years ahead of us, maybe three to five years, followed by the UK,” says Janis Putnins, founder of Latvian earned-salary-access startup Flipful, which was established in March 2019 and is currently focusing on the Baltic states. (Flipful is planning its own funding round towards the end of this year, or early in 2021.)

As with elsewhere, those pushing the technological solution in Europe must overcome caution among employers and employees, who are used to monthly pay cycles and could easily equate salary-on-demand with payday loans.

In order to have access to payroll information, startups operating in the sector must work with employers, and need to convince management of its value. While many salary-on-demand startups see themselves as the direct answer to the toxic legacy of Wonga and other payday lenders, which in some cases charged interest rates that spiralled to more than 5,000%, there is a distinct lack of awareness of what they are and offer.

“From my experience, around 30% of companies we talk to begin quite skeptical,” says Putnins. Meanwhile, he says, “10% say they would not offer it because they have this association with payday lending or they believe they shouldn’t interfere with employee finances.”

That leaves around 60–70% who are at least somewhat interested. Even so, “they want to see how it will develop and evolve, in particular because the financial education in some companies is a bit struggling,” he says.

Getting technology up to speed

It’s only been in the last few years that the technology and up-to-the-minute access to payroll information reached a level where financial apps of this kind were feasible.

“I think that earned wage access couldn’t have happened five years ago in Europe. You need to have precise information about whether an employee has worked or not on a given day, and how much, because that’s the way you de-risk the loans,” says Benoit Menardo, cofounder of Spanish startup Payflow, which closed its first funding round in July, worth €1.6m, months after it was founded by two former consultants at Bain & Company and BCG.

“In Spain, even now, some companies are still using Excel, big companies, you'd be surprised,” he adds.

At the same time, according to Payflow more than 60% of Spaniards have admitted to suffering financial stress in recent years, with the number likely to rise due to Covid-19.

In its first three months of operations Payflow signed up more than 30 companies, and it is already looking to expand into neighbouring countries. Even so, when it comes to awareness of earned wage access as a concept, Menardo says that “there is a lot of noise in the investment community, among entrepreneurs in general, but the awareness of the end customer is very low.”

Who pays?

There are different business models behind earned wages access, with some providers charging employers a subscription fee to allow employees free withdrawals, and others working on a model where those taking out the money are charged a small amount for each transaction. Some companies pay for their employees' first few monthly transactions, before they are required to step in.

90% of users will take out no more than 10% of their earnings in any given pay cycle, says Wagestream.

Wagestream’s data shows that active customers use their service on average 2.2 times a month, taking out an average amount of £76. 90% of users will take out no more than 10% of their earnings in any given pay cycle, the company says, potentially allaying concerns that it could lead to unhealthy spending habits.

At the same time, while the money technically comes out of the pay cheques, the earned wage access companies generally front the money, which is then reimbursed by the employers at the end of the pay cycle.

“A lot of companies like to keep hold of cash,” says Briffett, though he adds that some companies are now choosing to pay to use their technology but funding the salary payments themselves.

The future of pay

Going forward, Briffett says that there are a lot of startups emerging in the space, but also that companies like Cisco and Oracle are now looking at how they can incorporate flexible pay.

In a report from July 2019, CB Insights found over 30 companies dedicated to "unbundling the paycheck,” providing consumers with flexible access to wages, creative solutions for tackling debt, and more choices to improve financial health.

“You're going to see new technologies emerging from people like us, but you're also going to see quite a few of the incumbents offering this as an option for their clients, because it’s really looking like a massive benefit,” he says.

If anything, the coronavirus pandemic has further proved the value of the earned wage access model. “We saw at the beginning the entire hospitality industry dropped off a cliff in terms of shifts,” says Briffett. “But because of furlough and because we sit between the employer and employee we were able to allow any of our clients’ staff access to their furloughed money as they earned it.”

New client sign-ups were particularly strong in the second quarter, the company has said, with employers trying to make their workforce more financially resilient in the face of the global pandemic.

First step in a journey

Even so, some question the long-term model, seeing it simply as a first step in a larger journey towards offering ethical finance to workers and helping them gain control over their personal finances.

From my perspective, earned salary access is just a feature, and will be a zero margin business in the next five years.

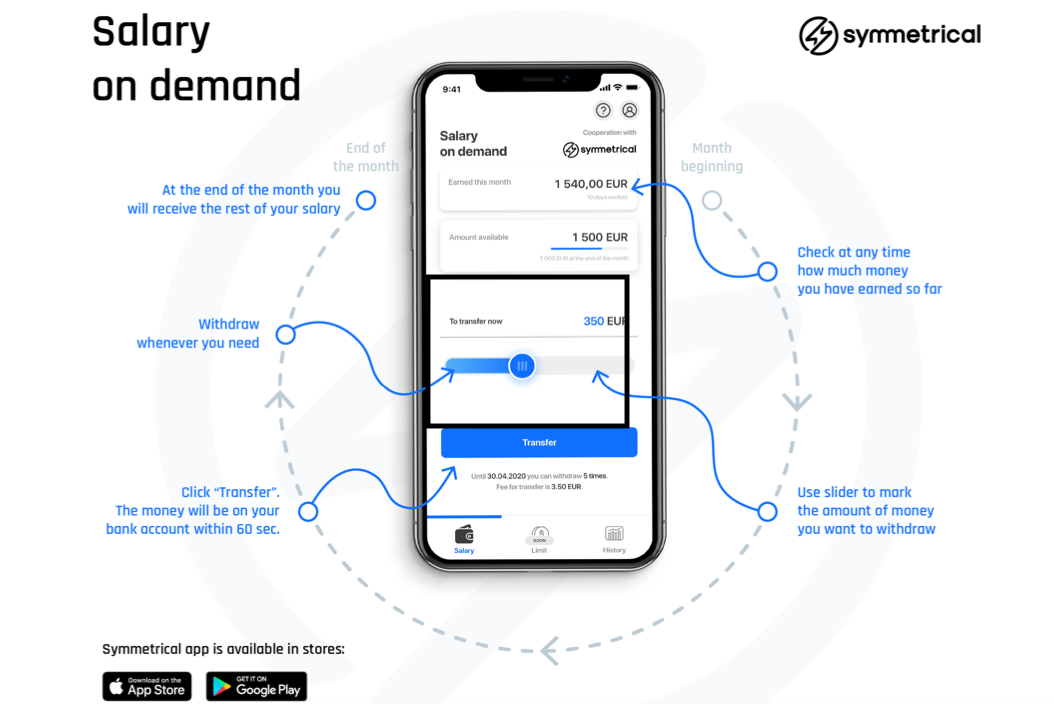

“From my perspective, earned salary access is just a feature, and will be a zero margin business in the next five years,” says Piotr Smolen, cofounder of Polish startup Symmetrical, which is focused on helping employees regain control over their personal finances through salary on demand and other financial services. The company signed its first client last September and now has 15 companies, mostly international brands, and access to 70,000 employees, with a few thousand active monthly users. In June it closed a €5.6m seed funding round.

“I believe that this is the right moment to offer something cheaper, faster, easier for the users, to increase inclusivity and give them access to a cheap source of liquidity,” he says. “It is a great place to start a relationship because right now it is needed, but our mind is much more around how to build a platform which will be a gateway for our user base to interact with financial markets the right way.” This includes zero interest employee loans and utilising an automated financial advisor.

Others are already pushing the technology onwards. In June, UK startup Hastee launched the world’s first earnings-on-demand debit card, with users able to access and spend their money in real-time as they earn it. “We’re excited to be spearheading a solution that revolutionises an outdated process and brings greater financial wellbeing to those who need it the most,” Hastee founder and chief executive James Herbert said at the time.

The startup was also the first in the UK to offer earnings-on-demand via an app, back in August 2017, where workers were able to withdraw up to 50% of their daily salary on the day they earn it. In December 2019 Hastee secured £208m in equity and debt financing.

No more payday loans

Those operating in the sector see a bright future.

“I'm really convinced that it will evolve, will grow, and everyone will know and will be using earning wage access services,” says Payflow’s Menardo. “It doesn't make sense that you're getting paid only once a month. Maybe one day you will even pay your rent this way, just like now you can rent a car per minute,” he adds.

Others suggest that within the next five to seven years it will have risen to become a well-known and ethical alternative to payday loans. “It's not payday lending 2.0, it’s a much, much better alternative,” says Flipful’s Putnins.