European quantum investment has reached new heights over the past few years, signalling a move away from prototypes and research to commercialisation.

According to Sifted data, the European quantum industry has received a YoY increase in funding since Q2 2024, with early stage and growth stage startups receiving €66.4m and €185.6m respectively by June of last year.

EU based quantum startups now also make up a third (32%) of all global quantum startups, according to research by the European Commission.

Leading European quantum startup IQM Quantum Computers successfully secured €275m ($320m) towards the end of last year in a Series B funding round led by US investor Ten Eleven. The funding round will work to accelerate IQM’s trajectory within US markets.

Yet Europe remains up against its wealthy neighbours from across the pond, whose pockets can stretch to accommodate for far longer R&D cycles, specialised talent and higher risk capital.

Big tech companies in the US such as Google and IBM started developing quantum computing over 15 years ago. Now the US leads the way globally with 77 quantum startups and $1.6bn in funding in 2025, according to McKinsey’s Quantum Technology Monitor report.

“The challenge in Europe is to scale and to make startups big. Even though we have a lot of startups, I think it's very challenging to have them scale and to be able to compete at a global level,” explained Jan Goetz, CEO of IQM Quantum Computers.

Public funding mechanisms are working hard to support European quantum startups in growing and succeeding. One public fund is the European Innovation Council (EIC), and with €10bn at its disposal, the fund ranks as the most active quantum investor since 2024.

In an interview with Sifted, Goetz unpacked Europe’s position within the global quantum industry, the challenges it faces and how public funds such as the EIC are helping to build sovereign capital within the field.

You started your company IQM Quantum Computers in 2019 — tell me more about the work you do.

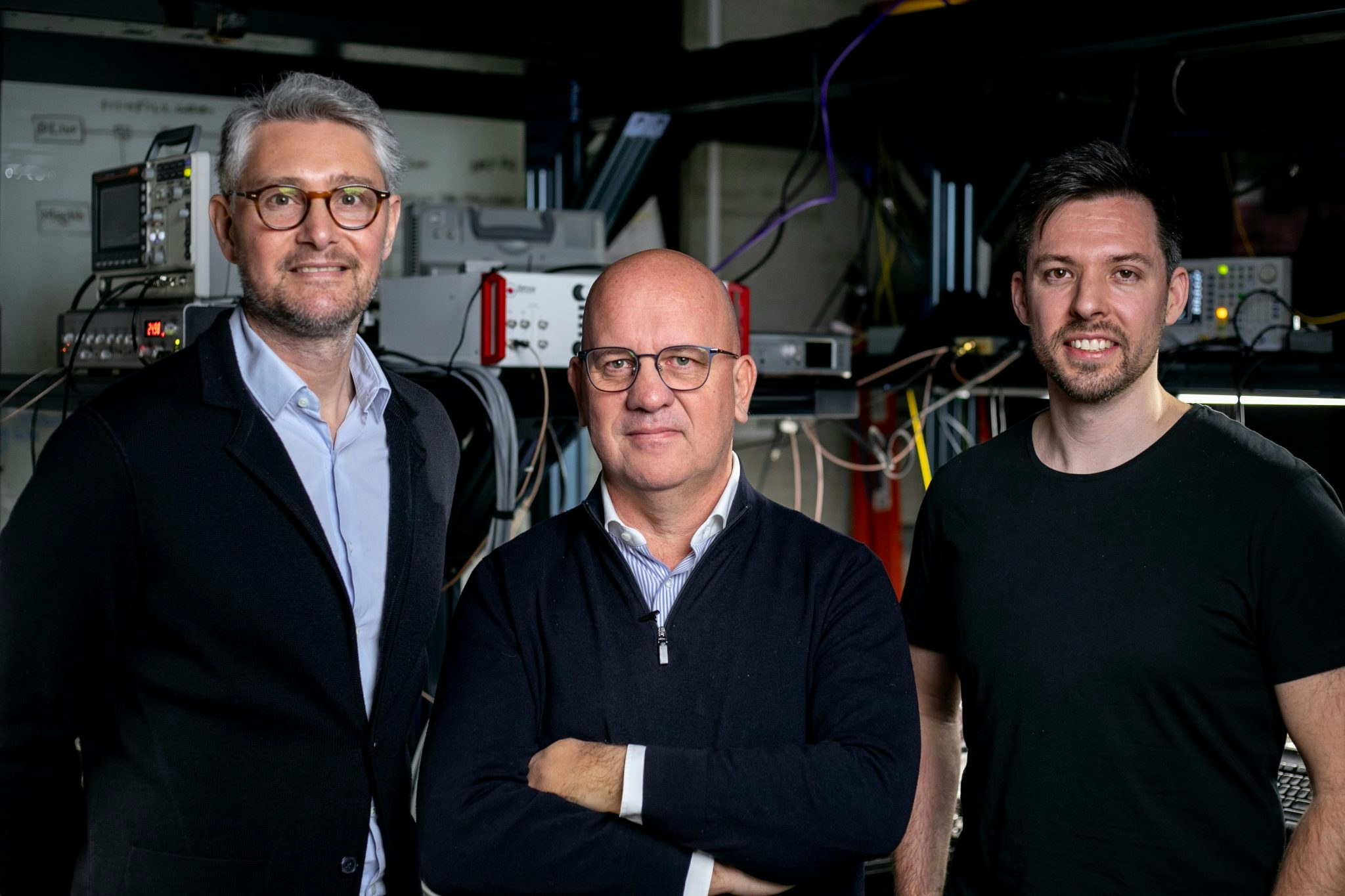

Goetz: At IQM, we build full stack superconducting quantum computers. We are a spin out from Aalto University and VTT Research Center in Finland. Headquartered in Espoo, we started in 2019 and since then we have been growing into Europe's biggest effort when it comes to building quantum computers.

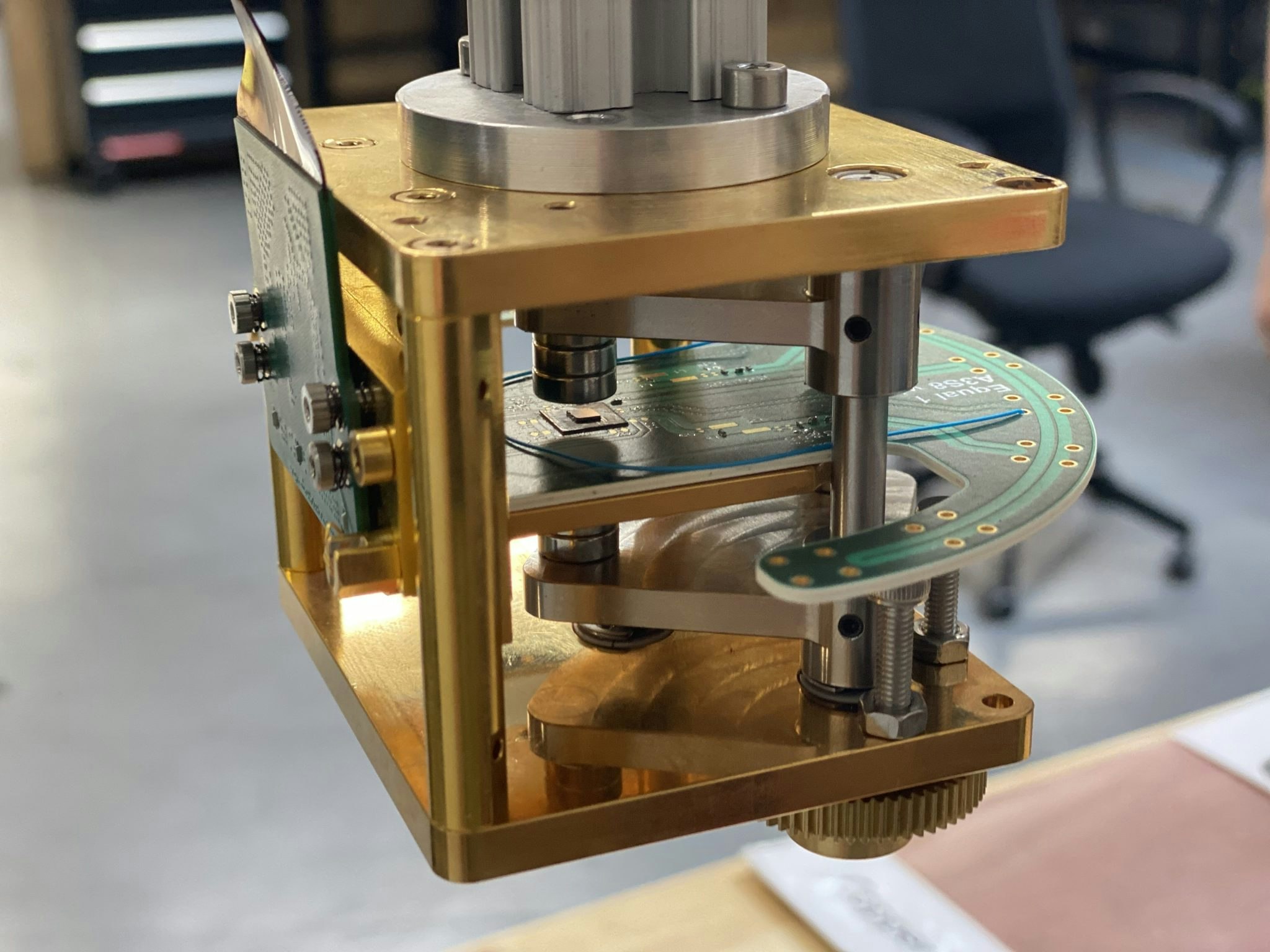

We are proud to say that we are the company that has sold the most quantum computers worldwide. We have been investing a lot into infrastructure to make this happen. We are running our own chip factory where we process 200mm silicon wafers. We are running an assembly line where we build the systems together and we're also running a data center in Munich where we host our quantum computers.

What is Europe’s current position in the quantum industry and what challenges does it face compared to other regions?

Like IQM, most quantum startups are university spinouts. Traditionally, Europe has a very strong standing when it comes to university research.

There are not many people in Europe that have been scaling companies in a repeated fashion, which makes scaling an operational challenge.

The challenge in Europe is then to scale and to make startups big. Especially given that in the US you have a lot of big companies like Google, IBM working in the field. We don't have that in Europe.

If we want to compete at a global scale, Europe needs to build large companies that can run the technology at this level. There are not many people in Europe that have been scaling companies in a repeated fashion, which makes scaling an operational challenge.

How are European quantum leaders navigating and overcoming these challenges?

On the one hand, in Europe, there are larger syndicates of investors with each investor making not so big investments, however all together they make a sizeable route.

The other thing is the engagement of government investors, like the EIC. In France, you have BPI, in our case, in Finland we have Tesi. You can pool money together from the private as well as the public side. This is one thing that is being done in Europe right now.

How are mechanisms such as the EIC helping quantum startups to scale faster? What makes public investment so crucial in aiding quantum startups?

There are two aspects and the first is about risk. If the EIC has looked at a startup and has done proper due diligence, especially on the technology side, and they give their stamp to it, this gives a level of credibility for these companies. It lowers the risk then for private investors to come in.

One unique thing about the EIC is that it can also be a strong partner for the whole startup journey.

The other aspect is the amount of capital. In the EIC’s accelerator programme, they bring up to €15m of equity investment. In the STEP program, it can be up to €30m. It is important, for these sizable growth rounds that they also have a minimum of capital around the table.

One unique thing about the EIC is that it can also be a strong partner for the whole startup journey. When there's a university project, you do the first spin out activities, there's a lot of non-dilutive funding, and then you go through all the different stages. That's helpful when it comes to the EIC.

What more is needed to build sovereign capability within the European quantum field?

In Europe we actually have a very strong supply chain. This is a huge opportunity because now, from where the industry is currently standing, we need to start scaling from the first prototype to rolling out in an industrial fashion.

This is a big opportunity for Europe to really create value around the supply chains, building complete ecosystems and then scale the companies together with the whole industry. I'm optimistic that we have a good chance in Europe to actually succeed even at a global level.

How do you see the European quantum industry growing over the next few years?

My hope is that on the end-user side we see more buy-in. This could be from established industries in Europe, like finance, pharmaceuticals, chemistry, logistics, the kind of industries starting to use quantum computing.

If public bodies are buying products from startups, it helps because these startups are then forced to develop products from a customer centric point of view.

For the public sector, the best role to play is through public procurement. If public bodies are buying products from startups, it helps because these startups are then forced to develop products from a customer-centric point of view.

In addition, it gives the companies a way to create revenues, and these revenues are important for raising the later stage growth rounds, because the investors in these growth rounds are slightly different. They are more institutional, financially driven and they need to see a growth trajectory on the revenue side and a path to profitability.