Sometimes companies bootstrap because they cannot find VC investment on attractive terms. For others, they don’t want the VC money.

Tadas Burgaila, the cofounder and CEO of Kilo Health, for example, wanted to bootstrap as much as possible to preserve his freedom to act.

“The decision to forgo VC money made a significant impact on the company's culture and ability to adapt and develop new products as quickly as possible,” he says.

The lack of VC money certainly doesn’t seem to have hampered the business. Kilo Health is growing fast, with more than 500 employees and an expected nine-figure revenue number next year.

But Kilo is part of an oft-ignored segment of the European startup ecosystem — the bootstrapped companies who don’t seek VC backing but forge ahead on their own terms.

It may take them a little longer to find success, but if they do the founders reap all the reward without having it diluted down through successive funding rounds.

The decision to forgo VC money made a significant impact on the company's culture.

Some bootstrapped companies have grown to a huge size before they raise, list on the stock market or sell the business. Atlanta-based email marketing services company Mailchimp was profitable from day one and bootstrapped itself until it was sold to Intuit for $12bn, while the Croatian messaging services company Infobip raised no funding until it took in a $200m round last summer at a unicorn valuation.

Papara, the Turkish challenger bank, has bootstrapped itself to revenues of $200m, a level that would likely give it a unicorn valuation if it were taking funding rounds.

Bootstrapped companies are often B2B businesses, where one or two big contracts with a large corporate client can bring them to positive cashflow. Or, like Bitvavo, they may be in areas like cryptocurrency where there are easily available alternatives to VC funding.

And they often don’t play the media game as much as VC-backed startups do.

We have generally stayed away from the startup world and its narratives.

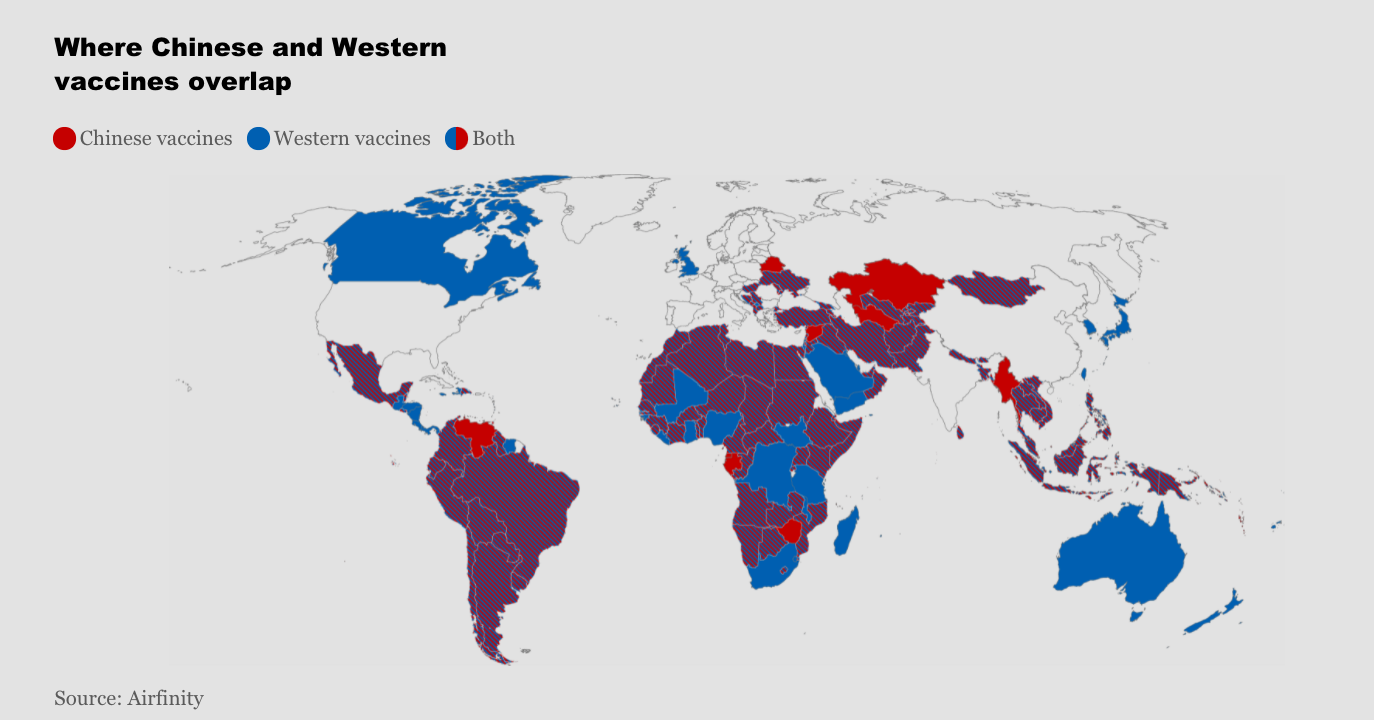

“We have generally stayed away from the startup world and its narratives,” says Rasmus Bech Hansen, cofounder and CEO of Airfinity, a healthcare analytics startup.

“I have found it to be very noisy and that startups with big lofty claims were not taken seriously by real decision-makers (our clients) so we have chosen just to let our data and product do the talking.”

This is ironic because Airfinity became one of the most-quoted companies in the media last year because of the information it was gathering and analysing about the Covid-19 pandemic.

In a normal year, however, Airfinity — like many bootstrapped companies — might have been difficult to spot.

“Bootstrapped companies are hidden gems, because you have to search for them,” says Ahmed Karslı, founder and CEO of Papara.

At Sifted we believe it's important to show non-VC-backed routes to scaling a company. So we went on the hunt for the fastest-growing bootstrapped companies from around Europe. We looked for businesses with a strong growth signal from either rapid hiring or growth in website visits — and then we asked the companies to tell us more.

Bootstrapped companies are hidden gems, because you have to search for them.

Many of these companies are starting to think about raising their first round. But most of them are still under the radar of VCs — so Sifted Members are getting a sneak preview.

We’re also very much aware that this is only scratching the surface of the bootstrapped companies across Europe. If you are a fast-growing bootstrapped company or you know of one please get in touch. We’d love to keep expanding this list.

Papara — likely unicorn

Founded: 2016

HQ: Istanbul

Leadership: Ahmed Karslı, founder and CEO

Karslı didn’t start out with the intention of bootstrapping Papara, the Turkish challenger bank. “That wasn’t the way we would have chosen to go,” he told Sifted. “Five years ago, we were looking for investors.”

The trouble was, investors didn’t believe in Papara’s vision of challenging the incumbent banks with simplified ways of money transfer and paying bills. “No one believed we could do it in Turkey.”

No one believed we could do it in Turkey.

So Papara, which focuses on Turkey’s large unbanked population, had to be self-financing. It did this with a relentless focus on keeping users happy. “You have no external funds, so the only way you can fund yourself is by monetising your users. So you have to stay user-centric and invest in user experience.”

It appears to have worked — in September, Papara had 10m users accounts and the company is expecting to end the year with $200m in revenue. Revenues have grown 4.5x on average every year for the last five years. This level of revenue and growth would generally give a company a unicorn valuation, although that's hard to prove without a funding round.

“One of the disadvantages of being a bootstrapped company though is that, unless you have investors, it’s difficult to get that ‘unicorn’ stamp,” Karslı says.

Funding plans

Papara has plans to expand into central and Eastern Europe and this might put it in the market for external investment. Karslı would also like the validation and governance that investors can bring.

Kilo Health — expected to hit nine-figure revenues next year

Founded: 2013

HQ: Vilnius

Founders: Tadas Burgaila, cofounder and CEO

“Just a few years ago, we were a team of ten people with nothing but our laptops, heads full of ideas, and ambition to build something big. Now we are one of the fastest-growing healthtech companies in the world, with more than 500 talented team members, a strong portfolio of well-performing products and even bigger goals,” says Burgaila.

Kilo Health expects to double staff to 1000 next year.

Kilo Health was one of the many healthtech startups that got a boost from people’s widespread move online during the pandemic. It went from 200 employees at the end of 2020 to more than 500 now. Many of those work remotely from locations including Germany, Spain, the US, the Philippines, Pakistan and Ukraine. The company hires 8-15 new staff members every week and expects to have more than 1,000 staff next year.

Revenues have grown 125% in the last 12 months and the company has more than 4m customers globally, including in the US (their largest market), UK, Australia, Canada, New Zealand, Germany, France, Spain, Italy, Brazil, Mexico, Chile, Middle Eastern and Scandinavian countries.

“Our average annual revenue growth since the start has been 154%. We plan to double our revenues again next year, which already means generating a nine-digit new revenue next year,” Burgaila told Sifted.

Funding plans

Kilo Health is not proactively looking for capital investment, but is open to talk with investors who demonstrate the potential to become strong business partners.

Why they chose to bootstrap

“We’ve been profitable from day one and are a customer-funded company with sufficient funds to expand our business,” Burgalia says. “I believe that being a bootstrapped company is a huge part of Kilo Health success. We are free to decide what risks we take, what we try next, tomorrow or the next year. We constantly test and introduce new products, and we have already invested millions into other health tech startups over the last 12 months. Even more are on our radar.

“Being a bootstrapped company that is growing so fast gives us confidence and the 'we can do anything' attitude. We experiment, we are ambitious, not afraid to be bold and stand out. In fact, we encourage people to do exactly that.”

Kidadl — 1100% user growth after pivot

Founded: 2018

HQ: London

Leadership: Hannah Feldman and Sophie Orman

Kidadl was forced into a big pivot during the pandemic. The British startup began life as an app offering tickets to family events and activities. As those activities shut down during the lockdowns, founders Hannah Feldman and Sophie Orman switched to offering parents suggestions and advice on how to entertain and educate their children.

The idea caught on, with monthly page views going up from 2,000 a month pre-pandemic to 8m a month today. Users have grown from 60,000 to 5m, with about half of them in the US. “Over the last 12 months alone our users have grown by 1100%,” says Feldman. At the same time, the company has grown from 5 employees to 25.

Revenues, which come mainly from advertising and sponsorships with a little ecommerce and subscription mixed in, are growing at 40% month-on-month and Feldman says the company is seeing a run rate of $2.4m.

Funding plans

The startup has only raised money from angels so far, but would like to raise an institutional round in the next 6 months to further accelerate its growth.

Why they chose to bootstrap:

“We bootstrapped out of necessity as we did not find venture funding partners along our journey, possibly as we are two women entrepreneurs without prior experience in the tech ecosystem and the funding stats speak for themselves. This has forced us to become hyper-focused and resilient, as we have had to operate on limited budgets and focus entirely on our KPIs without any diversion,” says Feldman.

One Logic — headcount to triple to 600 by 2025

HQ: Munich

Founded: 2013

Leadership: Andreas Böhm, founder and managing director

One Logic actually just took a double-digit millions funding round from Salvia, the investment company founded by Helmut Jeggle, of BioNTech, but we have included it in this list because up to now it has taken the bootstapping approach, in sharp contrast to competitor Celonis. Bavaria-based One Logic is an AI platform that helps big companies extract value out of their data. It started off as a service company doing bespoke projects for large customers like BASF and ThyssenKrupp, businesses with billions of euros in annual revenues.

This is partly why didn't have to raise VC funding for a long time — in a services business it is easier to grow organically, in line with the amount of work that comes in. One Logic i has taken funding now as it plans to turn the AI it has developed into more of a software product.

One Logic has kept a much lower profile than Celonis and has been far more cautious about spending money, preferring to grow organically. In the early days, it meant there were some times when a late-paying customer meant struggling to make payroll, but it now has a big enough customer base for it to think about expansion.

The company has nearly doubled its headcount to 200 over the past year, and is aiming to grow to 500-600 people by 2025.

Funding plans:

The fundraise from Salvia will keep One Logic founded for some time, but the company is open to fundraising from more mainstream VCs in the future.

WeGo — user numbers quadruple, revenues double

Founded: 2011

HQ: Amsterdam

Leadership: Peter De Jong, chief executive

WeGo is taking on the traditional corporate car leasing market with a more flexible range of car-sharing options along with other vehicles, from trucks and vans to mopeds and bikes.

”Post-Covid organisations are reconsidering the required mobility mix of their employees,” says Peter De Jong, chief executive. “Traditional corporate lease cars are being reduced. Coming to work on e-bikes is promoted when you live in the vicinity. From work you can use shared vehicles to go to appointments.”

Thanks to its focus on the B2B market, WeGo didn’t suffer from the pandemic in the way that some car-sharing companies did. It has long-term contracts with business customers, rather than making money from individual trips. Around 120 business customers pay a licence fee for use of the platform and for they tend to sign long contracts of two years or more for each vehicle.

Although business growth slowed a little during Covid, there were no cancellations, says De Jong. And now numbers are picking up rapidly.

In the last 12 months, users have gone from 25k to more than 100k and WeGo now has more than 7,000 vehicles on its books. Revenues have doubled in the past year and employee numbers have gone from 10 to 15.

Funding plans

The company has only taken a little angel investment up to now but is planning to raise a first round of €5-10m to finance European expansion, and after that expansion into either North America or Asia.

We don’t want to over-finance.

De Jong says he is deliberately keeping the raise modest. “We don’t want to over-finance,” he says.

Creditro — monthly revenue tripling every quarter

Founded: 2018

HQ: Esbjerg, Denmark

Leadership: Mathias Kobberup, founder and chief product officer; Ronni Baslund, founder and CTO

Creditro is a Danish regtech startup, offering companies real-time tools to monitor for fraud, money laundering and potential bad debts. The startup faced a lot of scepticism when it was founded in 2018.

Initially people said we were crazy.

“Initially people said we were crazy, actually. They saw we were up against major companies and we were not usual domain experts, so they didn't want to fund the case,” Mathias Kobberup, chief product officer,

told Sifted. So Creditro took the bootstrapping route — the only equity it has sold was 2% to board members, mostly to secure their commitment to the company, Kobberup says.

Despite initially being outsiders in the sector, Kobberup says Creditro was able to get traction by “being quite religious with listening to customers and being humble”.

Three years on, the company is seeing strong growth. Customers numbers have doubled quarter-on-quarter since the start of 2021 and monthly recurring revenue is growing three-fold every quarter. That may be about to go up another notch as Creditro launches its first add-on product.

The company will have 31 full-time equivalent staff after 5 more employees join next month.

Funding plans

The company is currently raising a Series A round, and hopes to accumulate €7.5m. However, Kobberup says he hopes getting on the “VC wagon” will not mean abandoning their principles for growth at any cost.

PiktFresh — users up 130% in the last year

Launched: 2019

HQ: Boston, UK

Leadership: Matt Godfroy, CEO

PiktFresh offers organic, zero-plastic fruit and veg boxes delivered directly to the doorstep for businesses and consumers. Food delivery businesses of all kinds saw demand go through the roof during pandemic and PiktFresh was no exception. User numbers increased 130% over the last year, and Pikt has added 10 staff members in that time.

Pikt is part of the SunFresh Produce group, a B-corporation that already delivered organic fruit and vegetables as a wholesaler, so much of it could be financed from existing cashflows. CEO Matt Godroy says he wanted to prove that Pikt's fruit and vegetable boxes were a scalable model before he looked for any outside investment. The B-corp certification also makes him quite careful about bringing in investors.

Funding plans

The company is putting together a pitch deck and will start looking for investors.

Airfinity — 10x increase in user numbers since the pandemic

Founded: 2015

HQ: London

Leadership: Rasmus Bech Hansen, cofounder and CEO

Airfinity provides predictive analytics for large pharmaceutical companies and has been in the news during the pandemic for its predictions about Covid-19 cases and vaccines. The company also works on cardiovascular disease and oncology during more normal times.

Airfinity has taken money from angel investors and the Future Fund, the UK government scheme launched during the pandemic to support UK-based companies. But it has been financed primarily through customer revenues.

We felt the early-stage VC community was too focused on standardised SaaS models.

“We felt the early-stage VC community in UK and EU was too focused on tried and tested standardised SaaS models and too little on unmet global needs, genuine business innovation and real impact and therefore gave us unattractive terms,” says Hansen, cofounder and CEO.

“In retrospect that has turned out to be a very good decision for us. Our client and impact focus has been key reason we have been the most influential analytics firm under Covid and our data been able to help save many lives.”

User numbers have grown 10-fold over the last year and the company now has 50 large enterprise clients.

Airfinity is hiring employees at the rate of around 3 a week and is up to about 50 staff.

Funding plans:

Airfiniy is considering a larger growth round to increase its R&D and data investments and to expand globally.

Relive — user numbers are growing 50% each month

Founded: 2020

HQ: Portugal

Leadership: José Costa Rodrigues, cofounder and CEO

Relive offers property agents a SaaS tool to create their own real estate business, with CRM and marketing tools plus workshops and quizzes to help them with job development. All of this is delivered via mobile phone.

“Proptech is super hot right now, as we see the traditional brokerage models falling behind in terms of technology and proper tools to their agents,” says José Costa Rodrigues, a series founder. The company has done $200k in business in the 6 months since launching the app, and Rodrigues says users are growing by 50% every month.

Funding plans

Currently raising a first round.

Blue Current — revenues doubling year-on-year

Launched: 2014

HQ: Utrecht

Leadership: Mark de Raaij, director

The Dutch company provides electric charging points for business and residential customers and is benefiting from the rapid growth of electric vehicles. Revenues and the numbers of charging points the company has rolled out have both more than doubled in the last twelve months. The number of kilowatt-hours used by customers has tripled. Staff numbers have gone from 18 to 50 in the past year.

Funding plans

The company is planning to raise a funding round.

Bitvavo — 300% customer growth, employees tripled

Founded: 2018

HQ: Amsterdam

Leadership: Mark Nuvelstijn, CFO; Guy Rombaut, CTO

Dutch cryptocurrency exchange and broker Bitvavo is benefiting from the growing interest in crypto and other digital assets. The company, which offers very low (0.25%) transaction fees, has seen customer numbers grow 300% this year to around 600k, and earnings before tax, interest, depreciation and amortisation grow 500% so far this year. Not only is the company reaching more customers, but each customer is also increasing their spend.

The team has grown from 20 employees at the end of 2020 to 65 now, and the company plans to hire even faster from here.

Funding plans

Bitvavo hasn’t had to seek VC money but may consider a round in the future.

CUBE — 100x growth in users

Founded: 2011

HQ: London

Leadership: Ben Richmond, CEO

CUBE is a regtech company helping financial services companies manage regulatory compliance, particularly by helping them to find and manage their unstructured data.

"The number of customer signings has doubled over the past 12 months," says CEO Ben Richmond, "and the growth in number of users has been exponential — between 100x and 1000x. A number of very big customers rollouts have helped this growth. CUBE's biggest customer has a quarter of a million people using the system."

10-year-old CUBE has a first-mover advantage in regtech. "We were the first firm of our kind ten years ago and as the market for regulatory intelligence got hotter we've had a mature product and been able to execute at scale globally," Richmond says.

The company has hired around 100 people over the last year, bringing its headcount to 250.

Why they chose to bootstrap:

Richmond says: "From the start, our sole intention was to bootstrap the business for the first few years.

"We wanted to run the business for the benefit of the customers, the employees, the management, and to get to build great products without working within a time vacuum of a VC’s fund lifespan. You get your own runway and you're able to continue with your own vision and meet the customer commitments that you make.

"We won our first customer within the first year. We then carried on winning customers and because we were building recurring subscription revenue streams, we were able to leverage those to raise debt to fund our growth.

There are a lot more sleepless nights. It is hard but the rewards are worth it.

"Over recent times, it has generally become a lot easier to raise debt as a startup based on SaaS invoices and contracts. Now, for us, as we’re a lot bigger it is not just venture debt that we can access but cash from the banks also.

"You've also now got a lot more alternate options with lenders like OakNorth and Funding Circle.

"The upside also is significant as you don’t have the same dilution. There are a lot more sleepless nights. You're constantly juggling to keep the right side of the cash flow. You've got to win customer confidence and credibility when you don't have a big balance sheet. It is hard but the rewards are worth it."

Funding plans:

CUBE is planning to raise equity capital in order to accelerate growth.

"We have established ourselves as the industry leader, to build on that position we require greater levels of investment. We can't go fast enough by deploying our own cash flows and we want to go faster," says Richmond.

"We are also more comfortable with growth equity capital now we're in a position to get the investment on the terms that we want to get it. There's also more competition amongst VCs for deals which lowers the cost of capital."