If there's one set of fintechs that consumers love, it's the apps helping them get rich.

It's no surprise then that UK wealthtechs — investment apps, trading apps, pension platforms and money managers — are soaring in popularity. At least 3.2m Brits have downloaded a wealth app since March 2020, with a particular bump recorded following the Gamestop saga in January, according to data released last month by analytics platform App Radar.

Nonetheless, it's a competitive space.

Customers can now pick from a range of different models. Efforts to woo young Europeans span from no-fee stock-trading platforms to crypto trading — and even more simple ‘basket’ investing, seen in apps like Plum and Tickr.

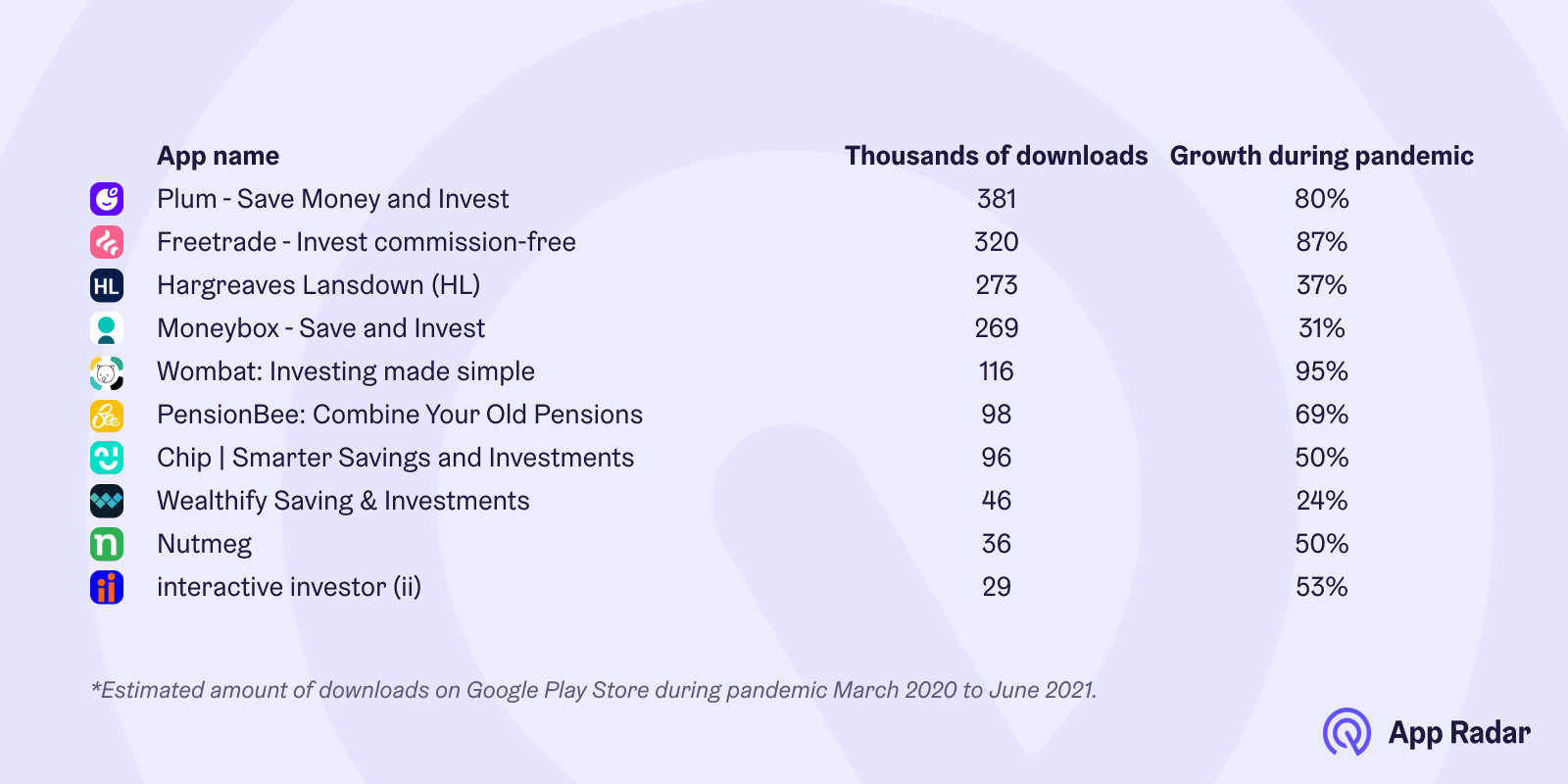

To find out who's winning, App Radar analysed how many downloads the top UK wealth apps attracted between March 2020 and July 2021 (using data from the Google Play Store). Since the study only pooled Android data, the numbers could be even larger when accounting for iOS users.

The results, shown below, reveal fintechs like Plum and Freetrade to be on top with over 80% growth, ahead of incumbents like Hargreaves Lansdown.

The surge seems to be continuing too. In May 2021 alone, Freetrade — which offers stock trading — lured 140k new Android users, according to App Radar.

Meanwhile, Nutmeg, a wealth management app that was recently bought by JP Morgan, ranked relatively low. Interactive Investor, which has been tipped for an IPO and is over two decades old, was also a slow climber.

App Radar estimated top UK wealthtechs saw average growth of 58% during the pandemic.

The battle is also raging in continental Europe. Top players include 99 in Spain, Holland’s Bux, Denmark's Dreams, Israel’s eToro and Germany's Trade Republic. The latter appeared as Germany's third most downloaded fintech app across 2020, according to a recent Sifted analysis.

Fierce battleground

Despite the surge in usage, the playing field is still wide open.

App Radar calculates that just 12% of UK adults now use an investment app. While that's nearly doubled since 2019, it still leaves a large part of the population untapped. A similar trend is playing out across the continent as well.

VCs are now eyeing up the opportunity, pumping €1.7bn into Europe's wealthtechs so far this year, according to Dealroom data, which includes Trade Republic's giant $750m round.

This shows renewed confidence in wealthtech after investors got spooked last year and investment in the space dropped 45% at the start of 2020, according to Pitchbook.

With VCs back in the game, a new wave of startups are getting backing to join the fray.

Among them is Lightyear. Led by two former Wise employees, Lightyear recently raised a competitive seed round to launch a pan-European investment app that’s free of commission and foreign exchange fees.

Another genre of upcoming wealthtech apps are those focused on sustainability. They're tapping into growing concerns for the climate, prompting the Wall Street Journal to describe green finance "less like the niche interest of socially conscious investors and more like a sustainable gold rush."

Among those leading the green category in the UK are Clim8, Tickr (which is now rebranding), and newcomers like ekko.

The other trend to watch in this space is crypto. Specialised players like Copper allow users to trade and store digital currencies as part of an investment strategy. These startups are also growing rapidly, with Copper telling Sifted it saw a 463% growth in assets across Q4 last year.

Meanwhile, automated savings apps like Snoop and Chip are also trying to catch VCs attention, although there have already been fatalities, including Oval.

French fintechs in this category include Birdycent, Moka and Yeeld, which put round up each time you spent and put that money aside.

Unit economics

While the data tells part of the picture, it's worth noting that downloads aren't everything.

Indeed, Hargreaves Lansdowne charges a fee per trade on UK stocks, making it one of the most expensive options — but arguably a more lucrative business model.

Moreover, downloads don't convert into active users. This has long been a controversial point, with companies like Curve called out for using download figures as a proxy for real customers.

The challenge now for wealthtechs is to find loyal customers who can finance a sustainable business model. That will involve not only masses of users, but also force companies to take a cut of the assets under management, charging standard fees or introducing a subscription.

That's why some wealthtechs have chosen to target niche, more elite audiences, rather than winning the 'download game.' Among them are Germany's Moonfare, which require a minimum of £50k to invest into private equity holdings.

It also still needs to be seen if the influx of UK retails investors are here to stay, or if the majority were simply in it for opportunistic, easy wins like the Gamestop short saga, which prompted unprecedented activity on some apps.

For now, though, the data looks promising, says Thomas Kriebernegg, CEO and cofounder of App Radar.

We're seeing a seismic shift in how people manage their money in the UK.

“We're seeing a seismic shift in how people manage their money in the UK... Fintech companies have significantly lowered the bar to entry... It would not be a surprise to see the vast majority of UK adults using at least one investment app in the next five years," he said.

It's also worth persevering in the wealthtech space, given the size of the price. This has been shown in the success of US trading apps like Robinhood and Coinbase, which both went public amid the global rush of new investors.

Robinhood dropped its plans to expand to the UK last year.