This roundup first appeared in our weekly Monday newsletter. If you’d like to get this straight to your inbox each week sign up here!

________

We’re back with the weekly fintech roundup. Here are some key insights from last week's stirrings and a guide to what you should keep your eye on in the coming days.

1. Payment companies are the real fintech heroes

Business-to-business payment infrastructure companies aren't usually headline grabbers. But, while they're not particularly sexy, this breed of fintech continues to be a key driver of investor returns according to the latest figures.

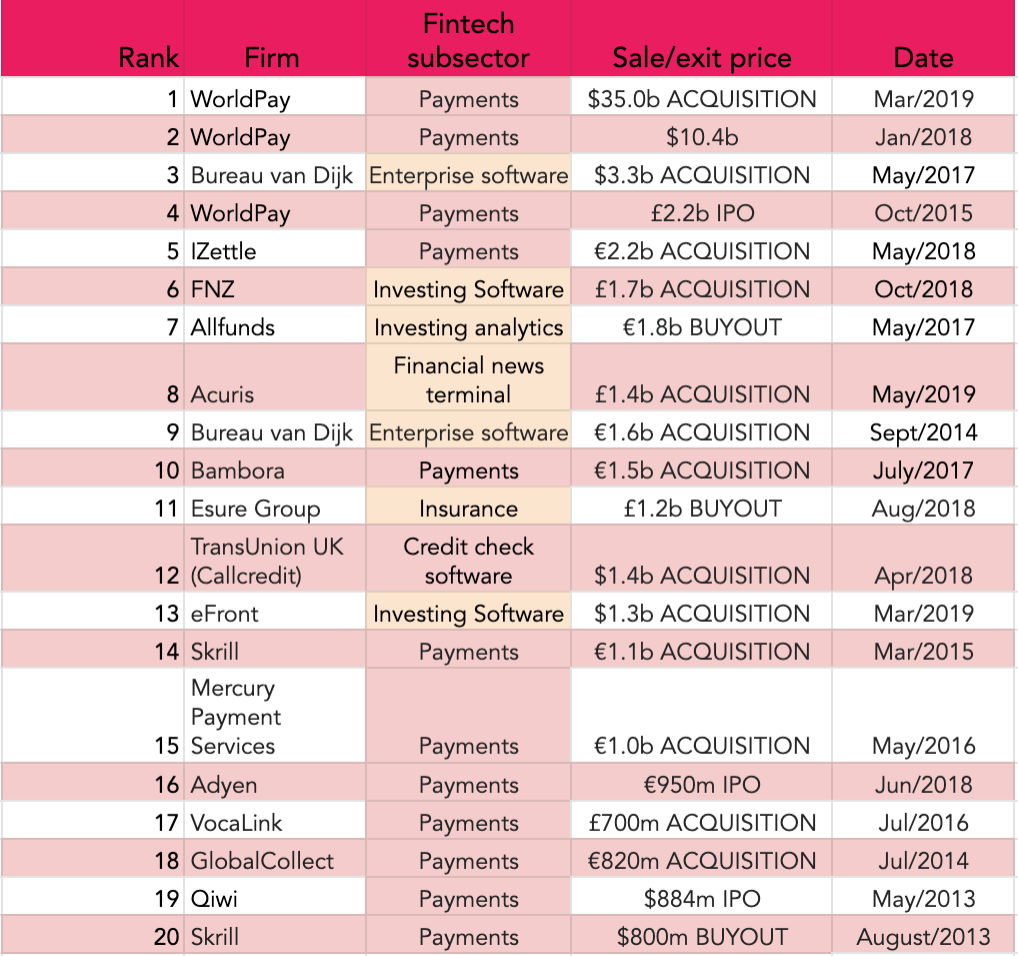

We reported last week that fintech exits have raked in a reported €83bn since 2013. But a closer look shows payment-processors make up the main bulk of sales in this sector.

Indeed, half of the headline figure comes from the acquisition of Worldpay in March. And if we recalculate we see that payment exits have raked in €55.6bn since 2013, while exits from non-payment fintechs add up to a slightly less impressive €27.4bn.

This also ties in with a broader theory that we here at Sifted have about fintech in Europe: the more boring it sounds, the bigger the opportunity there is for making money.

Top 20 exits

Data source: Dealroom. Only one of the top five sales is by a non-payment startup

There are, of course, a good number of reasons why 'payments' is such a lucrative category. Firstly, the payments sector has received the most funding of all fintech, naturally boosting its growth and sale prospects. It's also one of the oldest sub-groups, giving it a maturity advantage.

But it's also a reminder to take a more nuanced view of a broad category like fintech and its success. In short, not all fintechs are equal. Be mindful of the distinctions within this ever-growing industry.

Beyond that it re-asserts the importance of the startups operating quietly behind the scenes.

Having said that, it's not terrible news for everyone else. The fintech industry — excluding payments — has raised $10.6bn since 2013, meaning it's nearly tripled investors' money (taking the $27.4bn exit figure).*

Now the question is whether rapidly growing market for challenger banks will overtake payments when (or if) the big players exit. Or will the market take them down a peg and slash their current lofty valuations...

* This excludes acquisitions where the sale number wasn't publicly disclosed.

2. What's going on-zo with Monzo?

Another week, another challenger bank facing the heat. Last week it was Klarna, who faced criticism from local Swedish politicians. This week it's Monzo, who faces an investigation by the BBC.

The BBC Watchdog revealed that Monzo has frozen or closed thousands of customers' accounts, leaving them unable to withdraw their funds for weeks. Suspicious behaviour has been cited as the main catalyst for freezing accounts but Monzo's alarm seems to go off unusually often and without speedy resolution.

"How do you explain to a four-year-old that there's no food in the house because of a bank," one customer told the BBC, adding that the account-freeze meant her partner's salary had disappeared.

Other customers say they have been "ignored or that there was no update" when they complained, while a handful said they had been told to go to a food bank.

The root of the problem, the BBC hinted, was that Monzo has neglected to refine "the tech" in fintech

All banks freeze accounts when financial crime is suspected as part of their regulatory duties but the BBC argues that Monzo is being particularly "heavy-handed" and that there have been many more complaints about Monzo than "any other bank".

"You query whether they have the infrastructure and processes to deal with [it]...Their compliance procedures haven't caught up with their growth," a financial crime solicitor told the BBC.

Still, not everyone thinks the BBC's analysis is fair.

Monzo responded with a statement explaining that such incidents are "very rare." It also said it aims to review issues "within 10 minutes (night or day)", but that privacy laws mean it could not always explain why it was shutting down accounts.

Many of Monzo's three million customers also came out in its defence:

Regardless, it's bad press for Monzo, which like all neobanks is currently fighting off the image as fun but not as trustworthy as traditional high street banks. And Monzo will be feeling its effect — at least in the short-term.

Meanwhile, over in the US leading branchless bank Chime had an even worse week. The bank scared its five million clients when its system went down for an entire day. 24 hours later transactions were functioning again but its app wasn't, according to CNBC. This is reportedly Chime's third outage since July.

This should be a warning to Europe's challenger banks to invest — above all — in the tech. Especially as they expand into the US, where N26, Monzo and Revolut are all trying their luck, largely by relying on third-party bank providers.

Being just as good (or in this case, as bad) as the incumbents simply isn't enough.

Other news :

- Banking incumbent HSBC is giving online retail bank first direct a new look to attract a younger crowd, as one in four UK citizens under 37 have turned to challenger banks

- Marcus — Goldman's Sachs' online banking spinoff — may be feeling the pinch after it informed users it was changing the terms and conditions around its famed interest rates. Customers will now only get 14 days notice if it lowers its interest rates, rather than two months.

If you’d like to get more fintech updates straight to your inbox each Monday sign up here!

[sifted_newsletter_signup]