The European Commission has made its first direct equity investments into startups — backing 42 companies from around Europe — in an attempt to plug the funding gap and boost innovation on the continent.

Under the new European Innovation Council Fund, each of the companies will receive between €500,000 and €15m, with €178m invested overall. The companies span a range of sectors, including health, circular economy and advanced manufacturing.

This is the first time the Commission has made direct equity investments — with ownership stakes expected to range from 10% to 25%.

A senior commission official told reporters that the move marks a “paradigm shift” for European funding, away from grants, and is aimed at helping companies compete with their American and Asian counterparts.

Europe generates an impressive number of startups, he explained, something that’s exemplified through the research output of universities and the number of Nobel prizes awarded to European research.

However, the number of European unicorns is limited and the VC market is three to four times smaller than in the US, the official said, demonstrating the need to boost the funding landscape in Europe.

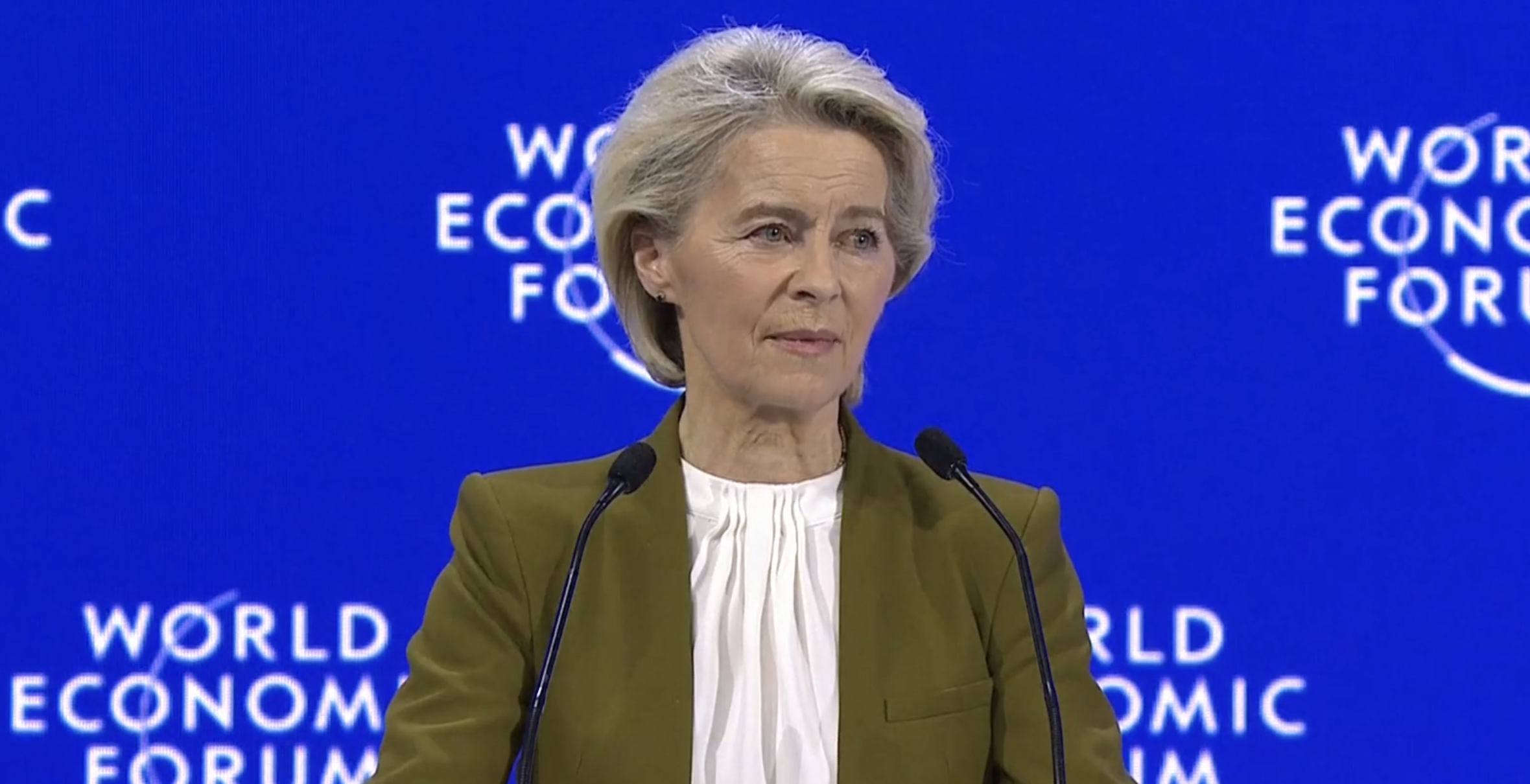

“Europe has many innovative, talented startups, but too often these companies remain small or relocate elsewhere,” said Mariya Gabriel, commissioner for innovation, research, culture, education and youth.

French company CorWave, which works on patient care for people with life-threatening heart failure, was the first to receive the investment.

The company received €15m from the EIC fund and has gone on to raise €35m in total by combining the funding with private investment.

The case demonstrates the Commission’s aim to encourage private investment into companies alongside public European funding, a senior official explained.

The aim of the funding is to encourage private investors to join them in backing companies by de risking investments, particularly for deeptech companies where returns are on a longer term basis than other startups.

Among the other companies to receive investment are Hiber, a Dutch company building international satellite and communication systems, French company Xsun, which designs energy-independent drones to be fully autonomous so they can operate without any human intervention and Irish startup Geowox that provides automated property valuations.

There are currently 117 companies in the pipeline to also receive direct equity investment, pending a due diligence process.