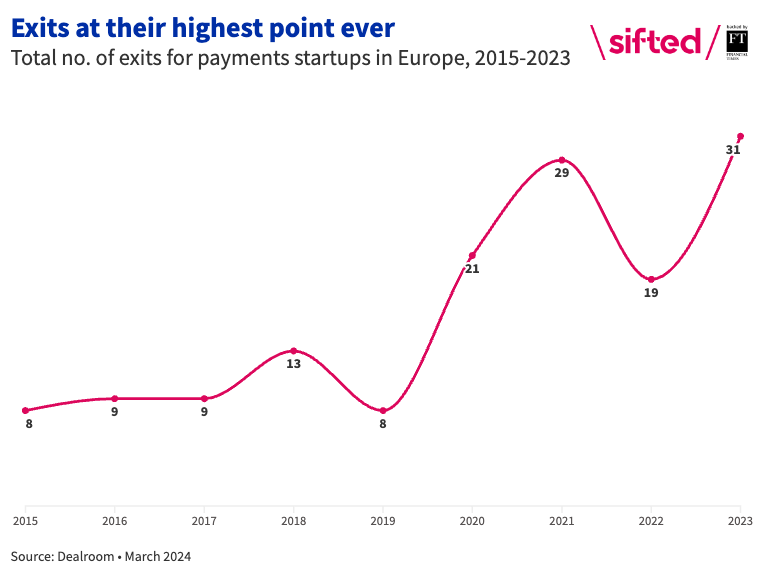

Exits at European payments startups are at their highest point ever, amid a dip in investment in the sector.

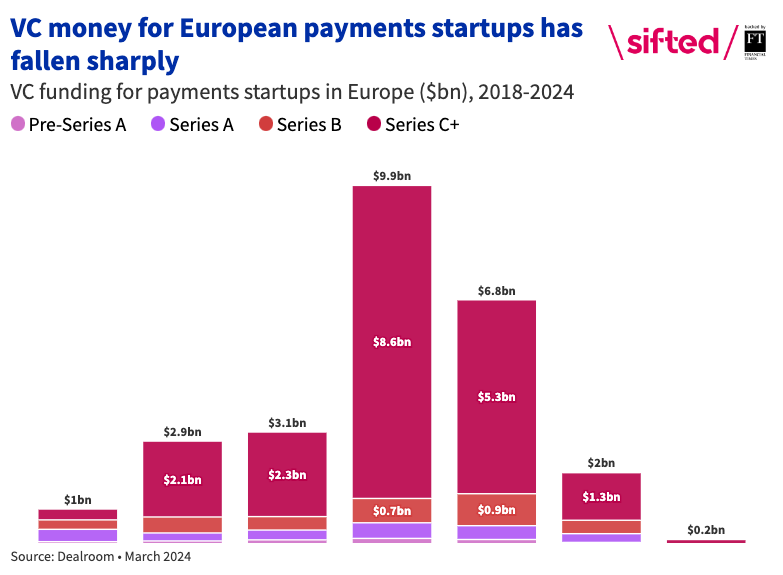

Last year, while VC funding in the space totalled $2bn — its lowest level since 2018 — there were 31 exits among payment companies in Europe, according to Sifted Intelligence’s latest weekly Briefing.

Notable examples include Swedish open banking business company Trustly’s acquisition of SlimPay and fintech infrastructure Rapyd’s buyout of the Netherlands-based PayU.

The payments subsector was one of the hardest hit casualties of the fintech funding drought last year. The sky-high valuations of leading payments players in the sector have also been watered down as of late. Swedish buy now pay later giant Klarna, for example, saw its valuation plummet to $6.7bn from a high of $46bn when it raised in 2022.

Still, while the level of capital flowing into the fintech sector may pale in comparison to its peak at $9.9bn in 2021, there were some major funding rounds for payments startups in the current funding environment.

Redpin Holdings, a company providing payments services for the property market, raised a £140m growth equity round from Blackrock last year, for instance. This year has also already seen property management and payments company Mews raised $110m in a funding round led by Sweden’s Kinnevik at a $1.2bn valuation.