Despite the economic downturn, the European deeptech sector keeps growing — with startups from the continent on track to raise far more in 2022 than even the heady days of 2021. This year has already seen a few new deeptech entries into the unicorn club, including robotics company Exotec and flying taxi startup Volocopter.

In total, there are now 18 deeptech unicorns across Europe, according to data from Dealroom looking at startups founded in 2010 or later, with a confirmed valuation of over $1bn.

The UK has the largest number of unicorns, with five. It's closely followed by Germany, which has four, and Sweden and France, with three unicorns each.

Unsurprisingly, most of these unicorns are in the artificial intelligence sector — which is the best funded within deeptech. There are also a few unicorns in the energy and robotics sectors.

The list also reveals that women are extremely underrepresented in deeptech — none of these companies have a woman as their CEO. This reflects the big diversity issue seen across the C-suite of the broader European tech sector.

So, who are the unicorns?

Celonis

What: Celonis is a "process mining" company that helps companies optimise their business processes using artificial intelligence. Its clients include well-known companies including Vodafone, Uber, BMW, Airbus and Siemens.

Where: Munich, Germany

Valuation: €13bn

Notable investors: HSBC, Accel, 83North

Northvolt

What: Northvolt makes batteries for electric vehicles that have an 80% lower carbon footprint than the batteries most EVs currently use. The company beat the record for the largest European deeptech round last year, at €2.8bn, and has been luring talent from Blue Origin and Tesla to Sweden.

Where: Stockholm, Sweden

Valuation: €12bn

Notable investors: Goldman Sachs, KfW, Baillie Gifford

Improbable

What: Improbable is a metaverse games company that makes simulated virtual worlds using artificial intelligence. The company is working on a metaverse platform that aims to be more democratic and decentralised than Meta’s, and it raised a $100m round at a $3bn valuation earlier this month.

Where: London, UK

Valuation: €3.4bn

Notable investors: Andreessen Horowitz, SoftBank

CMR Surgical

What: CMR Surgical has developed a robot that can perform high-precision surgeries with minimal incisions. The technology has been used to perform over 5,000 surgeries worldwide.

Where: Cambridge, UK

Valuation: €3bn

Notable investors: LGT Capital Partners, Cambridge Innovation Capital

Graphcore

What: Graphcore makes microprocessors specifically designed for artificial intelligence computations. The company is planning to build a supercomputer more powerful than the human brain within the next two years.

Where: Bristol, UK

Valuation: €2.4bn

Notable investors: Amadeus Capital Partners, Molten Ventures, Atomico

OCSiAl Group

What: OCSiAl is a low-cost manufacturer of graphene nanotubes, which are used to improve materials across a wide range of industries including electric batteries, mobility, aerospace and oil and gas.

Where: Luxembourg

Valuation: €2bn

Notable investors: Da Vinci Capital, ExpoCapital

Exotec

What: Exotec makes robots that automate the management of warehouse storage. The company became France’s fourth unicorn in January 2022.

Where: Lille, France

Valuation: €2bn

Notable investors: IRIS, 360 Capital Partners

Volocopter

What: Volocopter wants to bring electric flying taxis to cities around the world. The company hired ex-Airbus executive Dirk Hoke as its CEO earlier this year and has plans to be operating during the Paris Olympic Games in 2024.

Where: Bruchsal, Germany

Valuation: €1.7bn

Notable investors: Lucasz Gadowski, btov Partners

Cognite

What: Cognite uses machine learning technology to support decision-making, remote operations and automation across industries such as oil and gas, energy and manufacturing.

Where: Oslo, Norway

Valuation: €1.6bn

Notable investors: Accel, Saudi Aramco

MindMaze

What: MindMaze has developed a virtual reality interface that can be used to rehabilitate patients that have lost motor or cognitive functions due to injuries or disease.

Where: Lausanne, Switzerland

Valuation: €1.5bn

Notable investors: AlbaCore Capital, Leonardo DiCaprio

Einride

What: Einride makes electric and driverless vehicles. Its freight trucks are used in Sweden and the US, and the company recently announced its expansion to Germany.

Where: Stockholm, Sweden

Valuation: €1.4bn

Notable investors: Northzone, EQT Ventures, Norrsken VC

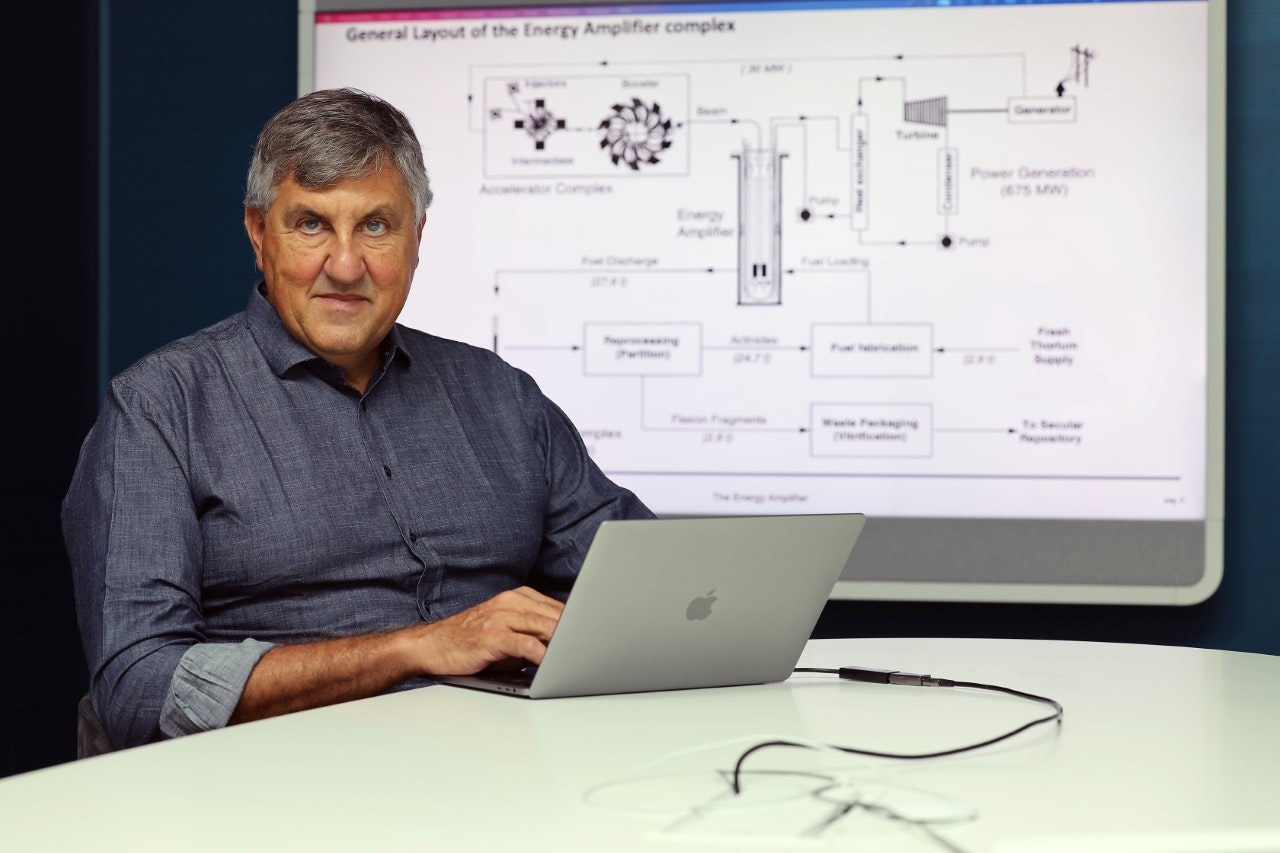

Newcleo

What: Newcleo develops nuclear power plants that are significantly smaller than the ones we use today, making the initial costs much lower. The company raised €300m in June 2022 that will go towards using nuclear waste as fuel for its next-generation reactors.

Where: London, UK

Valuation: €1.3bn-€2bn

Notable investors: Exor Seeds, LIFTT

Polarium

What: Polarium makes lithium batteries that reduce the costs and environmental footprint of energy storage across industries including telecommunications, electric vehicles and solar power.

Where: Stockholm, Sweden

Valuation: €1.2bn

Notable investors: AMF, Roosgruppen

Agile Robots

What: Agile Robots is a spin-off of the German Aerospace Centre that makes intelligent robots that can see, move, feel forces and adjust to unknown environments. The startup became Germany’s first robotics unicorn in September 2021.

Where: Munich, Germany

Valuation: €1bn

Notable investors: Sequoia Capital, Linear Ventures

DentalMonitoring

What: DentalMonitoring uses artificial intelligence to help dentists and orthodontists monitor their patients remotely. The company became the world’s first dental software unicorn in October 2021.

Where: Paris, France

Valuation: €1bn

Notable investors: Vitruvian Partners, Mérieux Equity partners

Tractable

What: Tractable is an insurtech that helps insurance companies process claims faster using computer vision to assess pictures of car damages. The company hit unicorn status in June 2021.

Where: London, UK

Valuation: €1bn

Notable investors: Insight partners, Zetta Venture Partners, Ignition Partners

Infarm

What: Infarm makes vertical farming warehouses, which use 95% less water and land than traditional farming. The company recently opened its largest growing facility yet in Bedford, UK.

Where: Berlin, Germany

Valuation: €1bn

Notable investors: Atomico, Balderton Capital, Bonnier Ventures

Shift Technology

What: Shift Technology has developed an artificial intelligence platform that automates and optimises decision-making for insurance companies.

Where: Paris, France

Valuation: €1bn

Notable investors: Accel, Bessemer Venture Partners, Elaia Partners

According to Dealroom, H2 Green Steel and Wayve are potential European deeptech unicorns, with a valuation ranging from $800m to $1.3bn. They have not been included in this list given their unicorn status is not confirmed.