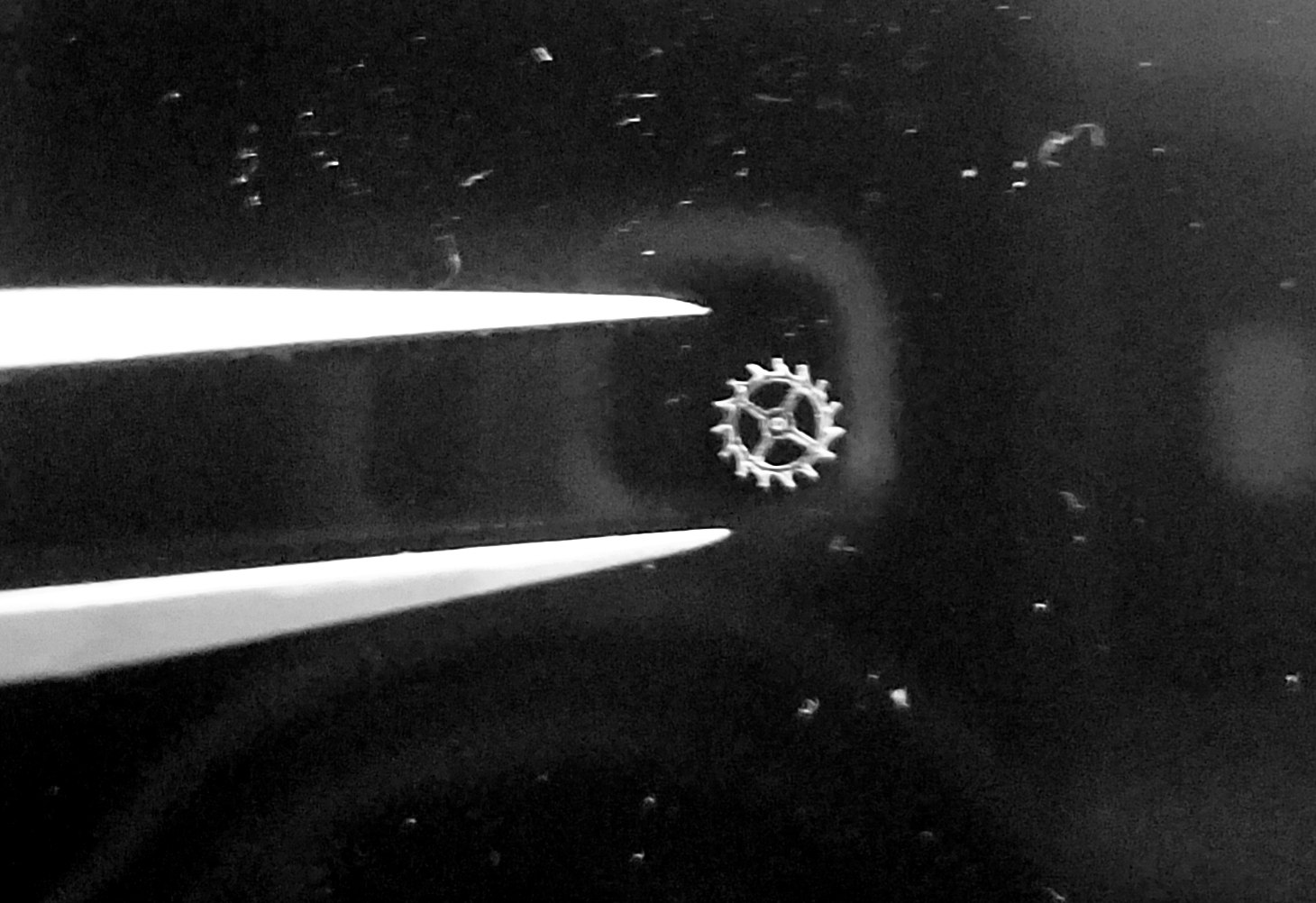

The cog is a tiny translucent sliver barely visible between the tips of the tweezers. It is destined for the inside of a high-end Swiss watch and it is made entirely of diamond.

In fact, this will be the first time that a gear made from a single-crystal diamond will be used inside the workings of a watch, says Pascal Gallo, the founder and chief executive of LakeDiamond, a Swiss synthetic diamond startup which made the piece.

We see diamonds as a new material to trigger a new industrial revolution.

Parts made out of the world’s hardest material should last far longer than those made from traditional metal, he says.

But the diamond watch gear, exquisite as it is, one of the simplest of the uses Gallo has in mind for his lab-grown diamonds. The covered gemstone is increasingly being harnessed for the technology industry — for everything from mobile phones, magnetic imaging and quantum computing.

“We see diamonds as a new material to trigger a new industrial revolution. For example, aluminium helped the creation of the aviation industry. Silicon was the basis of the computing industry. Diamonds will be the basis for the next technological leap,” says Gallo.

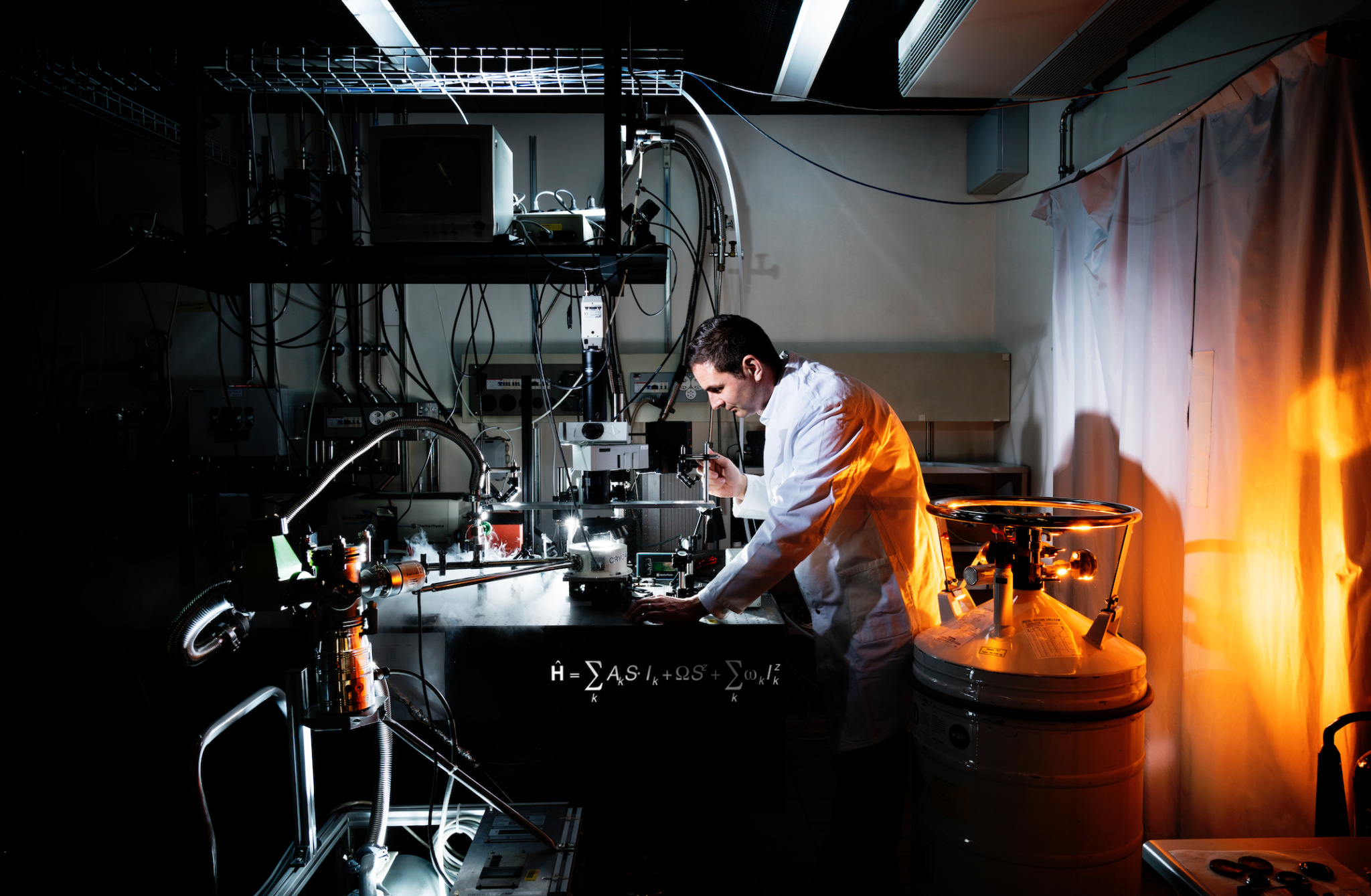

LakeDiamond, based at the EPFL Industrial Park in Lausanne, Switzerland, is building reactors that can grow ultrapure pure diamonds for this new tech-based market. The 25-person team is coming in as the scrappy new competitor in a market currently dominated by the De Beers industrial diamond arm, Element Six, which has a 73-year history and more than 1,900 staff, and Singapore-based IIa Technologies, established in 2005, which opened a 200,000 sqft diamond growing plant four years ago.

How to grow a diamond

Synthetic diamonds have been around since the 1950s when the technique to create the gemstones using high temperature and high pressure was developed by the US industrial conglomerate GE. In the 1980s, however, a new method of growing diamonds was developed, called chemical vapour deposition, where diamonds are grown from a hydrocarbon gas.

LakeDiamond uses a variant of this technique. Tiny square slivers of pure diamond — seeds — are placed inside a chamber that looks a bit like a very high-tech pressure cooker (we’re not allowed to publish pictures of it here because the design is part of LakeDiamond’s commercially sensitive “secret sauce”).

The reactor uses about 6 kilowatt hours of energy, about the same as a big electric radiator.

The air molecules inside are vacuumed out and replaced with a carefully controlled mixture of methane and traces of other elements — the exact “recipes” are how LakeDiamond differentiates itself.

The methane is blasted with plasma to break apart the carbon atoms, and these settle on the slivers of seed diamond in a crystalline pattern, layer by layer, forming a new gemstone. A bit like 3D printing, but on an atomic scale.

It takes around three weeks to grow a one carat diamond, says Gallo.

Beyond jewellery

The jewellery industry has in the last few years become interested in lab-grown diamonds as an alternative to “blood diamonds” — gemstones mined in conflict zones or in exploitative conditions — and many synthetic diamond companies have formed to address a growing consumer desire for more ethical gems.

Diamond Foundry, based in the US, has raised more than $100m from a varied group of investors including actor Leonardo DiCaprio and many Silicon Valley luminaries, on the idea of ethical and carbon-neutral diamonds.

Last year De Beers, the world’s largest diamond miner, which had long been critical of lab-produced stones, caved in and began selling synthetic diamonds through its Lightbox brand.

Synthetic diamonds aren’t much cheaper than mined ones. A one carat LakeDiamond diamond costs around $15,000, in the same ballpark as a mined diamond of the same grade.

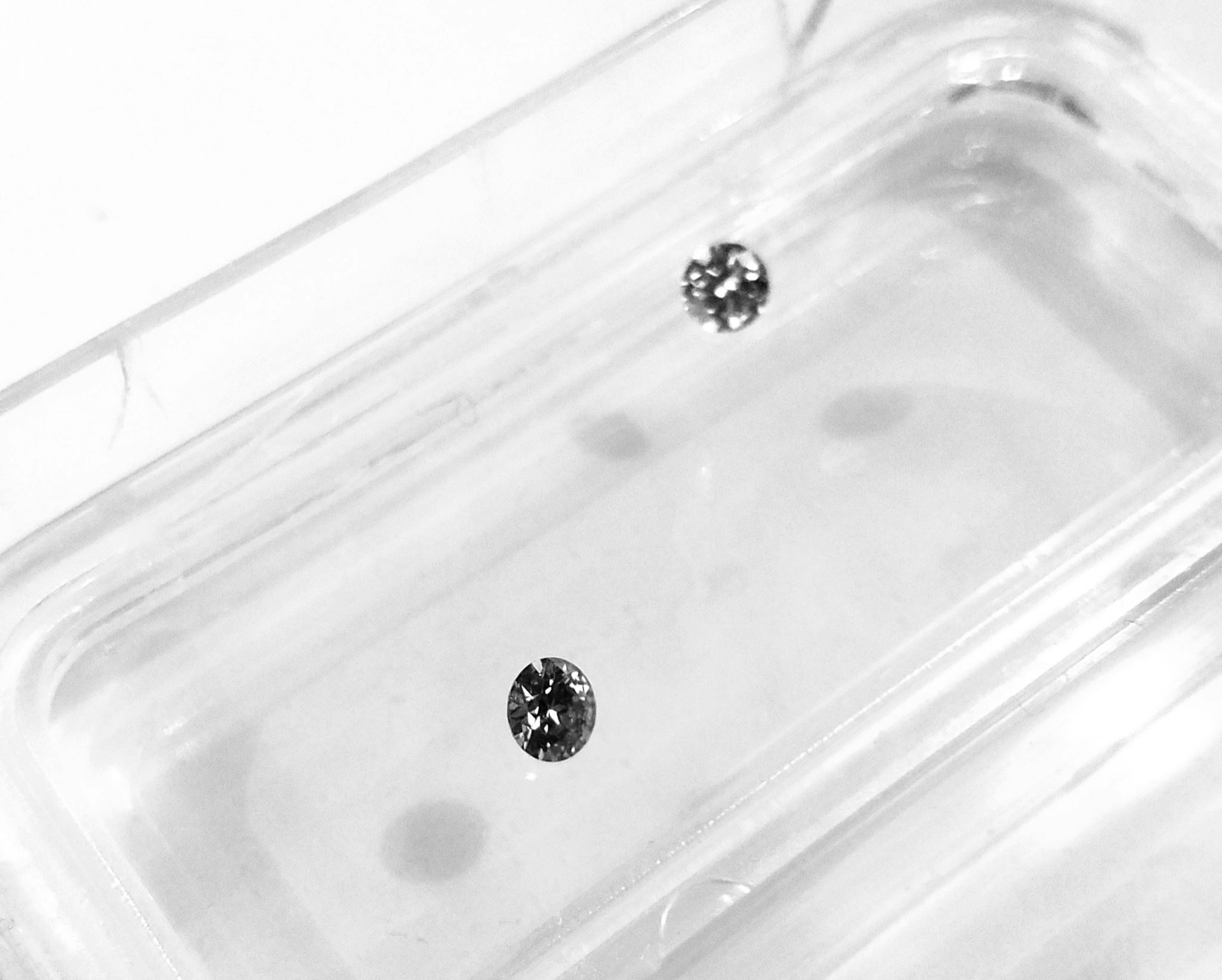

Jewellery is not, however, the most exciting market. Of the 147m carats of rough diamonds that were produced in 2018 only 19% were made into gem-quality, polished stones. Nearly half go to industrial uses. Traditionally these have been tiny stones and diamond powders used for cutting and grinding.

However, ultrapure synthetic diamonds have features that have got the tech world excited. High-powered lasers need diamonds that are not, for example, contaminated with nitrogen, which makes them appear yellowish. “For lasers you need diamonds that are as pure as possible as the nitrogen will absorb some of the light,” Gallo says.

On the other hand, lab-grown diamonds can be engineered to contain boron, which not only turns them a bluish colour, but makes them conductive, opening up uses for diamonds in electronics. Diamonds like these are being used for water purification without chemicals.

Diamonds for quantum computing

The most cutting-edge synthetic diamonds, however, are the ones that are deliberately engineered to be imperfect — with tiny, atomic-sized holes in them. This so-called nitrogen vacancy defect involves creating a diamond lattice where there are two carbon atoms, a nitrogen atom and a hole, or vacancy, next to the nitrogen atom. This turns the diamond a pinkish colour — but more importantly, the electrons trapped inside this hole have a spin that can be used to sense magnetic fields.

Harvard physicists Mikhail Lukin and Ronald Walsworth are using diamonds like these to study the magnetic fields given off by neurons and human heart cells. Diamonds could be used to create medical imaging equipment, much like MRI scanners but with the advantage of being smaller and able to work at normal room temperature rather than having to be supercooled.

Diamonds with deficiency defects could also be used for quantum computing. Prof Lukin and his colleagues are also experimenting with using the vacancies inside diamonds as qubits, the basic building blocks of quantum computing. [For more on quantum computing read the Sifted explainer here.]

LakeDiamond’s Gallo himself came to the diamond business through quantum physics. He had been fascinated by gemstones since boyhood, having grown up with a vast collection of stones built up by his grandfather, a diamond prospector. Then, as a research scientist at the Ecole Polytechnique Federale de Lausanne his work on quantum mechanics involved learning how to grow crystals that would help him test quantum spin. These techniques turned into the basis of the LakeDiamond business.

The medtech uses are about five years away, and quantum — maybe a decade.

So far LakeDiamond has just one reactor, which can fit about 40 diamond seeds at a time — pretty small compared to what Element Six and IIa can produce. However, the company is looking to raise $50m through an initial coin offering [see box below], launched last November, to build a series of bigger reactors and ramp up production from 15,000 plates a year to 300,000.

The quantum market, is still distant, admits Gallo, with work in this field mainly in the realm of scientific papers. Even diamond-based medical equipment is still mainly in the lab. Jewellers and watchmakers will provide the bread and butter for some time.

"The medtech uses are about five years away, and quantum — maybe a decade," he says.

[box title="Creative funding"]LakeDiamond’s initial coin offering is a case study in how creative deeptech companies need to be in finding funding. Gallo initially tried the traditional VC route in order to raise capital for expansion, but got nowhere.

“Some specialist investors were willing to put money in but they wanted to restrict us just to producing diamonds for the jewellery industry or just for military clients. More general VCs just took us for daydreamers,” he said. Many of the generalist VCs, he says, were surprised to hear you could grow a diamond in the lab. Not a great start.

An investor Gallo met on a flight, however, suggested an initial coin offering — raising money by inviting investors to purchase cryptocurrency tokens. ICOs were all the rage in 2018 with one Cayman-Island crypto startup, for example, raising $4bn without any product to show for it. But they were also getting a reputation for being scammy, and Gallo was keen to do it properly.

[more]“We wanted to be the best in class and follow all the rules,” he says, which made the process slow. “We had to prove we were not like the scam projects.”

Gallo got Finma, Switzerland’s financial regulator, on board. It was also the world’s first ICO distributed by a bank— Swissquote — which not only added respectability, but meant investors didn’t have to set up a fiddly cryptocurrency wallet to hold the tokens.

Each token represents a minute of diamond-growing time in LakeDiamond’s reactor, and has a value of SFr0.55 each. When LakeDiamond gets orders, buyers can contribute their minutes to the production process, earning a share of the sale. They may see an increase in the value of the token if it is used to grow a very complex, high-value diamond. If nothing else, you can use your tokens to grow your own diamond to turn into jewellery. For a one carat diamond you’d need about 27,720 minutes, or SFr15,246 (€13,500).

With $33 as the minimum investment, LakeDiamond’s ICO investors ended up a varied bunch, some professional investors, others interested enthusiasts. One man bought tokens as a present for his 12-year-old son.

An ICO was not a cheap option — set-up costs came to SFr1m (€0.9m) says Gallo. And by the time the sale launched in November 2018, ICOs were deeply unpopular. “We were in crypto winter,” laughs Gallo. As a result, the ICO has not yet raised the hoped-for $50m and is still ongoing.

“In 2017 you could have raised that in a day. Now it will take months,” says Gallo. He may have to expand his reactor capacity more slowly than planned. But Gallo doesn’t, even now, regret taking the ICO route. “It has been a bumpy road. But the bottom line is we have got the money and we haven’t had to sell any shares.”

[/box]