Strategic or financial? This is the one-billion-dollar question I usually ask the managing partners of CVC funds.

Spoiler alert: I got both answers and neither one is 'right'.

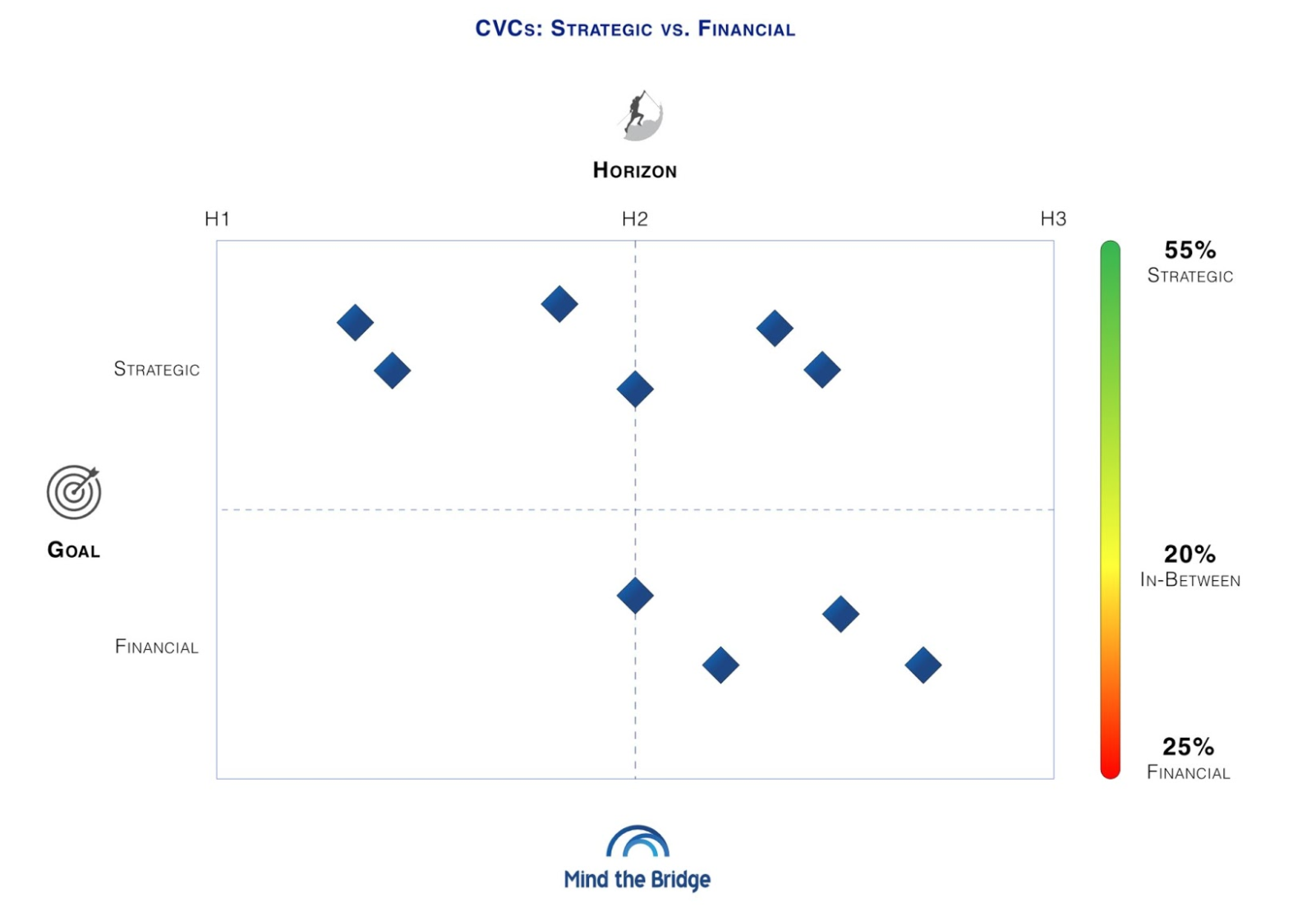

But I always ask the question (and keep track of the answers, see the chart below). It's a useful way to get companies to understand the tensions of running a CVC fund.

The immediate answer, except in a very few cases, is 'mainly strategic'. But there is always a 'but'. Shortly thereafter they all immediately point out that they also have to be 'strongly return-focused'.

In the end, for CVCs it's a balancing act between strategic and financial interests. That's easier said than done.

There are (at least) three complications.

1. The strategic value of CVC is hard to prove

CVCs are supposed to be the “eyes and ears” of the parent company, as Geert van de Wouw, VP at Shell Ventures put it during our last Mind the Chat. They have to report back to the mothership the strategic insights gained from scanning potentially disruptive trends and anticipating external change. Because, in the end, "portfolio companies are an early indication of what is coming."

"CVCs are not supposed to move any short term needle," Peter Jorgensen, partner at Maersk Growth pointed out in a recent interview.

But how do you measure the strategic value produced by a CVC? We are currently working with some of them, identifying some KPIs to factor the strategic contribution to the top management, but it's not an easy task.

Tracking the acquisition of portfolio companies isn't a good enough proxy, particularly if you are investing in areas far ahead of where the core business is (none of RBVC investments, for example, have been bought by Robert Bosch thus far). On the other hand, measuring the impact of CVC investments on strategic decisions (what we define as return on innovation) requires assessing a broad spectrum of indicators — most of them soft factors difficult to grasp.

2. Show me the money

The brutal truth is that strategic venture investment principles are unlikely to deliver either strategic value or financial returns to a CVC in the long run.

“Pure strategic investing doesn’t work after a while,” Ingo Ramesohl, managing director at Robert Bosch Venture Capital (RBVC) told me in our Mind the Chat a few months ago. “[In] the end, CVCs have to be strongly return focused. Moneymaking is an enabler for innovation making."

“We are driven by strategic goals, at the condition we provide financial returns," Jan Lozek, managing partner at EO.N. Future Energy Ventures added in our latest conversation.

Why? Financial is a proxy of a company’s health, and, says Peter Jorgensen, “a strong strategic fit is not supposed to turn a mediocre venture case."

“We can invest in a startup targeting a 2x return (rather than 10x), but we are not going to invest if there is no venture case."

3. Reorganisations happen

In corporate environments, working on long term objectives — like CVCs are supposed to do — exposes companies to the risk of a change of governance.

That means that the 'aircover' the investment team originally received from the CEO can suddenly disappear.

Then, it is important to be able to demonstrate the value the fund has created beyond the usual return on investment (calculated as proceeds from exits and fair market value of portfolio companies).

There's a reason for this.

Whatever ROI the fund will produce, the impact won’t be material for the corporate P&L. As innovation coach Tristan Kromer says: “If you don't agree on the metrics before launching any innovation project, the metric is always ROI." And ROI is a lagging indicator that takes a while to materialise.

Strategies to use

Although CVCs are, by design, more strategic than financially driven, a strong focus on returns should be maintained.

Strategic value to the mothership is simply too hard to capture in financial KPIs and P&L indicators. This is particularly relevant for the majority of CVCs that invest in startups that are ahead of the core business. If your dominant focus is on the long term (Horizon 2 and 3, rather than Horizon 1) it is unlikely that your portfolio companies will have any impact on EBITDA (top line growth and/or cost savings) or become a potential target for acquisitions.

One way to address this is to set up a comprehensive KPI system to track and measure the overall return on innovation — that is a broader concept than return on investment.

Another is to focus on financial returns in CVC investments, and for the innovation part, to run a venture client model to find startups that are ready to work with business units straight away (through proof of concept projects and partnerships). This can provide quick strategic wins.

The secret is balance, both in goals (financial vs strategic) and horizons (H2/ H3 vs H1, to be addressed in a subsequent article) for 'stayin' alive”'

Alberto Onetti is chairman of Mind the Bridge.