Deeptech — technologies like AI, robotics and even quantum computing — are receiving a lot more attention these days. But how much are big companies really willing to invest in these areas? What are they looking for in startup partners with deeptech expertise?

Seeqc, the US-based quantum computing company, helpfully surveyed 200 decisionmakers at large enterprises (those with 1,000+ employees) to find out how they evaluate and source deeptech solutions.

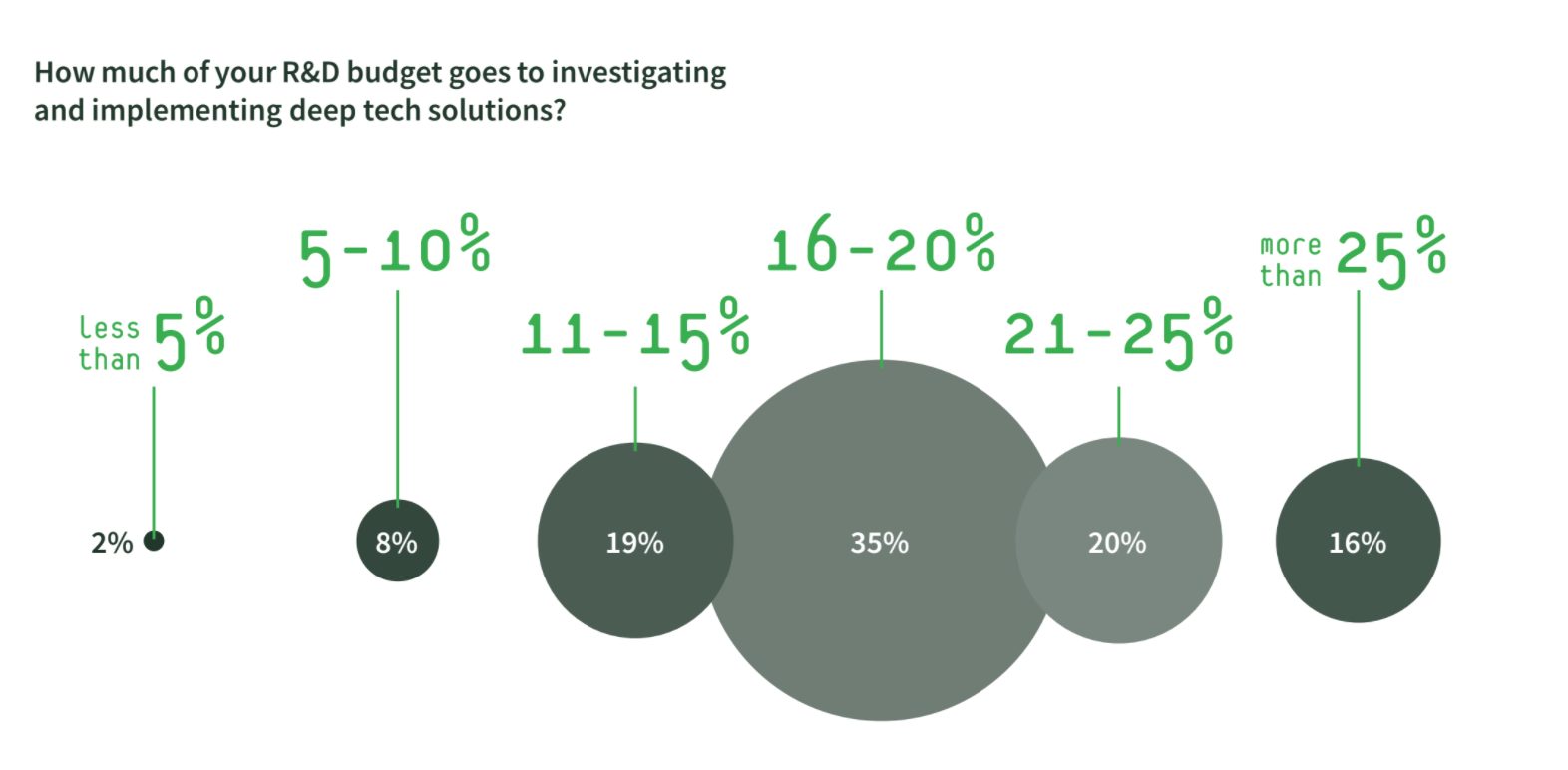

The good news is, deeptech is getting a reasonably big budget from companies — the majority are planning to spend more than 15% of their R&D budget on it. The bad news? They are expecting a return from these investments much more quickly than may be realistic.

This is what the survey tells us:

1. AI is the most popular deeptech area

Half of the companies surveyed are looking at artificial intelligence (with all the hype around AI it’s actually surprising that this isn’t higher). The next most popular technology is 3D printing at scale, followed by renewable energy.

One big surprise is that a third of companies were looking at quantum computing. Given how nascent this sector is and how far quantum computing still is from being genuinely useful for companies, this seems quite a high percentage. Quantum computing was more popular than drones and advanced robotics although those are already in use. It may reflect the fact that quantum computing has become easier for corporate customers to dabble in as big IT companies like Google, IBM and AWS now offer quantum computing as a service.

Quantum computing also has the potential to cut across almost all sectors, observes Levy. “Everyone can imagine some application that is relevant to them, much like with AI, while that may not be the case with autonomous vehicles, for example.”

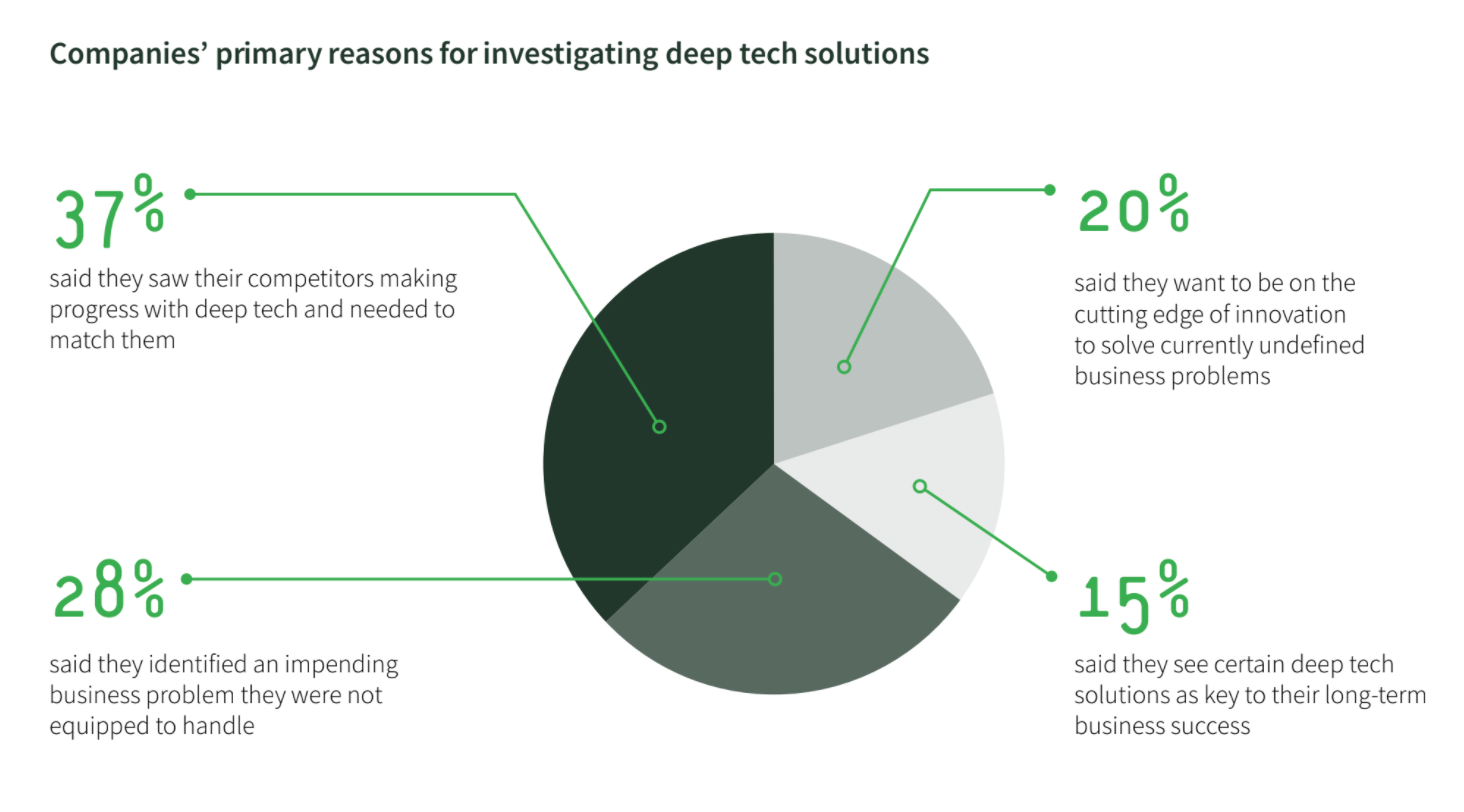

2. FOMO is the main reason for investing in deeptech

Some 37% of the companies polled said they were investing in deeptech because they were worried about being left behind by competitors.

“Fear seems to be a big theme in the motivation for investigating deeptech. Fear of not doing anything, fear of making the wrong decisions,” says John Levy, chief executive of Seeqc. Levy said this anxiety might reflect national-level fears about falling behind in deeptech.

“We are reading about the Chinese government pumping tens of billions of dollars into quantum computing research, while at the same time the US has been having a chip shortage that means we can’t even produce enough for our immediate needs. It seems like a recipe for disaster.”

He adds: “Now imagine you are a pharmaceutical company and you know there is someone in your sector going way deep into quantum computing to solve problems that you understand very well. The alarm bells should be going off.”

There’s a good sales insight here for deeptech startups — if you want to clinch a deal with a big corporate, tell them their competitors are already doing this.

3. There’s a big budget for deeptech

Some 71% of the companies surveyed were dedicating 15% or more of their R&D budget to deeptech.

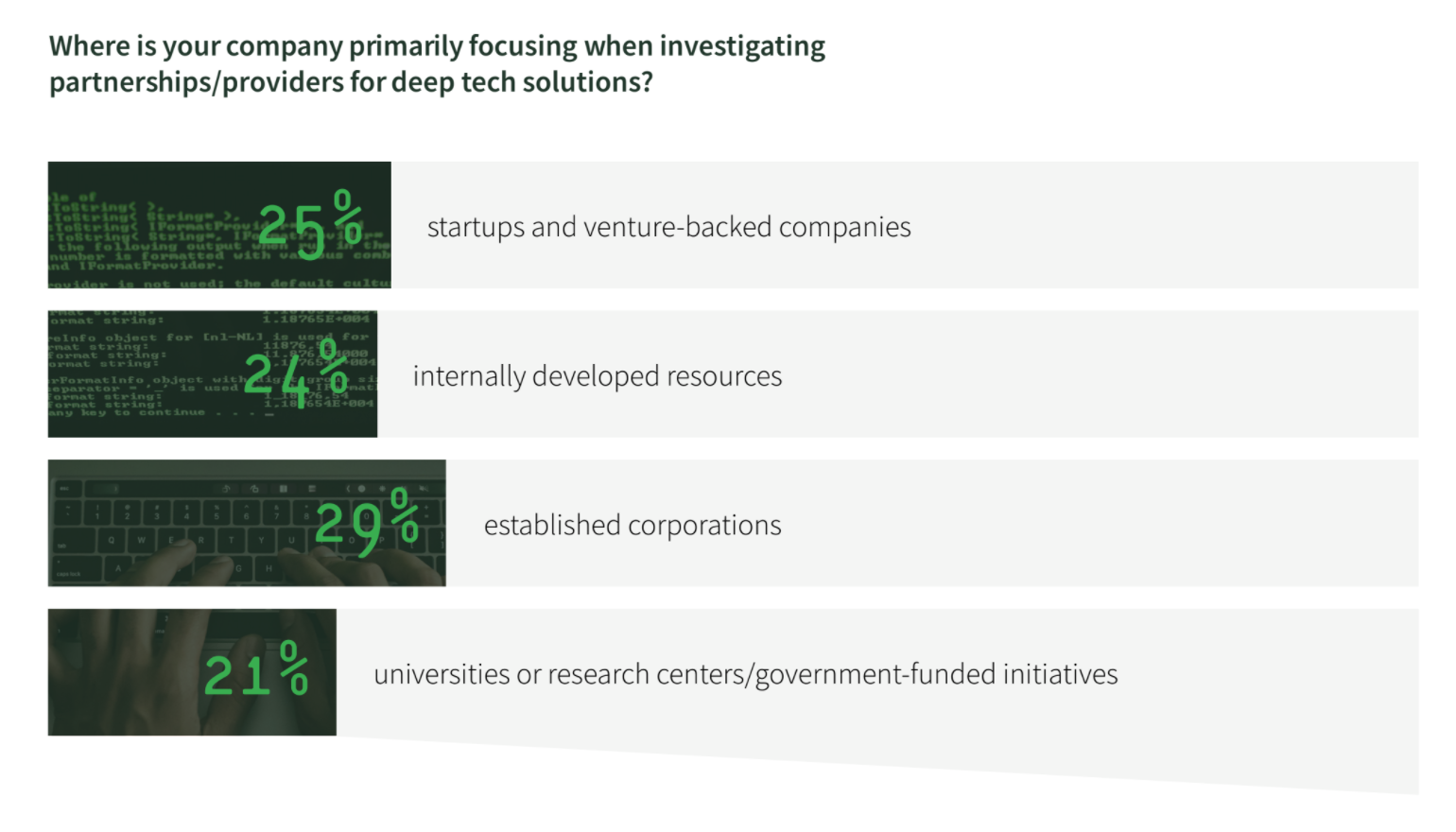

4. There is no clear preference for where companies are finding deeptech solutions

Startups, established companies, internal ventures and universities are all equally popular as places for finding expertise.

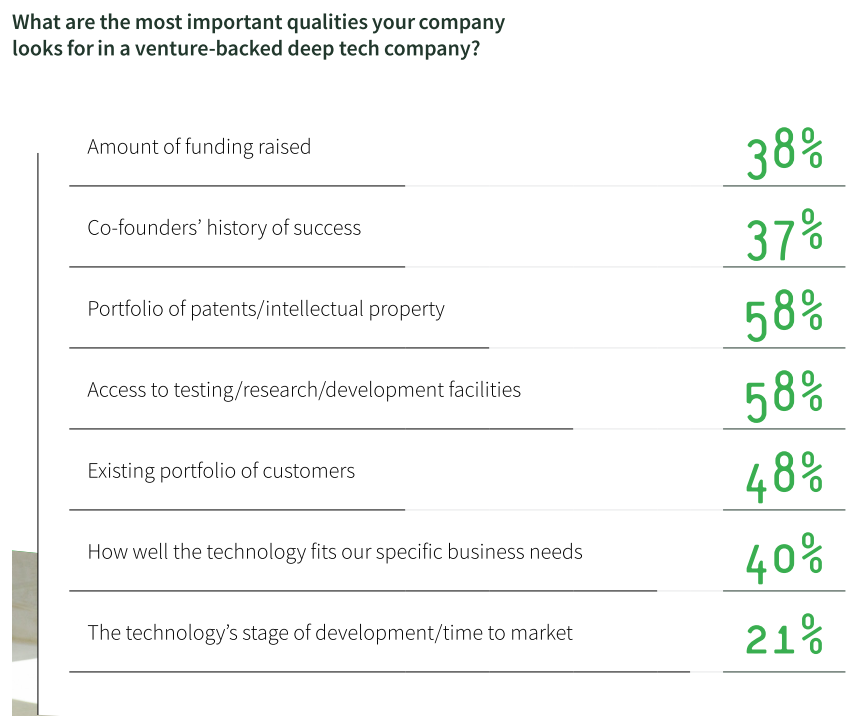

5. Patents and access to lab facilities are two of the most important factors for companies when evaluating deeptech startup partners.

The media often focuses on the amount of money a startup has raised as well as the track record of the cofounders. These, it turns out, are not nearly as important for corporate partners as patents and labs.

“Maybe it is a proxy for how protectable companies want the solutions to be. They want the solutions to give them a real market advantage and if they decide a startup would be worth acquiring it is also important to know that they have protected IP,” says Levy.

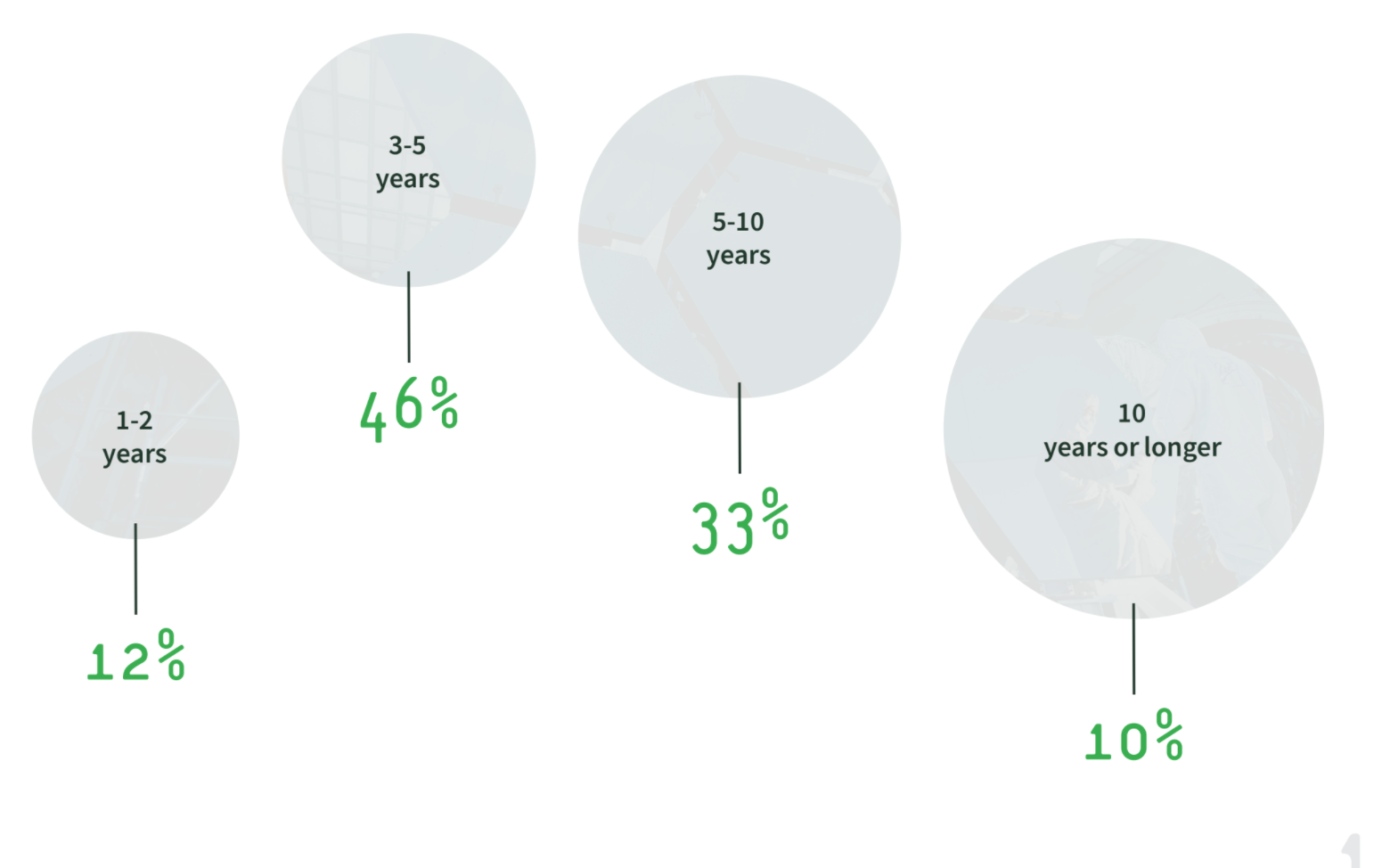

6. Companies expect to see business results from deeptech within five years

This is perhaps the biggest area for potential disappointment. 58% of companies were expecting to see a return on investment within five years — 12% within one or two years. This might be possible for AI or 3D printing, but for areas like quantum computing, it is highly unlikely any real returns could happen this fast.