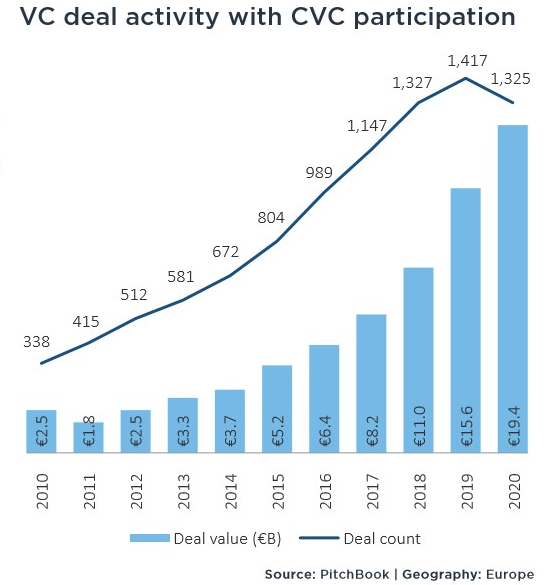

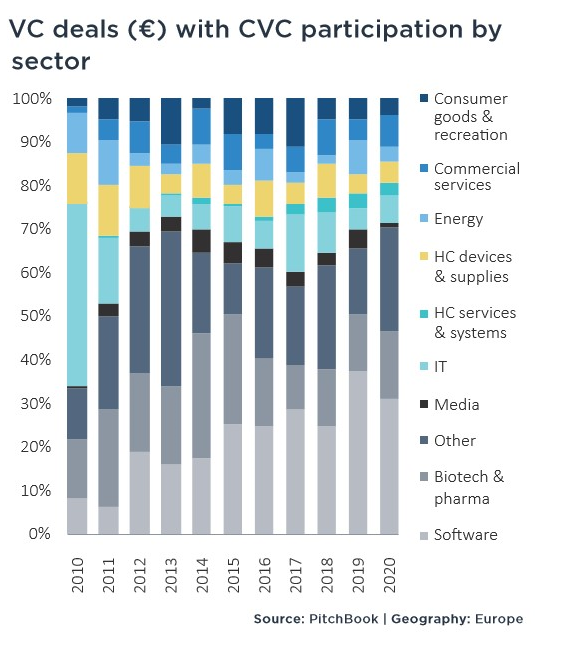

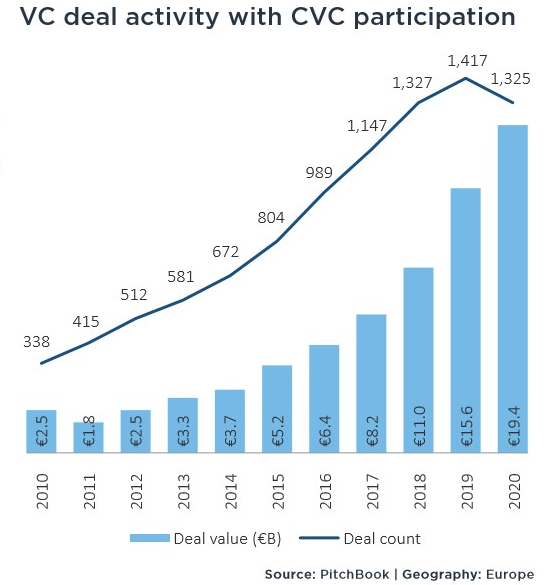

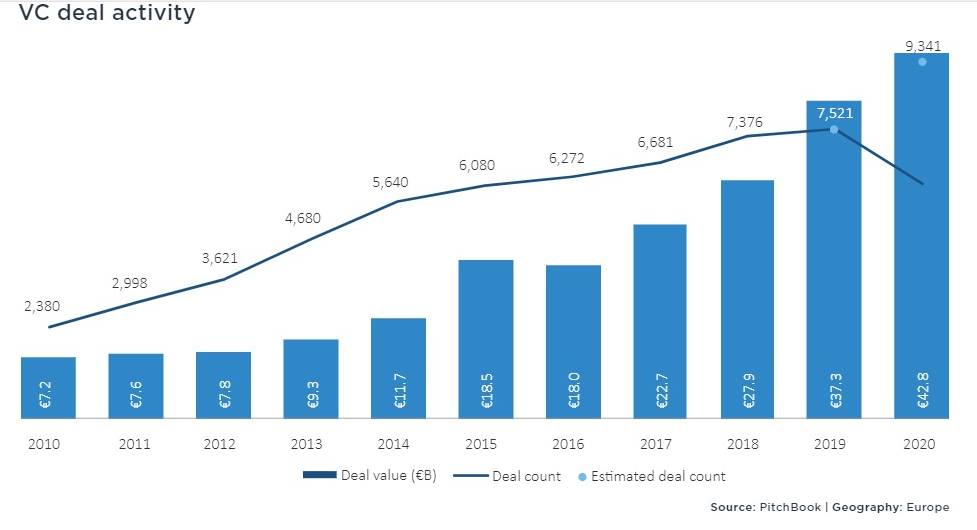

Corporate VC deals hit a record high last year, up 24% from the year before — and it was investments into ecommerce, online recreation and remote working tools corporates that drove the growth.

News

February 2, 2021

2 min read

Corporate VC deals hit a record high last year, up 24% from the year before — and it was investments into ecommerce, online recreation and remote working tools corporates that drove the growth.

Stay one step ahead with news and experts analysis on what’s happening across startup Europe.

Recommended

Europe is making faster cars and better batteries than Tesla

European technology companies such as Rimac, Skeleton Technologies and Einride are rivalling the mighty Tesla empire.

"VCs aren't the enemy"

An investor makes his case for why founders shouldn't be quite so suspicious of VCs.

"Companies that outperform don’t dabble in innovation at the edges"

Customers are hopping from one digital service to another with increased frequency. Great design is a way to keep them loyal.