Europe’s climate tech companies brought in €3.7bn in the first quarter of 2024, according to Sifted data. That’s more than any other sector, surpassing fintech which came in in second place and brought in €2.4bn.

But what are VCs on the lookout for next? We asked six climate tech investors for the pitches they'd like to see land in their inbox, from sustainable mining technologies to green steel produced without hydrogen.

Madelene Larsson — Head of climate and deeptech at Giant Ventures

Data centre decarbonisation

"I would love to see more ideas to decarbonise data centres by reducing energy and cooling needs altogether. Data centres are major contributors to carbon emissions, a footprint that is only increasing with the surge in AI. While there are some infrastructure plays to reduce the carbon footprint of data centres (like renewable energy sourcing e.g. co-locating data centres to wind farms in Scotland), there is still a pressing need for new innovative solutions that target energy use and cooling directly."

Critical metals

"The transition to net zero will require extensive electrification. However, this transition underscores the critical importance of securing a stable supply of critical metals, especially in light of geopolitical tensions. While the US may be exploring novel extraction methods to bolster its metal supply, Europe faces a different challenge due to its limited natural resources. As such, there's a pressing need for innovative solutions to bridge the supply gap, particularly in metals like copper, which are vital for electrification efforts. I would be delighted to hear about new ideas bridging this gap."

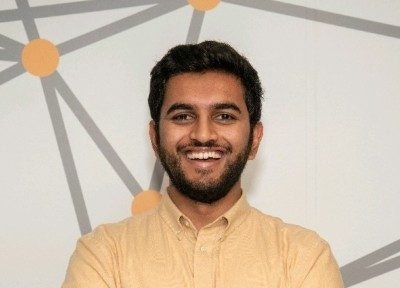

Burhan Pisavadi, investor at PT1 Ventures

Financial models for renewable assets

“A lot of consumers struggle to afford renewable assets like heat pumps and solar panels for their homes. Can a startup build a financial product where private capital buys the heat pump for me and they benefit from my savings? It can work out better for the consumer than a pure bank loan to purchase the asset.”

Action on supply chain sustainability

“Carbon accounting and lifecycle analysis (LCA) are necessary for understanding the climate and social impact of products. But we need to progress from reporting solutions to action: what steps can I as a manufacturer take to decrease the carbon factor of my widgets? And what impact does that have on my costs and my overall supply chain? We need startups like this to drive industrial decarbonisation."

Clara Ricard, investor at Transition VC

Software-enabled marketplace to scale timber for construction

“37% of global carbon emissions comes from the built environment and most of that comes from concrete and steel. Timber is a great alternative, it is widely available and relatively cheap and can act as a carbon sink.

“The demand for timber in Europe and the US has been rising significantly and this is expected to continue in the coming years. The supply chain is thousands of years old, lacks digitalisation and is decentralised and fragmented. This is the ideal ground for a software-enabled marketplace to grow, by bringing transparency, increasing access and enabling stakeholders to focus on what they do best. It will also be important to integrate features that ensure that the timber industry scales alongside sustainable forestry practices.

“A few companies are already working on this, tackling different parts of the value chain from production, manufacturing, design and delivery. I’m excited to see more founders building in this space, given the size of the challenge and the opportunity.”

Reid Carroll, investor at Sustainable Future Ventures

Surging power demand

“Data centres, electric vehicles, heat pumps, and other loads are being added to the grid faster than new generation is, meaning there are projects that don’t have a grid connection to plug into. We’ve already made a couple of investments in companies that help shape demand to match intermittent renewables, but we’d love to see companies working on ways to make grid connection faster.

“Companies that:

- Build strong data sets that show grid connection availability, alongside the costs for doing so;

- Enable more efficient data centres (the primary culprit for power demand growth);

- Enable capacity sharing — like a factory that primarily operates during the day sharing capacity with a company that primarily runs at night.”

Christian zu Jeddeloh, investment associate at Norrsken VC

Sustainable mining

“An area we’d love to hear more from is sustainable mining. It’s a compelling space since it’s so important for the climate transition, but also challenging from an impact perspective due to the huge CO2 and environmental footprint of the mining industry.

“We are interested in startups working to reduce the pollution from traditional mining as well as new and better ways to extract valuable resources from waste streams.”

Sebastian Heitmann, investor at Extantia VC

“We’re interested in:

- Concrete recycling;

- Green steel produced without hydrogen;

- Green ammonia produced without hydrogen;

- Battery recycling;

- Advanced materials or ways to replace critical materials.”