Raising capital is a tough task across the market right now, whether you’re an early-stage founder getting off the ground or a later-stage startup trying to scale.

Some believe the clouds are beginning to part: last week, investors told Sifted that the growth stage scene across Europe is starting to look more promising again. But new data from equity management platform Carta has revealed that while the amount that Series B companies are raising is on the up, it’s taking much longer for these deals to get done than it has in the past.

Here are some of the highlights from the report.

Speed

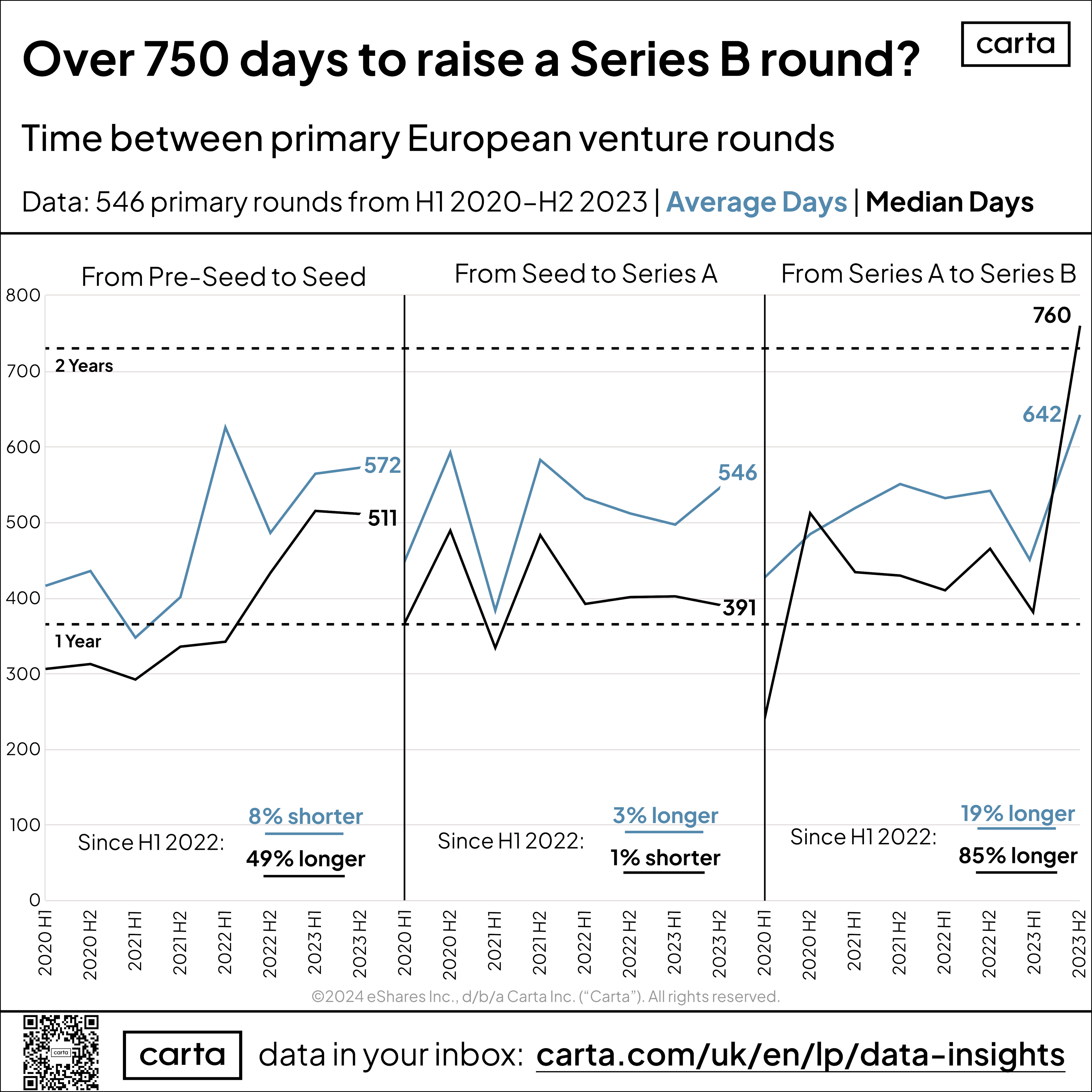

Later-stage rounds are taking longer to close: compared to H1 of 2022, it took a median time of 85% longer for startups to raise a Series B round after closing the Series A, the biggest jump in timeline across all round sizes.

It’s also been tough at the other end of the maturity scale: it took a median of 511 days for pre-seed startups to go on to raise their seed round, an increase of almost half (49%) compared to H1 of the year below.

But it’s better news for seed startups securing Series A rounds, which managed to raise the quickest: the timeline between the seed and Series A was cut by a median of 1%, taking just over a year (391 days) to close.

Size

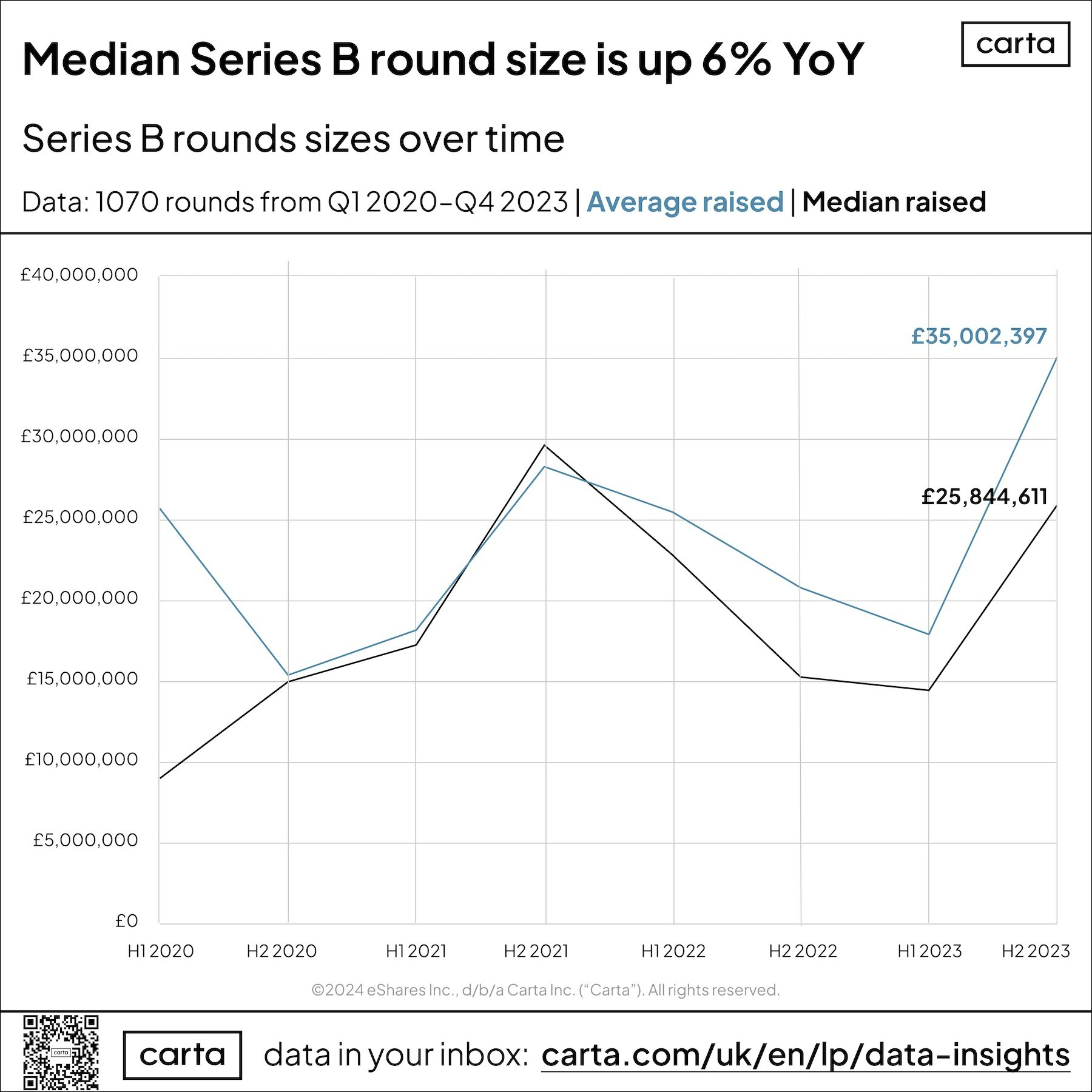

While it took longer to close a Series B, round size is on the up: the startups that did manage to close raised a record high average of £35m. The median round size was also up by 6%.

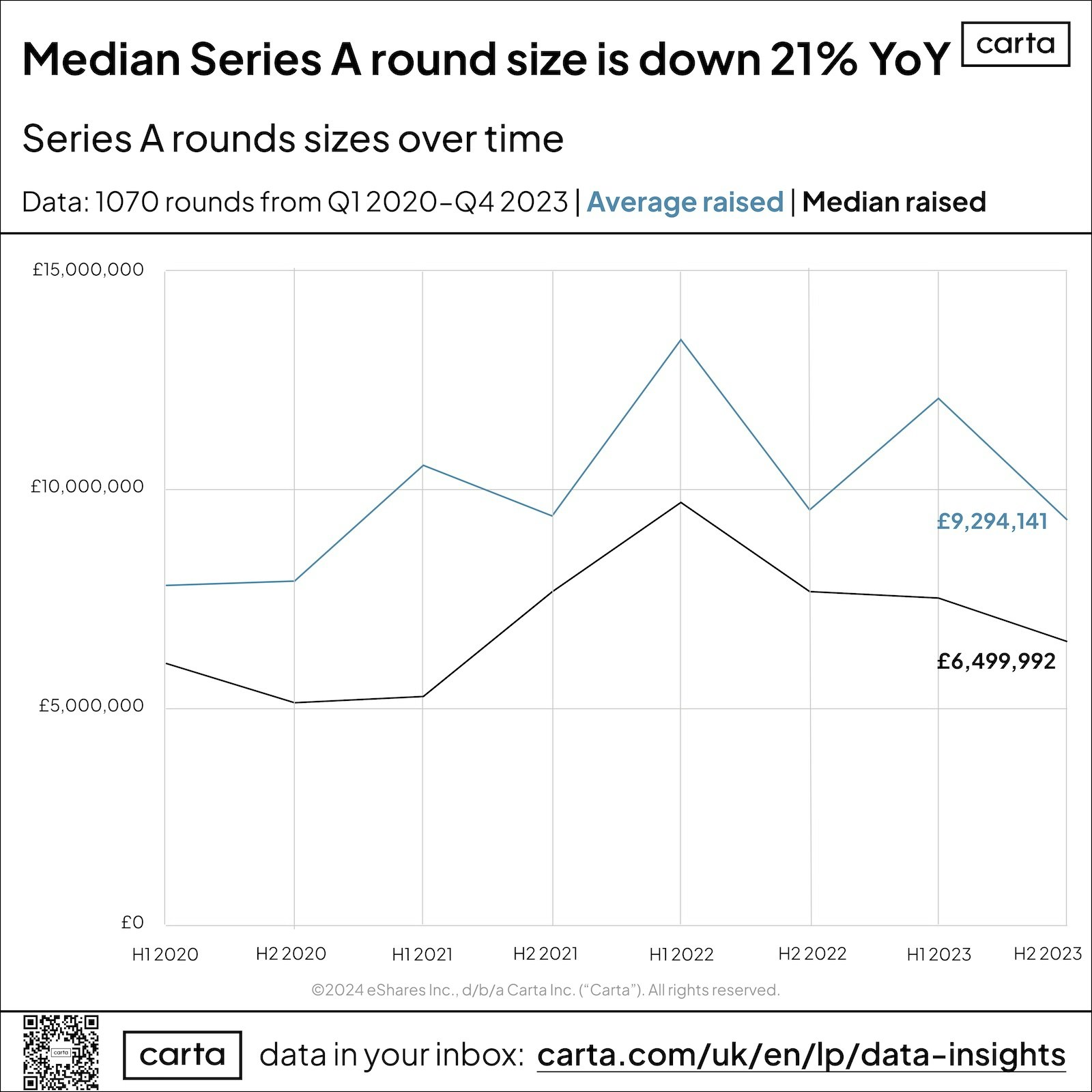

At the next rung down, however, Series A median round sizes dipped in size by 21% in H2 of 2023 year-on-year, with a noticeable sharper decline from its 2022 peak. Arik Oslerne head of Carta Europe, says that this can pose difficulties for founders when combined with the extended timeline to Series B. "Right now, founders are being more conservative on cash burn than their peers in prior years — and the decline in Series A round sizes means investors are expecting founders to do more with less," he says.

Those 2021-2022 funding boom years aside, there is improvement compared to 2020 for the Series A stage: the median round size in 2023 was 27% than in 2020, and volume of rounds rose by 13%.

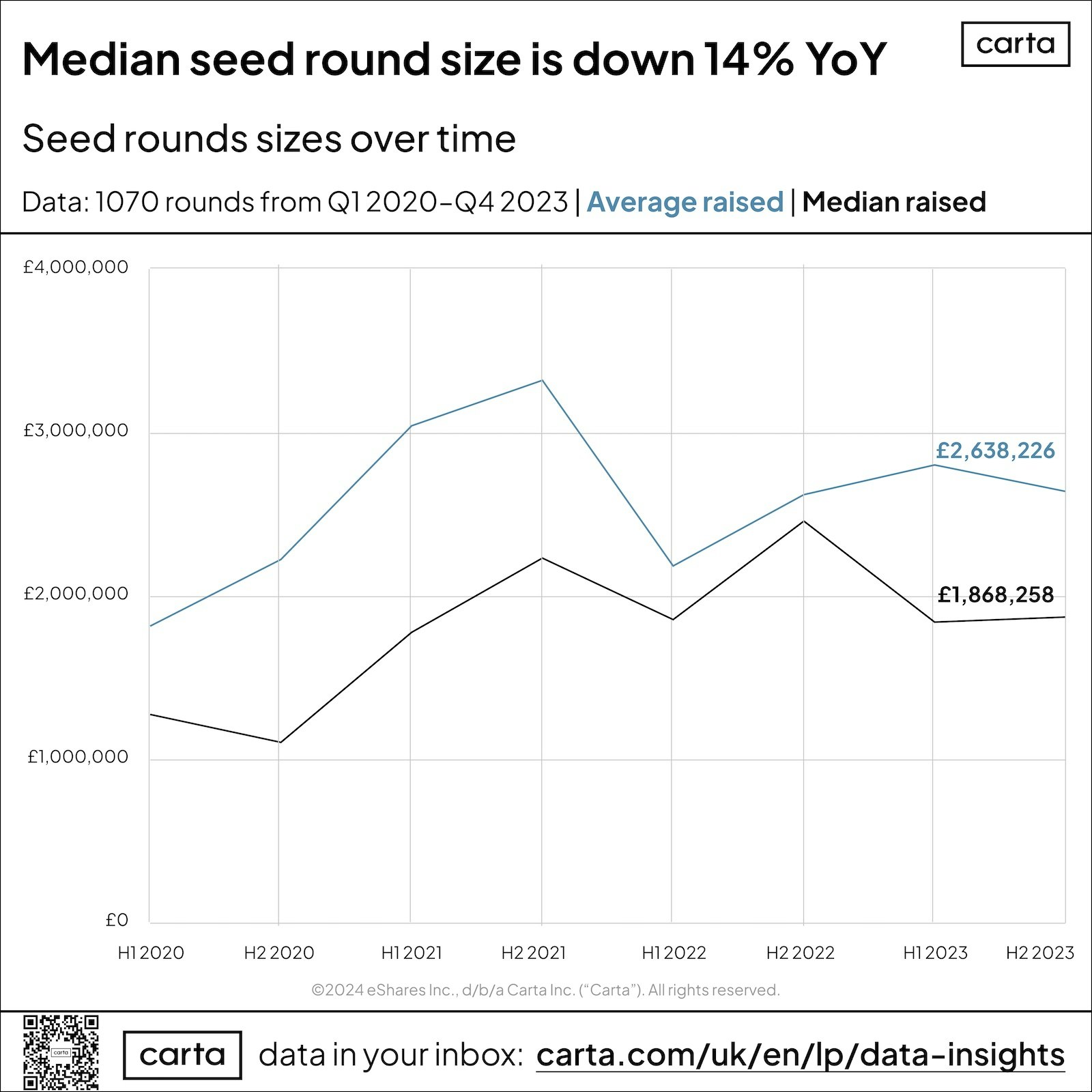

It was a similar picture for seed rounds in 2023, which saw the median value drop by 14% and deal count fall by 26% compared to 2022. But compared to 2020, there’s healthy growth: median round sizes are up by over half (56%).

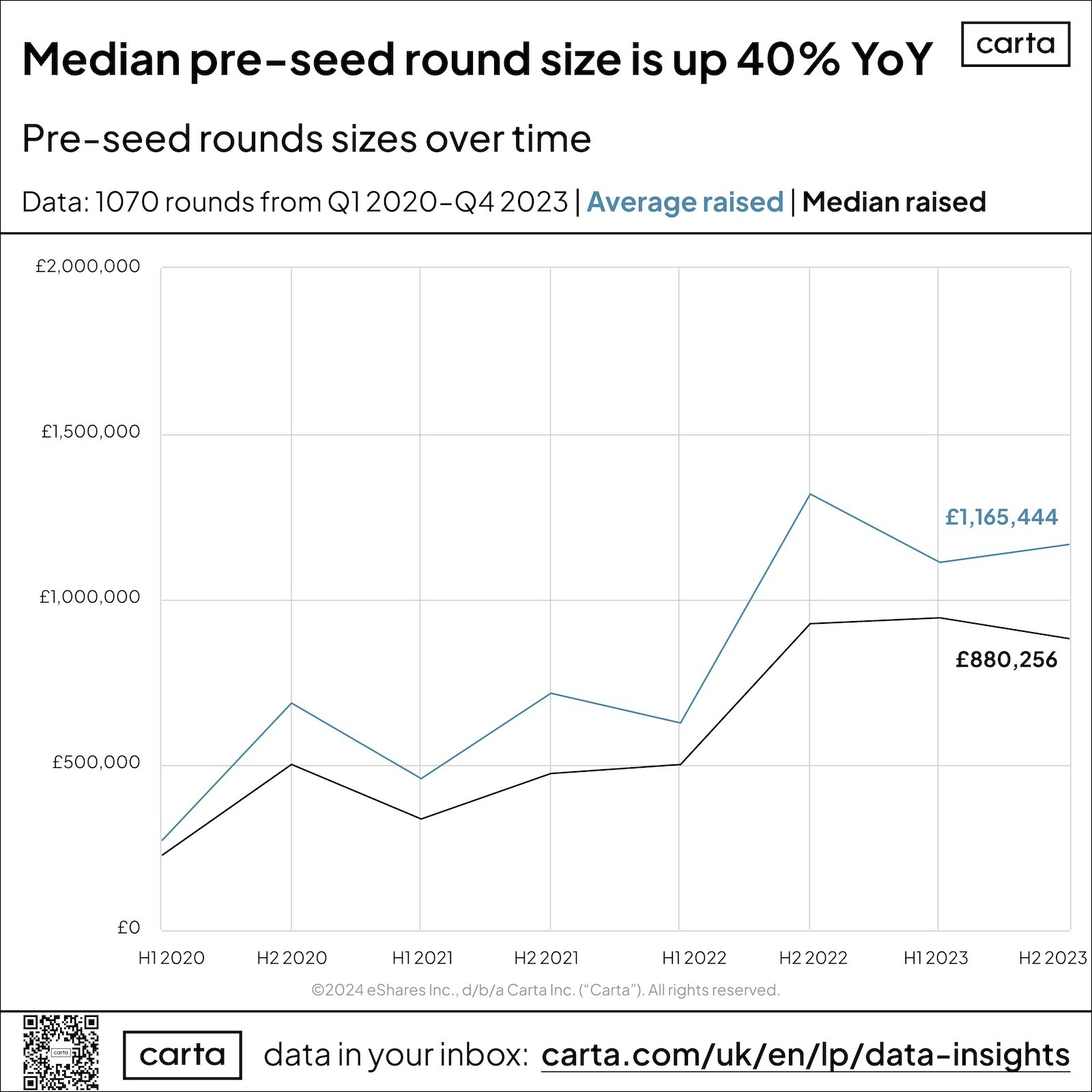

At the earliest stage of fundraising, the size of pre-seed rounds in H1 of 2023 jumped by 40% compared to H1 of 2022, to a median of around £880k.

Carta suggests that the increase “may be as a result of the significant contraction (by 30%) in the number of pre-seed opportunities in the market year-on-year, leading to a seller’s market,” leaving early-stage founders with more power over who they decide to add to the cap table.