For many startups, hitting unicorn status is a big item on the bucket list. However, as the tech industry continues to slow, so too has the number of new unicorns emerging — in 2022, just 47 companies reached unicorn status compared with 69 in the previous year.

Despite a drop in funding, reaching that coveted unicorn title doesn’t have to be a lost cause.

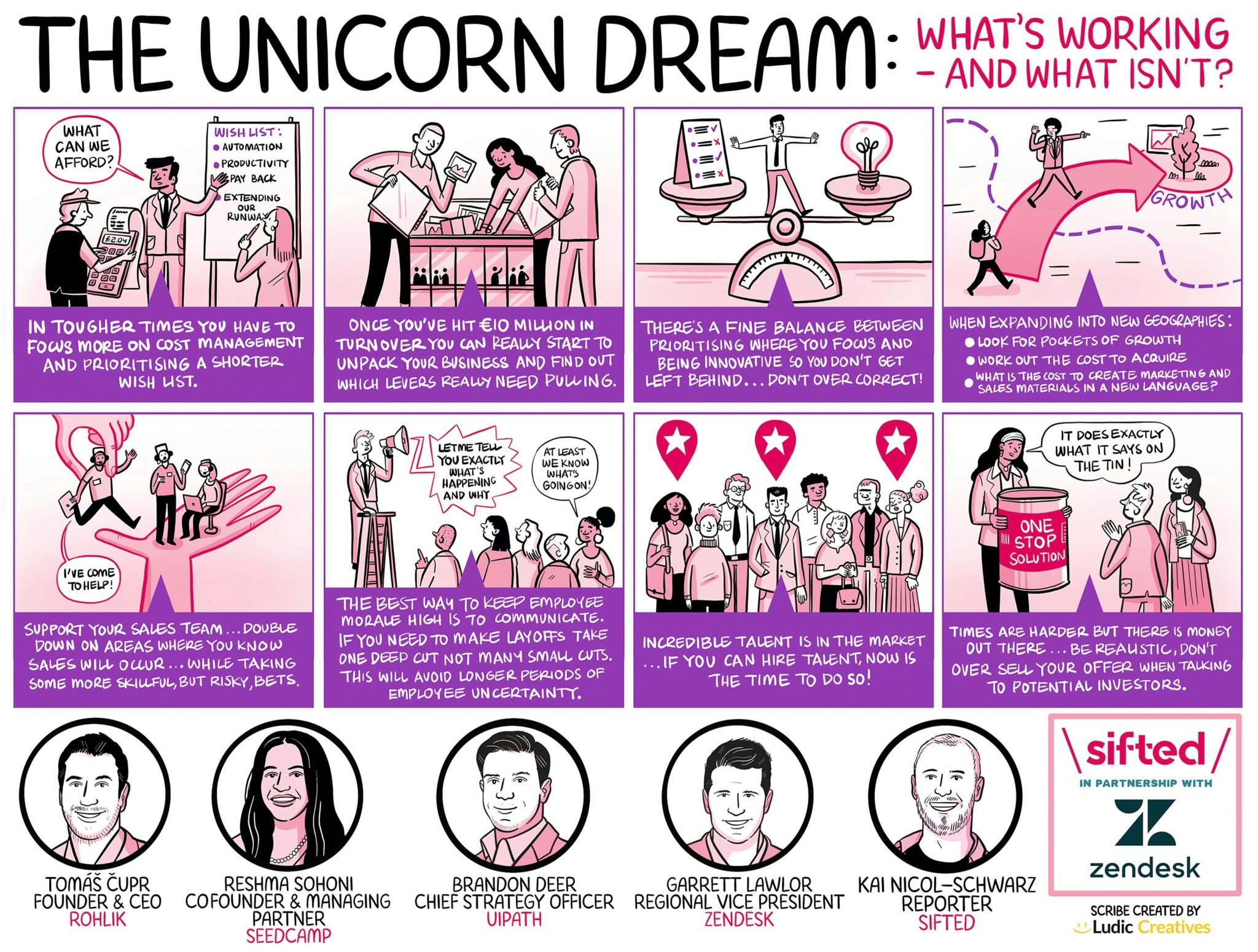

In our latest edition of Sifted Talks, we reviewed how cost management remains king when planning geographical growth, where and when to invest in your team and how opening communication channels with employees can prove fruitful in the long-term. Our speakers were:

- Tomáš Čupr, founder and group CEO at Rohlik, a grocery delivery startup and Prague-based unicorn;

- Brandon Deer, chief strategy officer at UiPath, which makes robotic process automation software and reached unicorn status in 2018;

- Garrett Lawlor, vice-president of sales at Zendesk, a customer service software solution and unicorn;

- Reshma Sohoni, cofounder and managing partner at Seedcamp, a European seed-stage venture capital fund based in London.

Here are the key takeaways from the panel:

1/ Be thoughtful about cost management

When it comes to operating in an uncertain economic climate, the panel acknowledged that careful cost management was crucial.

Čupr noted that a lack of interest in online groceries in 2014 when Rohlik launched meant his company was built on bootstrapping and being really cash conscious. Looking at the present day, he flagged automation as a key method for staying frugal.

“We're investing close to €100m in fulfilment centre automation,” he said. “We’re really making sure that everything we do pays off within the following six months. The payback period for any innovation has got a lot shorter.”

Deer said he believes that cost management comes down to the combination of people and discretionary spend. On the people front, he said that UiPath had been more thoughtful with its expectations and performance management within the business.

Regarding discretionary spend, Deer referred to it as the "great reprioritisation" — the need to have a shorter list of things that you can do within the company, by acknowledging that you can't do everything at once now there are more constraints on resources.

In tougher times, the truth is that you need to be cost conscious — this means you need to follow a more standardised cost distribution curve in terms of the performance of your employees” — Brandon Deer, UiPath

2/ Clear communication is key for staff morale and trust

With tech layoffs dominating the news in the sector this year already, communication with employees has never been more important. Lawlor said there'd been an important focus on how much businesses communicate and how upfront they are about what's going on in the organisation.

He added that frustration often builds when there's a lack of awareness about business strains that evolve in a way that directly impacts staff members — like with redundancies.

Sohoni argued that this was more straightforward when you are a smaller startup. She said that founders of companies this size had the unique privilege of being able to speak to every employee individually and create an open conversation about challenges faced.

Čupr added that he'd had "hundreds" of conversations with employees over the past year related to pressures on business, and how it’s important for leaders to remember that their staff understand what’s going on in the economy.

You want the employees who are in it for the long term to be part of your company for the long run. The vast majority of them are in it to ensure that the company can win, that their teams can win, and that they individually can win along the way” — Tomáš Čupr, Rohlik

3/ Use cost analysis and data to plan expansion

While most startups are working on innovative ways to be operational during the turbulent times ahead in 2023, some are still eyeing up expansion into new geographies. Lawlor suggested looking at the data when deciding where to head next.

Sales and marketing costs must also be a key consideration. Lawlor recommended exploring the costs of developing your product and marketing in a new language, as well as the costs involved with creating new branding for another region.

Čupr added: “[When we look to expand, we look at] cost control, cash flow management and making sure that if we spend a euro, we get it back at some point within the runway time frame.”

You've got to weigh up the cost to acquire and support regional expansion from a marketing and sales standpoint with the return you're getting on it” — Garrett Lawlor, Zendesk

4/ Be intentional about what you’re working towards

The turbulent economic environment is leading many startups to take the time to step away and really think about what they want to prioritise, where to spend their time and checking they’re placing their bets in the right place.

Lawlor noted that while he has very much had this approach, with Zendesk pivoting to new regions and segments, he is still looking beyond the "now" and considering innovative projects that will help take Zendesk to the next stage of growth in the next two to three years.

If you’re doing too much of one or if you’re too conservative, you could potentially be left behind. It is a balance, and Zendesk is right in the middle of it” — Lawlor

5/ Boost support for sales teams to stay aggressive

According to Deer, if you have any amount of data within your customer base, you might have a decent understanding of where you've had the most success by industry or by region. To help sales teams excel, Deer recommended doubling down on those bets and bringing in more support resources.

Despite the tech slowdown, he said he believes that startups shouldn’t give up on a certain level of aggressiveness.

“If you have some cash, resources and market leadership, it's actually a time where you can create a step function difference three or five years down the road,” he said.

If you double down on propensity and density and skilfully place some riskier bets, I think you're in a place where you can both save money and come to a really great outcome” — Deer

Like this and want more? Watch the full Sifted Talks here: