The CEO of Builder.ai has hit out at the company’s lenders — claiming their “unexpected and irreversible action” triggered its collapse — in a leaked memo seen by Sifted.

Since launching in 2016, Builder raised more than $500m from a host of big-name investors, including Microsoft and the Qatari Investment Authority.

In March, the company’s founder and self-proclaimed “chief wizard” Sachin Dev Duggal unexpectedly stepped down as CEO, promising a “new chapter” for the company. He was replaced by Manpreet Ratia, a managing partner at Singapore-based Jungle Ventures, which had previously invested in Builder.

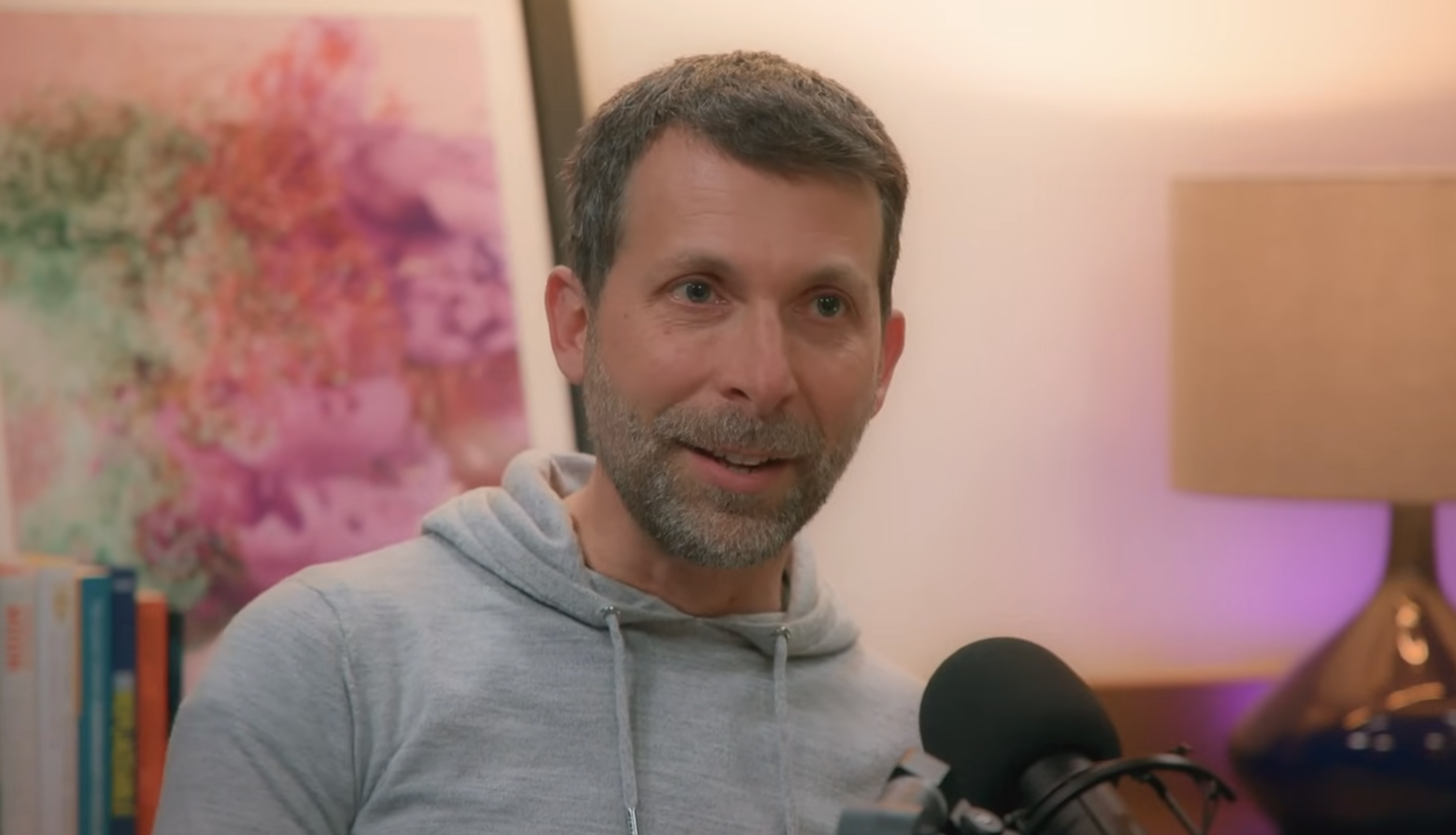

Since then, Ratia has sought to stabilise the company, overseeing emergency fundraising efforts and restating the company’s accounts. But on Tuesday, the Financial Times reported the company had entered insolvency proceedings, after creditors seized the company’s funds.

Fresh details of an internal investigation at Builder emerged on Friday, revealing how "potentially bogus" sales had been logged and revenue forecasts slashed before the company collapsed. In a leaked investor update note seen by Sifted, Ratia said a group of Builder’s most senior lenders “restricted all access to funds” provided under a $50m debt facility the startup drew down on late last year.

He told investors the company’s planned turnaround had been on track, with “$7m in new bookings ready for contract execution”, claiming revenue for the quarter had already exceeded expectations.

“The lenders cited technical covenant breaches, swept over $40M in cash from our accounts, and restricted all access to funds, effectively shutting down our ability to operate,” Ratia wrote.

“Most critically, this left us unable to meet payroll or other operational commitments due this week.”

When approached for comment, Builder.ai did not respond to questions concerning the memo or the company's financial state.

'Irreversible action'

According to the note issued by Ratia, operating expenses had nearly halved to $21m per quarter, cash burn (excluding one-offs) has halved to $16m and the company had achieved 74% of its Q2 revenue target.

“Since the leadership reset in March, we made real progress,” he wrote. “But despite this turnaround, last week our senior lenders took unexpected and irreversible action.”

Builder also raised $75m in “rescue” financing from existing backers in March 2025 and restructured the debt facility with the lenders, the note said.

“[The lenders] also gave repeated verbal assurances of their support for the turnaround,” Ratia told investors. “Regrettably, those assurances were not honoured.”

The move by a consortium of Builder’s lenders, including Viola Credit, Atempo and Cadma — which have all been approached for comment — have also put the startup in breach of its AWS payment plan, of which it had negotiated a 50% discount on $88m in overdue payables, Ratia said.

Builder also told employees it owed Microsoft $30m on a company wide call on Tuesday, the FT reported.

AWS and Microsoft have been approached for comment.

“After exhausting all paths, we had no choice but to initiate insolvency proceedings,” he told investors.

Ratia added: “We are now working with the administrators to manage the transition in an orderly way — to protect customers, employees and any remaining value in the business. We’re also ensuring that all IP and data obligations are handled appropriately, and we will support any interest in acquiring assets or business lines where possible.”

This article has been updated to reflect new details of a reported internal investigation at Builder.ai.