Brolly, a London-born insuretech, has been bought for an undisclosed sum by Direct Line Group, the company announced on Thursday.

Cofounded in 2016 by Phoebe Hugh, Brolly recently went on to win City A.M.’s ‘Insurance Company of the Year’ and made a splash in the press. It also featured in Sifted's list of 9 top fintechs to watch in 2020.

Brolly began as an insurance provider for small items and gadgets, but later launched a dashboard where customers could put all their insurance policies (from car to life) in one platform.

In January, Hugh told Sifted that the company — made up of 9 employees — was "looking to scale at the tail-end of 2020, and [was] growing at 10% per week." She added she was confident Brolly could be the “leading” contents coverage provider in future, taking market share from the big players, and that "the powder [was] still pretty fresh” for shaking up the UK insurance space.

However, in April, one of Brolly's early investors told Sifted the startup had "struggled for some time" and had "not got traction," as well as being in need of more funding after raising £1.7m back in 2017.

The investor added: "[I] imagine they are looking for someone to buy their tech and employ what remains of the team. Will create an elegant exit for Phoebe if she wants to stay and keep it going in some capacity."

The company has also faced encroaching competition from German insurtech, Getsafe, which launched in the UK earlier this year. Meanwhile, the economic slump triggered by Covid-19 may have also reduced demand for consumer-facing insuretechs like Brolly.

Still, while Brolly's sale may be more of a "dignified exit", the company has still managed to attract one of the UK's biggest insurance companies as its buyer. Brolly's nine person team is reported to be joining Direct Line as well as sharing its tech platform; seemingly folding its own 'Brolly' brand.

Hugh was not available for comment.

Insurtech having a moment

Although the lockdown may have temporarily stunted demand, insuretech is increasingly seen as one of the most exciting trends in finance.

Barbod Namini, a fintech partner at HV Holtzbrinck Ventures, told Sifted in May he expects insurance startups to broadly emerge stronger in the post-crisis world, with both renewed investor and consumer attention,

"Sharp downturns that result in job losses and businesses defaulting should result in a spike in interest in various types of insurance that alleviate the impact of such drastic events," he said.

"The insurtech space as a whole should hence be a net beneficiary, as it sees increased demand. That extends to startups with their own insurance products as well as startups like Wefox and Instanda who serve to improve incumbent insurers and brokers. Indeed, incumbents will also be looking for ways to digitise their distribution channels to better capture the new demand."

Indeed, US-insurtech giant Lemonade chose to list publicly in the midst of the pandemic, as well as beginning its expansion into Europe in June.

Martyn Holman, a partner at Augmentum, also says his fintech fund is now looking closely at B2B insuretechs, particularly those that offer analytics or software tools to handle insurance claims.

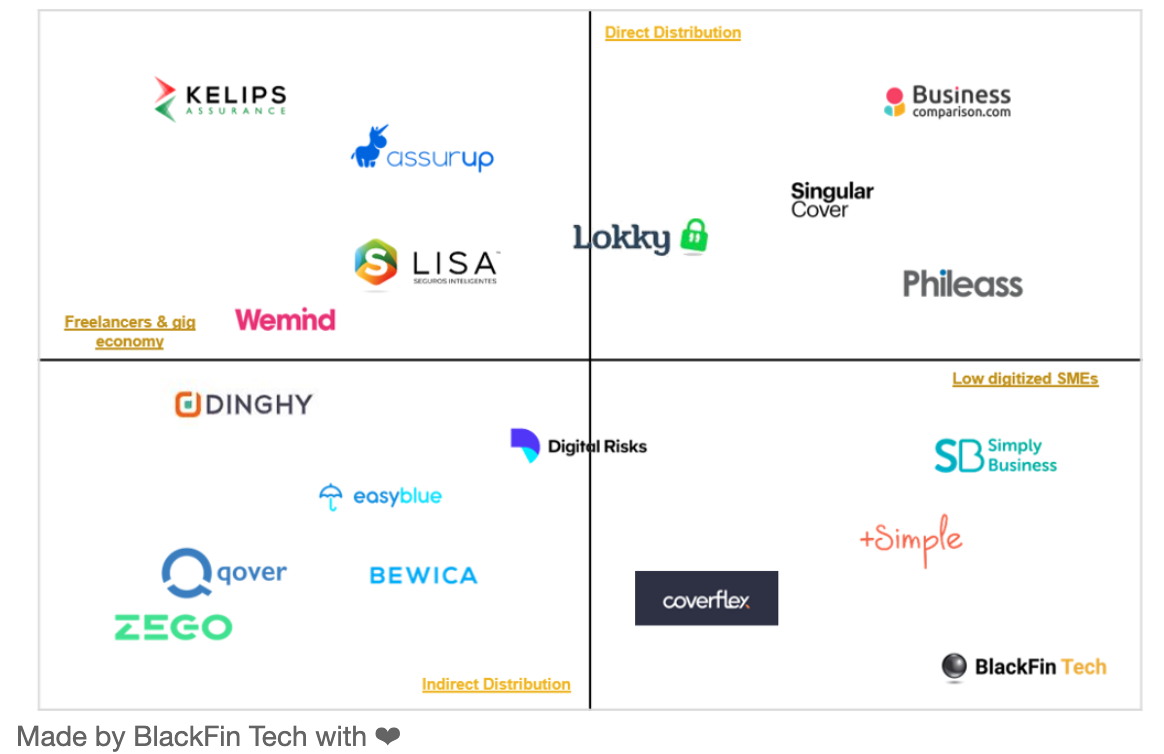

"[There's] large elements of manual operations, large inefficiencies and huge areas of cost — with massive opportunity to disrupt," he said yesterday, speaking in a public webinar. "We're seeing increasing numbers of players coming in the value chain perspective, insurance-as-a-service and the facilitation around that."

The insurance industry has been particularly slow to innovate, but the team at Finch Capital say the pandemic has accelerated the need for change.

“Insurers that haven’t fully digitised the claims process to date will come to the conclusion they have to," they told Sifted earlier this year.