Boards are the responsible bodies for any company’s governance. In startups, their members can act as a sounding board for strategic decisions and a hub of expert knowledge. But the wrong board composition can also be an Achilles heel. That’s why choosing each member of your board carefully is critical.

We sat down with a number of founders and board members to find out what a board member does, how to pick the right one and why they’re necessary.

Why are boards important?

“As with any partnership, it can both build you up or break you down,” Jessica Schultz, partner at multi-stage VC Northzone, says of boards and startups. She sits on a dozen boards including Einride, Dalma and Flink.

“Boards can hinder companies in the worst kind of ways. For that reason, it’s imperative for both founders and investors to be strategically aligned on how to drive the company forward.”

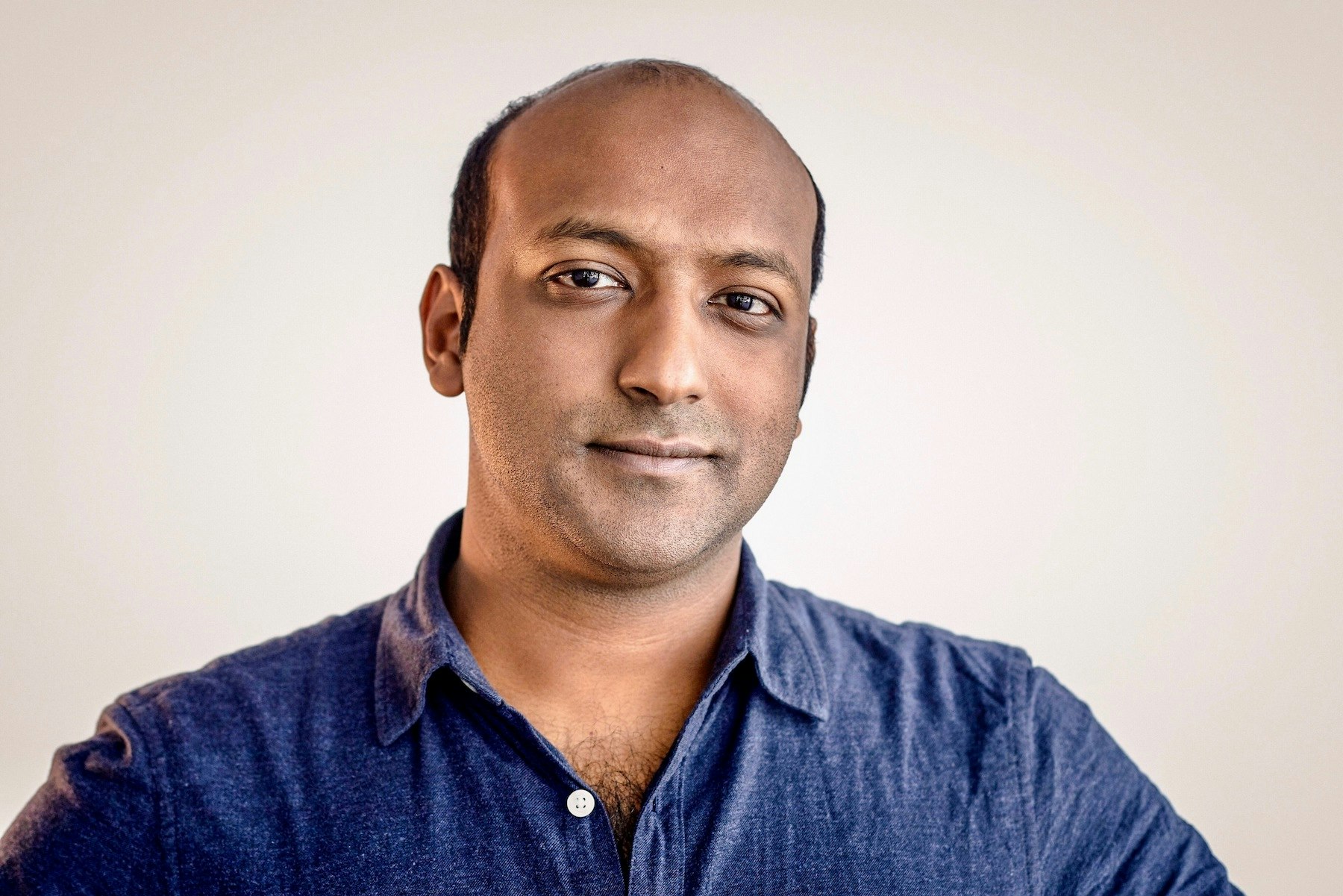

However, Saalim Chowdhury, managing director of Techstars, one of the world’s biggest seed investors, says you need to be very clear about the objective of your board. It shouldn’t be a box to tick. “A board should be there to ensure the company is doing the right thing and has the advice for the big key decisions,” he says. A former VC and founder, Chowdhury has both sat on boards and built them.

He warns against rushing into creating a board and believes in many cases they’re not necessary until Series B. It varies by stage, function and purpose, he says, but generally it’s best to keep tight reins on the number and quality of individuals.

“You should have boards as small as possible all the way through,” he says. “In my personal experience, I find boards pre-Series A with more than seven people a waste of time. They tend to be ineffective because there are too many voices at the table.”

What does a good board member do?

According to Max Parmentier, CEO and cofounder of Birdie, a home healthcare technology platform, good board members:

- Have the ability to read your business and clearly see its strengths and weaknesses

- Have the ability to advise on what’s coming next

- Contribute to board meetings

- Ask the right questions

- Are detail-oriented

- Focus at a strategic level and don’t get lost in the mire

- Act as an invaluable sounding board in difficult moments.

Getting board composition right

The first thing to be aware of is that there are two types of boards: formal boards and advisory boards. The makeup of a board usually consists of some investors, NEDs (non-executive directors, individuals who are not part of your executive team) and team members.

“Often funds which are leading rounds will try to have a board seat and add a board observer,” explains Parmentier, who helped Birdie raise $30m in Series B last year. “The board seat member has all the power. Depending on your negotiation, usually they can vote, approve, block things and so on. The board observer doesn’t have any power as such but can attend the meeting and be in the room.”

When setting up a board, the key thing is to “balance the ratio of investors and non-investors,” advises Chowdhury.

Something he’s adamant about is the importance of having another founder on the board. “You need another founder who’s been on that journey,” he says. “They don’t even need to be in the same space. But they need to have been on the journey of building, scaling and having done what you’re doing – often to explain to the people who haven’t on the board.”

“Every founder will tell you a different story,” adds Parmentier, “but, for me, it was absolutely critical to, yes, have a big name of a fund but, equally importantly, have a great person on the board. Because it can change the entire dynamic — even if you have a super cool name, tier one VC, if the partner isn’t someone you click with or is too busy, you don’t get the value.” Birdie’s current board consists of three investors, three team members, the founders and two board observers (also investors).

While you don’t always get to choose the investor that a fund puts on your board, with NEDs, “you can have a very clear brief of what you want”. This starts with looking at the skills needed on the board and within the company and determining any weak spots.

Doing due diligence and finding the right fit

Since representatives from an investor will likely join a startup’s board post-investment, finding an investor and a board member are all part of the same search for founders.

First up, Parmentier says, do your homework. He begins by identifying funds he’d like to work with because of their expertise and identifying partners with complementary skill sets. Then he’ll build a relationship with them over months — sometimes even years.

“Sometimes people rush with: ‘Oh this fund is interested, this partner sounds friendly’”, he says. “That’s not good enough. You need to do your due diligence. Make sure that you talk to people who have worked with that person and understand how they operate.”

Something crucial, he says, is aligning your expectations with the individual’s. So, having an initial conversation where you honestly discuss things like:

- Are we talking about a $10m or $100bn business?

- UK only or international expansion?

- Are we super aggressive and could lose it all or are we more conservative?

Personalities matter, says Northzone’s Schultz, and “companies should strive to partner with a VC that they genuinely like”. For her part, she always recommends entrepreneurs spend time with her before choosing her as an investor, “because we’re going to be collaborating for a long time”.

She also gives companies references: “Both investments that have done well and those that have not done so well. It’s just as important to see how board members react when things don’t go to plan as when they do.”

“Ideally, you’ve met with them lots, you’ve worked with them in some way, shape or form,” says Chowdhury. “Nine times out of 10, a good board member is independently wealthy and they can afford to spend an hour a month with you. It’s often a sign that they’re actually going to add value. Get to know them. Date them, for want of a better word.”

Red flags to watch out for

“If it’s an investor, make sure that investor will stay over time,” says Parmentier. “If a fund is not solid enough or clear enough on the investment strategy, there’s a risk that the person on your board may not stay long enough to add value.”

Chowdhury says to watch out for “predatory board members”. They’ll promise lots, get their 1% equity, be great for six months and then disappear on to the next startup.

“Backstreet driver operators have no place on a board,” he adds. “You’re there to help steer and provide governance, not to operate the company in any way, shape or form – no matter the money invested or experience.”

Schultz agrees: “The last thing a company needs is an investor droning on about how smart he or she is. It’s not about being smart; it’s about understanding the pivotal things that make a difference.”

“Make the board work for you,” continues Chowdhury. “The board is there to help amplify the company. It’s not meant to be a millstone around anybody’s neck. It’s there simply to provide check-ins and should be a place where you feel safe. You shouldn’t have to feel that you’re hiding things from them or trying to round up numbers to look good for the board.

“You need to feel safe enough to bear all. The best boards at early stages are ones that can handle the dirty internal reporting instead of fancy board presentations.”