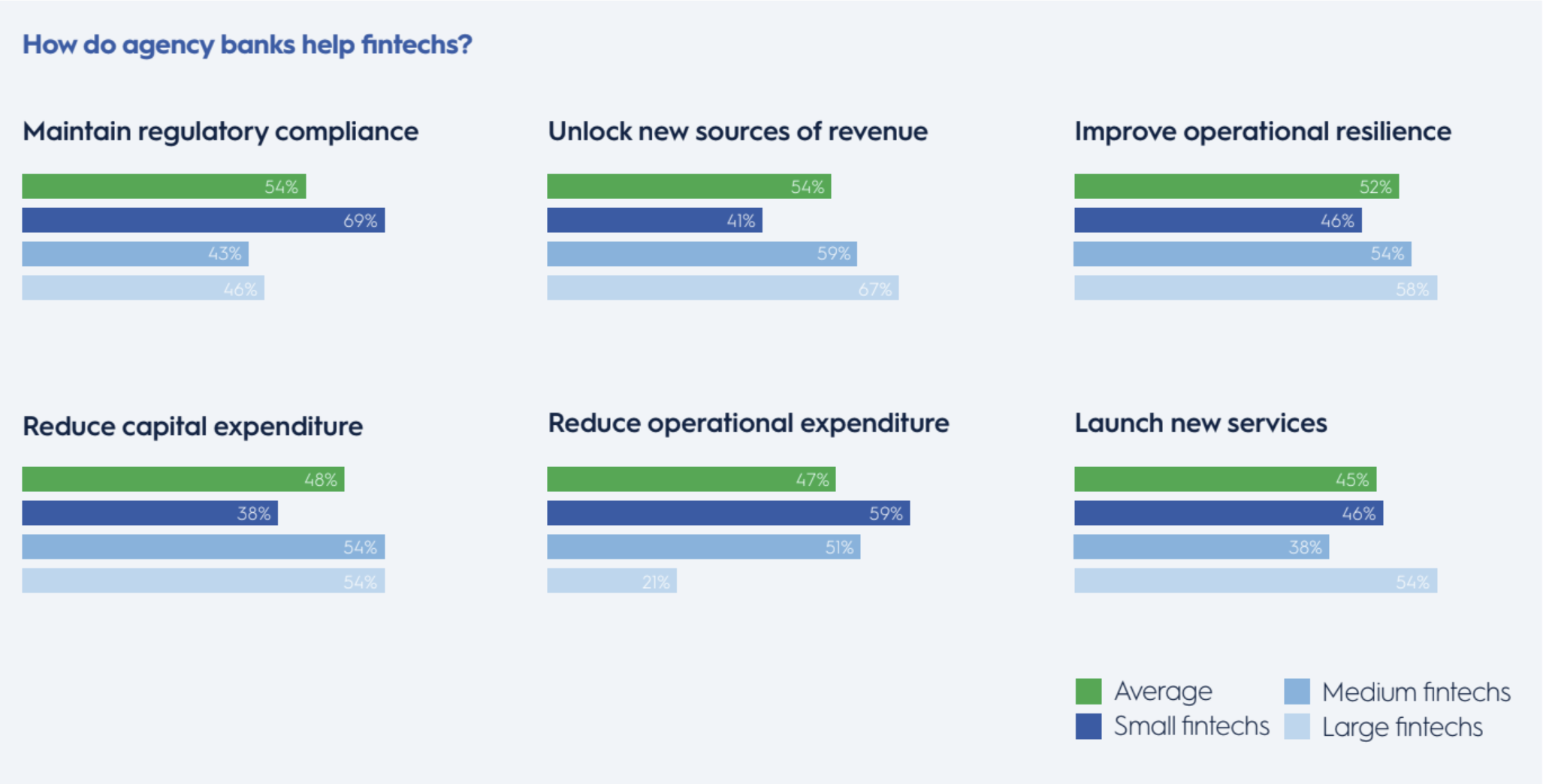

A recent ClearBank survey of European fintechs found that over 50% of fintechs see banks as ‘mission critical partners’ — helping startups with regulatory compliance, finding new revenue streams and reducing operational spend. And for banks, working with fintechs allows them to innovate alongside them, while also keeping their fintech collaborators from challenging their corner of the market.

Because of this, ‘agency banking’ — or when a fintech offers its customers a service that is provided and managed by an authorised financial institution, like a bank or credit union — has become an increasingly popular model for fintechs and banks alike.

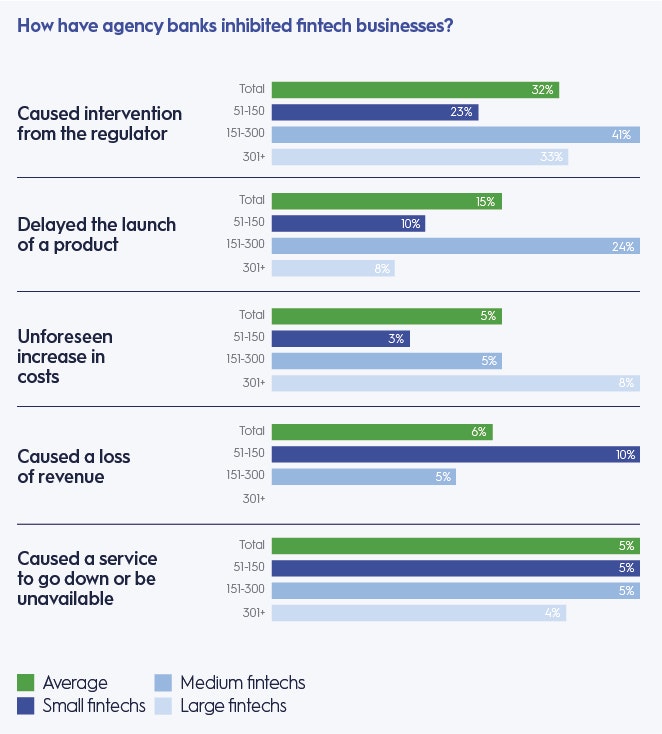

But ClearBank’s report found banks aren’t meeting their partners’ needs — just under half of respondents don’t think their agency banking partners have helped their business at all. Service outages, outdated technology and cultural clashes were cited as the biggest concerns.

So how can banks and fintechs work better together?

1. Big banks need to move to the cloud

A big draw of partnering with agency banks is that fintechs can improve operational resiliency. In practice, this means fintechs can minimise regulatory intervention by using systems and businesses that have already gained approval from statutory bodies. While fintechs can offer bank partners more innovative tech and services, agency bank partnerships should also increase protections against tech issues; by using an established bank’s payment systems, for example, fintechs should have peace of mind they will remain operational.

But many fintechs feel they’ve been left in the lurch by their agency bank counterparts. A third of the respondents to the ClearBank survey have dealt with intervention from financial regulators, while 5% have faced a serious outage of services — such as being unable to access payments or retrieve customer funds — due to a fault of their banking partners.

Simon Jones, ClearBank’s chief customer officer, believes operational resiliency can be improved by banking partners adopting cloud native systems instead of large data centres.

“Instead of having to have your servers in two different data centres, you can hold your applications across multiple clusters, across multiple zones within a cloud. And that really gives you a significant real time resiliency,” says Jones.

Not only does this mean less catastrophe when there’s a technological issue, but it also protects the fintech from further scrutiny. Service outages and unkept customer promises attract the beady eyes of financial regulators.

The cloud also allows banks to keep up with fintech innovation. Rather than batching platform or service updates in one big programme of change, banks can now roll out patches quicker, reducing risk of outages and providing real time improvements.

“In a cloud environment, you create lots of much smaller changes via a microservices architecture that allows you to make small changes on a continuous basis,” says Jones.

Instead of having to have your servers in two different data centres, you can hold your applications across multiple clusters, across multiple zones within a cloud. And that really gives you a significant real time resiliency,” says Jones.

2. Banks should offer more transparency

Legacy banking’s lending activity is also causing friction with fintech partners. 42% of fintech respondents to ClearBank’s survey wanted further transparency on the use of their customer’s money, while only 22% believe that high street banks can actually provide greater clarity.

“Transparency is extremely important,” says Neha Jha, group product manager at Mambu, a SaaS cloud banking platform that uses ClearBank as an agency partner.

“In a highly regulated environment, there has to be an audit trail and all checks and balances need to be in place — and the agency banking platform should be built with this in mind.”

Jha suggests that banks should provide accessible transaction data, clear reporting of fraud checking and automated dashboards that can give fintechs peace of mind quickly and efficiently.

The buck doesn’t just stop with the banks, however. Jones points out that fintechs should also be checking their banking partners’ investment strategies, in particular their loan to deposit ratios, to make sure their needs will be met.

In a highly regulated environment, there has to be an audit trail and all checks and balances need to be in place — and the agency banking platform should be built with this in mind.

3. Fintechs need better ‘banking as a service’ solutions

However, this need to investigate a bank’s lending speaks to the fundamental rift in the bank-fintech relationship.

Over half of fintechs believe that banks’ primary focus is on their lending and debt products, while fintechs want greater innovation in technology and systems. Only 48% of fintechs believe they have ‘banking as a service’ from their partner.

How do banks provide better tech solutions for fintechs? For Jen Anderson, chief technology officer at credit union fintech Incuto, the answer again lies in mirroring the quicker pace of their smaller partners.

“Moving away from large cumbersome IT programmes, which are more likely to fail, to a higher number of high-performing small teams with a clear mission of what they need to deliver, end-to-end, and who take responsibility for the business outcome — this will go some way towards greater agility,” says Anderson.

Jones agrees, but also points out that the underlying infrastructure that supports greater agility must also be improved.

“We see large banks starting to bring people with an agile mindset into their organisations. That's great to try and change the culture,” says Jones. “But if you don't change the underlying infrastructure, you’re not allowing them to adapt, to change, to develop. That's a big challenge a lot of banks still have: is their infrastructure moving quickly enough to bring in that talent, to allow that cultural change to happen more broadly, across the organisation?”

Moving away from large cumbersome IT programmes, which are more likely to fail, to a higher number of high-performing small teams with a clear mission of what they need to deliver, end-to-end, and who take responsibility for the business outcome — this will go some way towards greater agility,” says Anderson.

4. Fintechs need flexibility

Historically, banks haven’t needed to think too much about making these changes. Fintechs often struggle to switch providers due to a fear of a painful ‘offboarding’ process. Despite this, 14% of fintechs in ClearBank’s survey are expecting to move providers in the next year.

Jones expects banks will need to shape up quickly to avoid losing their fintech partners, and adopt standards that allow fintechs to move between providers more easily, or they will not win the business in the first place.

“Fintechs have got fairly flexible architectures, they can move quite quickly,” says Jones.

“I think there's a very clear message to agency banks, if you don't make it easier for people to switch. The industry is moving towards that anyway. The players that do provide that flexibility are the ones that are likely to be picking up a greater and greater share of that volume.”

ClearBank, Next Generation Banking Solutions. Through our banking licence and intelligent, robust technology solutions, we enable our partners to offer real-time payment and innovative banking services to their customers. Download our report here.