Balderton is one of Europe’s top venture capital firms. It's recently raised a new $400m fund to invest in European companies at Series A, and its team have met with a mega 7,500 European founders over the past two years.

But what makes it "top"? How good, really, is its portfolio?

We take a look, with data help from Dealroom.

Voi (Stockholm, 2018)

Balderton investment: Series A 2018

Employee growth over 12 months: +208%

Europe’s leading scooter startup is just over a year old, but has spread far and wide across the continent. With a fresh $85m in the bank, now it’s focusing on making a profit rather than growing at all costs. Will it also be acquiring any competitors?

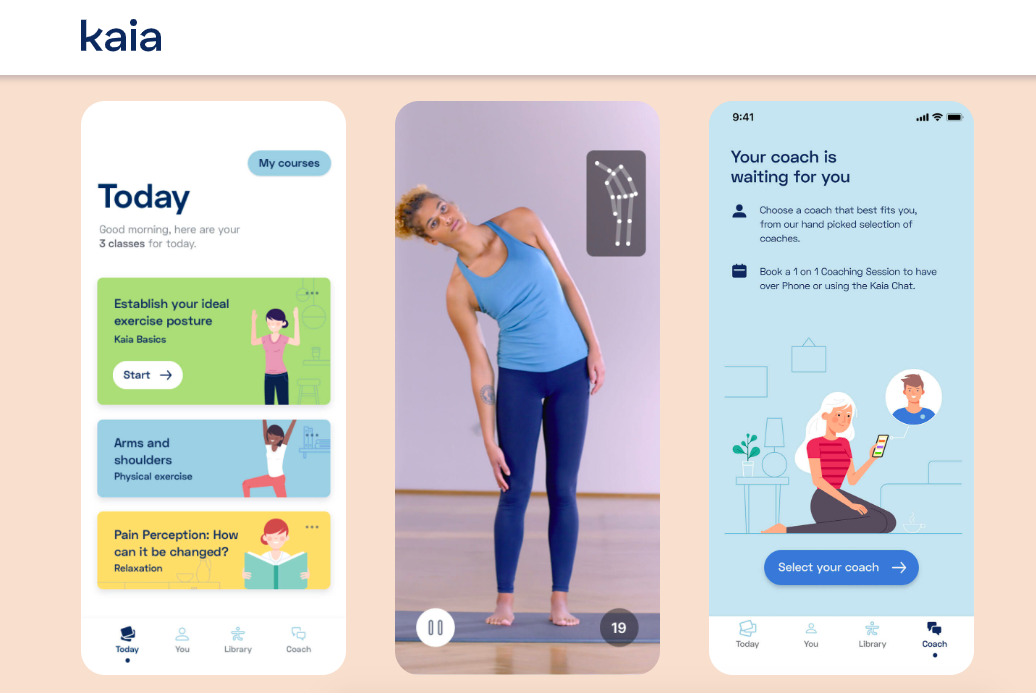

Kaia Health (Munich, 2016)

Balderton investment: Series A 2018

Employee growth over 12 months: +86%

One of Balderton’s growing portfolio of data-driven health startups, Kaia Health uses computer vision to help people get more out of their physio treatment. Its app reminds them how to do their physio exercises and when to do them, and can give feedback on how to perform them better. “That market — keeping people on the straight and narrow — is a huge opportunity,” says Chandratillake.

Revolut (London, 2015)

Balderton investment: Seed 2015

Employee growth over 12 months: +69%

With “unicorn” status and an army of fans across the continent, digital bank Revolut is one of Europe’s best-known startups. It’s also hoping to become a household name in the US, where it plans to launch soon and has built a 50-person team.

Read more: Europe is beating the US in fintech innovation, says Revolut’s Nikolay Storonsky

Healx (Cambridge, 2014)

Balderton investment: Series A 2018

Employee growth over 12 months: +58%

Healx puts its AI platform to work to discover new treatments for rare diseases — the kind of treatments which rarely get much attention from pharmaceutical companies because the cost of finding a cure is so enormous, and the market relatively small. “This could change humanity in a way little else can,” says Chandratillake. “The team understand AI and pharma and chemistry and biology: it’s a good example of where European tech works really well. Europe is home to the best pharma companies and scientific researchers, so when we get into that applied area of AI we can be world class.”

Simple Feast (Copenhagen, 2014)

Balderton investment: Series A 2018

Employee growth over 12 months: +58%

Danish startup Simple Feast delivers pre-prepared plant-based organic meals, in sustainable packaging, to customers in Denmark and Sweden. After raising €30m in September, it plans to launch in the US soon.

Virtuo (Paris, 2015)

Balderton investment: Series A 2017

Employee growth over 12 months: +53%

Car rental startup Virtuo has vehicles ready to be picked up at major train stations and airports across the UK, Spain, France and Belgium. It raised a €20m Series B earlier this year to fuel expansion, and save users of its apps the horror of lengthy queues and tricky paperwork at traditional car rental agencies.

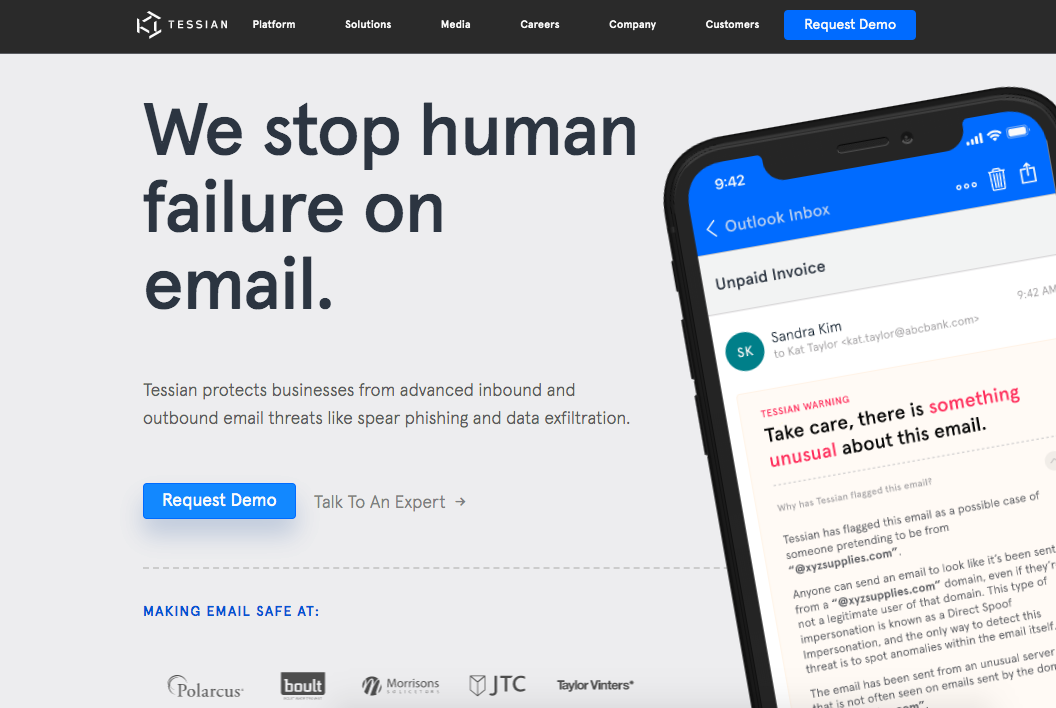

Tessian (London, 2013)

Balderton investment: Series A 2018

Employee growth over 12 months: +43%

Tessian’s website says that the average company sends 3500 misdirected emails every year. Some of those are just embarrassing; others could lead to massive security breaches. Tessian’s technology prevents these dangerous human errors from causing harm, and counts investment firms and lawyers as customers.

GoCardless (London, 2011)

Balderton investment: Series B 2013

Employee growth over 12 months: +38%

Payments company GoCardless shifted the gears up a notch this year, hiring 150 people, raising a $75 Series E round and launching a global payments network.

Read more: Brunch with Hiroki Takeuchi, founder of GoCardless

Darktrace (Cambridge, 2013)

Balderton investment: Secondary 2018

Employee growth over 12 months: +35%

Yet another unicorn in the Balderton portfolio, cyber security company Darktrace is growing its customer base globally and has more than 1000 employees. It’s one of the few portfolio companies run by a woman (two, in this case): Nicole Eagon and Poppy Gustafsson are co-CEOs.

Peakon (Copenhagen, 2015)

Balderton investment: Series B 2018

Employee growth over 12 months: +33%

Peakon is part of the growing world of “people” tools. Its employee engagement platform helps companies stay on track of diversity metrics, assess how happy its staff are and increase retention and productivity rates. It raised $35m earlier this year.

Read more: The startups helping to manage millennials

Sophia Genetics (Saint-Sulpice, 2011)

Balderton investment: Series B 2017

Employee growth over 12 months: +33%

Swiss startup Sophia Genetics uses machine learning to analyse genetic data, and suggest diagnoses to doctors. It has deals with over 900 hospitals around the world, and has recently begun analysing medical images too. Its last $77m funding round valued the company at $450m.

McMakler (Berlin, 2015)

Balderton investment: Secondary 2019

Employee growth over 12 months: +26%

Real estate agency McMakler is growing fast in Germany, Austria and France. Customers can value, list and market their properties on its platform. It’s raised €74.5m since launching in 2015, and now has over 450 employees.

Zego (London, 2016)

Balderton investment: Series A 2017

Employee growth over 12 months: +25%

Zego provides insurance for gig economy workers — taxi drivers, bike couriers, van drivers — whose needs aren’t met by traditional insurance providers. It’s also partnered with several big companies, such as Deliveroo, Uber Eats and Stuart, to design custom policies for their contractors.

Read more: Bookclub with Sten Saar, cofounder of Zego

InFarm (Berlin, 2012)

Balderton investment: Series A 2018

Employee growth over 12 months: +15%

Vertical farming startup InFarm has designed a system which vastly cuts the amount of water and land needed to grow herbs and leafy greens. They’re already on show in several supermarkets across Germany, France, Switzerland and the UK — Intermarché, Edeka and M&S are three partners — and with a $100m Series B closed earlier this year, it plans to launch in new markets, including the US.

Citymapper (London, 2011)

Balderton investment: Series A 2013

Employee growth over 12 months: +12%

Transport app Citymapper is well-loved by its users, but is facing increasing competition as cities across Europe develop their own mobility-as-a-service apps. This year, Citymapper began selling tickets for the first time in London in a bid to find some profitable business lines after a responsive bus trial didn’t work out. But will it be enough to keep up with micromobility’s fast movers?