Executing a startup idea is one thing, but getting people to believe in, pay money and want to work for it is another — that’s where marketing comes in.

Marketing covers many subfunctions like product, content and growth. The mix of marketing activities you carry out varies based on your company’s priorities, so it’s complicated for marketers to find industry benchmarks to measure themselves against — and compare budgeting with.

Sifted spoke to B2B SaaS-focused European VCs like Balderton Capital and Notion Capital, as well as leading CMOs, to understand how much you should be spending on marketing as a B2B SaaS startup.

Why do startups need marketing?

“You need to compete for attention before you can compete on product value. The best-marketed product, not the best product, is much more likely to win,” says Andrew Davies, CMO of Paddle — a B2B SaaS that helps other SaaS companies sell their services.

The role of marketing changes depending on the stage of the company. But early on it exists to fulfil two key roles:

- Simplify and communicate

What does the company do? What is its value proposition? What sets it apart from the competition? This becomes even more important if the company is offering something that hasn’t been seen before.

- Fill up the pipeline

To make sales easier and more effective, the marketing team needs to generate opportunities for the sales team to then close.

What marketing has to budget for

There are three main areas that you need to focus on when drawing up a marketing budget.

People, programmes, infrastructure

The main costs associated with a startup’s marketing department are the salaries of its team, the marketing activities it carries out (known as programmes) and the tools and processes it needs to be able to execute (its infrastructure).

Lauren Berkemeyer is the CMO of insurtech YuLife. She says that her budget for marketing covers:

- Inbound. Digital advertising — like Google Ads — for direct customer communication, and paid social media for brand awareness and retargeting.

- Events. Trade shows and digital events for awareness and trust building. "Face-to-face time with potential clients and meeting the wider industry is undervalued," says Berkemeyer.

- Martech stack. Tools to enable the marketing team to do its work. These include Hubspot, Linkedin Sales Navigator, Gong and Vidyard.

- PR and content. A PR agency for external comms and SEO optimised content creation.

Mid and bottom of the funnel

According to Dave Kellogg — executive in residence at VC firm Balderton Capital — marketing departments and CEOs focus heavily on budgeting for top-of-the-funnel activities. But that can be myopic. “Middle and bottom of the funnel activities [also] need money,” he says. “They don’t bring in new people, but they close deals.”

So what does that look like? Imagine you have a potential customer that loves your product but can’t get the budget approved to use it. Marketing could build a return on investment (ROI) calculator for their key stakeholders to see the value — this is a mid-funnel activity. A bottom of the funnel activity to close the deal may involve the CMO taking the potential client for dinner with three other customers who will advocate for the product.

Give your team pocket money

Have a line in the budget that is “play money” — Davies suggests this is about 20% of the budget. Managers need to be empowered to say yes to their team’s ideas. It incentivises creativity and innovation within teams. Marketing needs to have some shots in the dark — some wildcards — that have the potential for a big upside.

How do you work out your marketing budget?

- Marketing spend as a % of total spend

Marketing budgets represent 11.8% of overall company budgets, according to Deloitte’s latest CMO Survey. Everyone Sifted spoke to says that in a traditional business, 5% to 6% of gross revenue is spent on marketing.

“But startups are not like traditional businesses,” says Berkemeyer. “Startups are expected to grow fast and disrupt while lacking the brand visibility more established businesses have.”

She estimates that a pre-Series B startup should anticipate spending between 15% and 20% of gross revenue on marketing. This drops to 6% to 12% post-Series B.

Figuring out your marketing budget as a percentage of revenue can be useful for larger businesses to benchmark, but in most startups revenue shouldn’t be the focus. According to Davies, the revenue of growth-stage startups grows fast — if you base your marketing budget on current revenue at public market benchmarks, it wouldn’t be enough. You need to spend more to achieve the needed growth rates. “Marketing spend is more usefully analysed as a percentage of the net new annual recurring revenue (ARR) you are trying to generate in a period.”

- Lean on industry benchmarks

For early-stage startups without historical data to work from, looking at industry averages to support budgeting can be useful. Founders can ask their investors for benchmarks they’ve collated; industry peers for their learnings; and their employees for insight from their previous companies. There are also external data sources like SaaS Capital, which annually researches B2B spending metrics, and Meritech Capital’s benchmarking tool that can help too.

To start, some key benchmarks include:

- The median percent of annual recurring revenue spent on marketing at B2B SaaS companies is 9%.

- The marketing department’s budget is normally half of the sales department's.

- At B2B SaaS companies, sales and marketing budgets together amount to 31% of total revenue on average — this is normally double the research and development budget.

- Social media spend amounts to 15.4% of the overall marketing budget.

Benchmarking does have its issues though; numbers are often taken from top SaaS businesses, and those on the stock market with publicly available data — there’s a “best in class” bias. There is also geographical bias — a lot of data is still US centric. Finally, it’s not personal to a company and its specific resources and needs.

Davies says don’t get too caught up in the early stages: “prioritise the costs that will generate in-quarter and next-quarter demand for your startup, whilst creating as much learning as possible so you can hone the messaging and channel mix for the next period.”

- Work backwards

To figure out an overall budget, you need to know how many deals need to be closed in a specific time period. This will inform how many opportunities — also known as marketing qualified leads (MQLs) — need to be created by the marketing department. Once the team knows how much each opportunity costs to create, the cost of the people needed to execute the work and the fixed costs of infrastructure, a budget can be created.

According to Davies, a well run and optimised process should ideally generate 7x of pipeline — ideally 10x of the overall cost of creating opportunities.

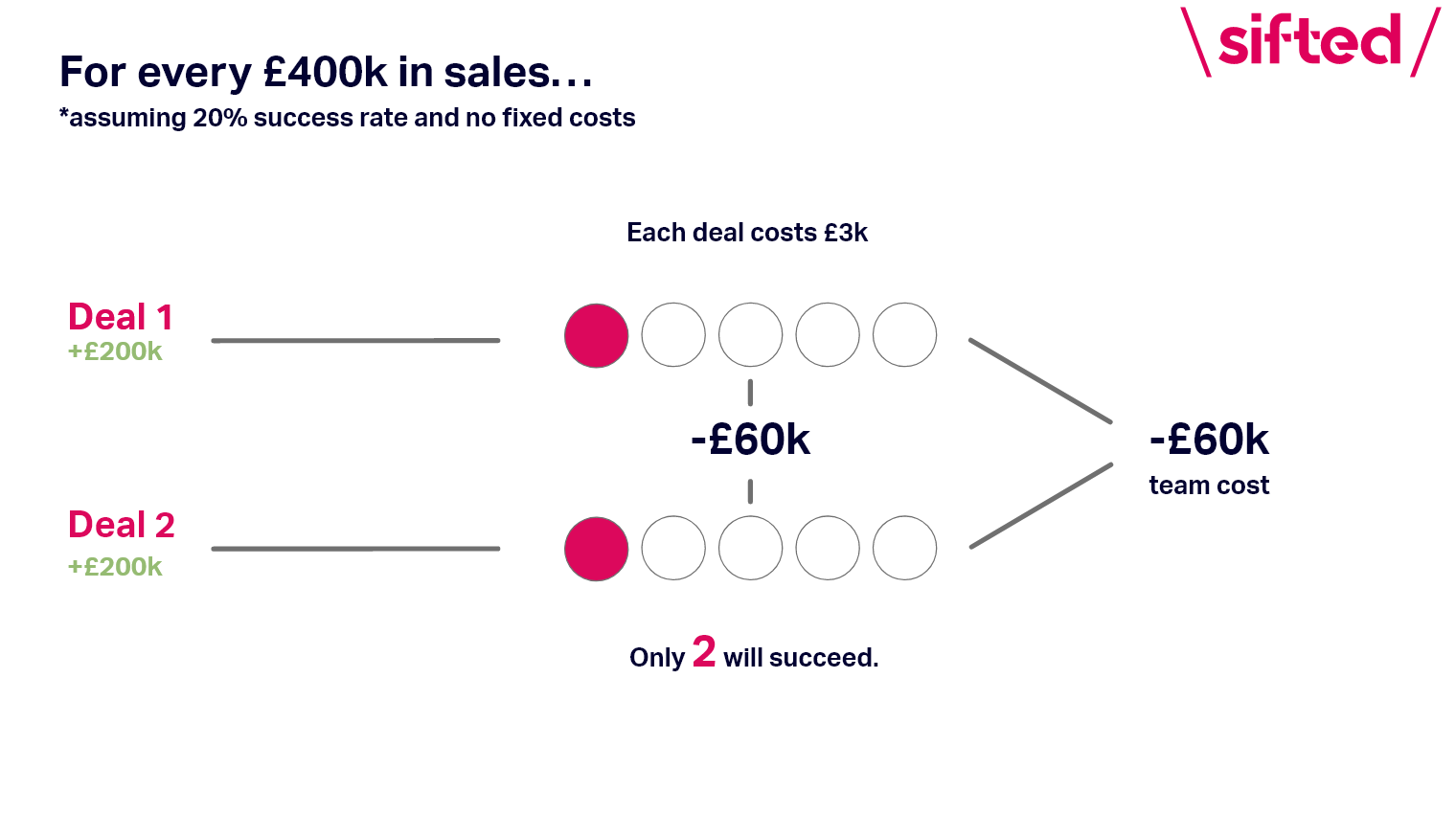

An example, back-of-the-envelope calculation:

- If your goal is £400k in sales and each deal generates £200k, the team needs to close two sales.

- You know the sales team — based on historical data or on industry standards — close two of every 10 opportunities presented to them.

- The marketing team now knows it needs to create 10 opportunities for the sales department.

- If you know the cost per deal is between £2k and 4k, to create 10 opportunities you need £30k to 40k. This could cover marketing channels, branding materials or a closing dinner, for example.

- If you assume the people cost equals the cost of marketing activities, another £30k to 40k will need to be budgeted.

- The total marketing budget for £400k in sales would then be £60k to 80k.

This doesn’t include fixed costs like software costs or PR firms.

A warning: at B2B startups historical data and industry standards don’t always tell the full story of how a sale happened. Most marketing departments assign credit on how a lead was added to the funnel by using first touch attribution — how were they first added to the funnel? Was it a social media ad, an industry event or a marketing email, for example? This analysis influences how much money is then spent on those channels in future.

But, Kellogg argues that assigning credit based on who found a lead means that mid and end of funnel activities get zero credit and show up as a complete waste of money. “If a closing dinner brought in no leads, its budget is cut. But if the purpose of that dinner wasn't to find new people but to help close leads, it should obviously continue to be funded.” A holistic approach of how a deal reached the dotted line — the 14 touches across five different channels over six months, for example — needs to be taken into account for budgeting.

Work out your CAC

Customer acquisition cost, or CAC, is the overall cost of acquiring a new customer. It helps companies figure out if their spending is efficient. It’s also a metric used by VCs to understand whether an injection of cash will be beneficial to growth.

CAC is calculated by adding all the costs from the beginning of a customer journey to getting a signature on the dotted line, divided by the number of acquired customers.

There are different ways to calculate CAC. YuLife looks at a fully loaded CAC, for example. It lumps all sales and marketing costs together — this includes salaries, tech stack, ad spend — and divides it by the number of paying customers acquired in a given timeframe.

Often, especially in B2C companies, CAC is conflated with cost per acquisition (CPA), which could mean a new customer is using your product or service on a trial period but not actually paying. This can lead to a more impressive CAC — mostly used to impress VCs.

B2B sales cycles are long — if a sales cycle is 90 days long but you’ve only used sales and marketing costs for one month to calculate the CAC, your numbers will be off.

Looking at CAC alongside customer lifetime value (LTV) can paint a more accurate picture. The LTV is the predicted revenue that a customer will generate with a company throughout the relationship. You want to look at the ratio of LTV to CAC to understand a customer's worth versus the cost to attain them. A good ratio is 3:1. If it is tracking higher than expected, like 4:1, you may be missing out on opportunities and need to plough more money into customer acquisition. If it tracks below, closer to 1:1, your marketing strategy needs to be seriously looked at.

However, Davies explains that if you’re post product-market-fit, have a lot of investment and can afford it, a high CAC isn’t always bad — it may be needed for high and fast growth in a competitive market. For example, if you’re looking to generate £5m in new ARR in the next year, and have capital in the bank to afford a 12-month payback period, your total CAC can be £5m.

Once you know your total CAC, play it back through your funnel to understand how much you can spend to generate an opportunity. This gives your team a good understanding of the constraints they’re working within.

How to get the most out of your marketing budget

- Understand your business’s go to market model. Davies says: “If you want to advocate for your department to get enough of the overall company budget, you need to understand the company inside out. You need to understand the constraints of capital, market size and growth targets.”

- A data-led approach is key to spending money. “Track everything, it helps qualify why the department needs a certain budget. For example, YuLife’s attribution modelling reported back that 48% of deals in 2021 were influenced by marketing. It showed us where we should be spending more of our efforts in the next period,” says Berkemeyer.

- Don’t reinvent the wheel. “Integrating with the tech stack that is used locally is critical to succeed when entering a new market. Don’t start from scratch. I wouldn't recommend spending marketing dollars unless your product is ready to be used in a given market,” says Itxaso del Palacio, partner at Notion Capital.

- Manage your vendors like your team. According to Berkemeyer, “PR agencies, influencers and any other external partners you work with… you want to treat them as if they were your own team. They will like you and work harder for you.”

- Justify every single cost. “Rather than trying to spend a specific amount, justify every single cost against its expected return. You want to treat it like a zero-based budget,” says Davies.