Funding continues to fall, venture debt has had a record year and the US is poaching European technical talent, according to Atomico’s State of European Tech report 2024.

The 10th edition of the report is more reflective than usual, looking back over the previous decade of European tech, as well as the past 12 months.

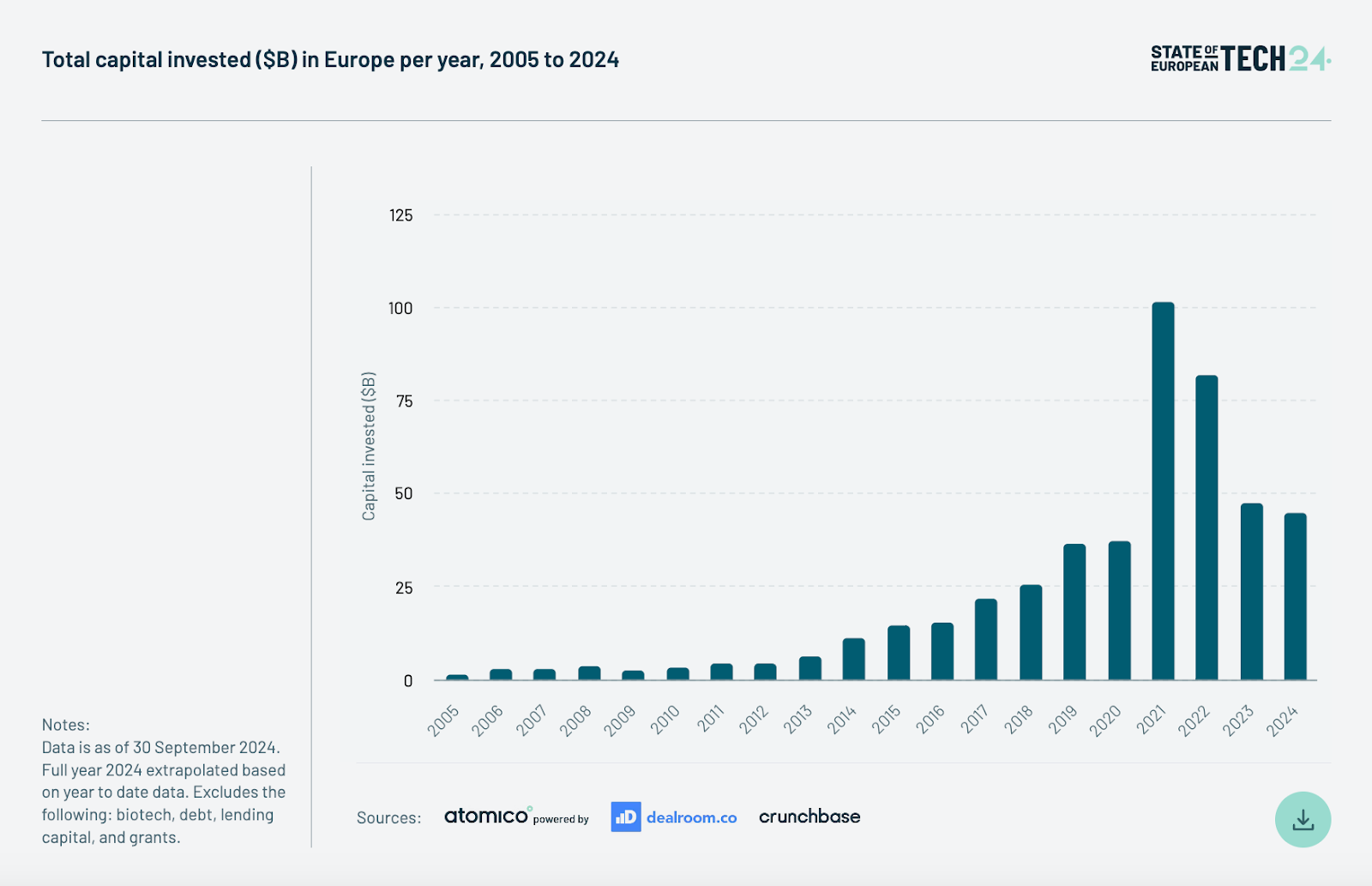

The headline from the past 10 years is one of growth: VC funding in 2024 alone is projected to eclipse all the investor dollars picked up between 2005-2015.

The picture from the past 12 months is less positive. Early-stage rounds have suffered, the IPO market still looks bleak and the gender funding gap is widening at some stages.

The State of European Tech report features data from several deal-counting platforms, alongside a survey of more than 3,500 founders, VCs, LPs, M&A advisors and startup operators.

Here are the highlights.

Funding

Funding drops across the board compared to 2023

VC funding in 2024 is on track to hit $45bn — a figure that would fall below the $47bn picked up in 2023.

Most major tech ecosystems in the region will likely see a dip in funding this year. The report predicts the UK’s funding figures will fall from $13.8bn to $13.1bn, France’s from $7.6bn to $7.5bn and Germany’s from $7.1bn to $6.7bn.

Sweden’s funding will fall from $5.2bn to $2bn, according to the report — the furthest of any major tech ecosystem in Europe.

On the flip side, funding in the Netherlands is on track to increase from $1.8bn in 2023 to $2.5bn this year.

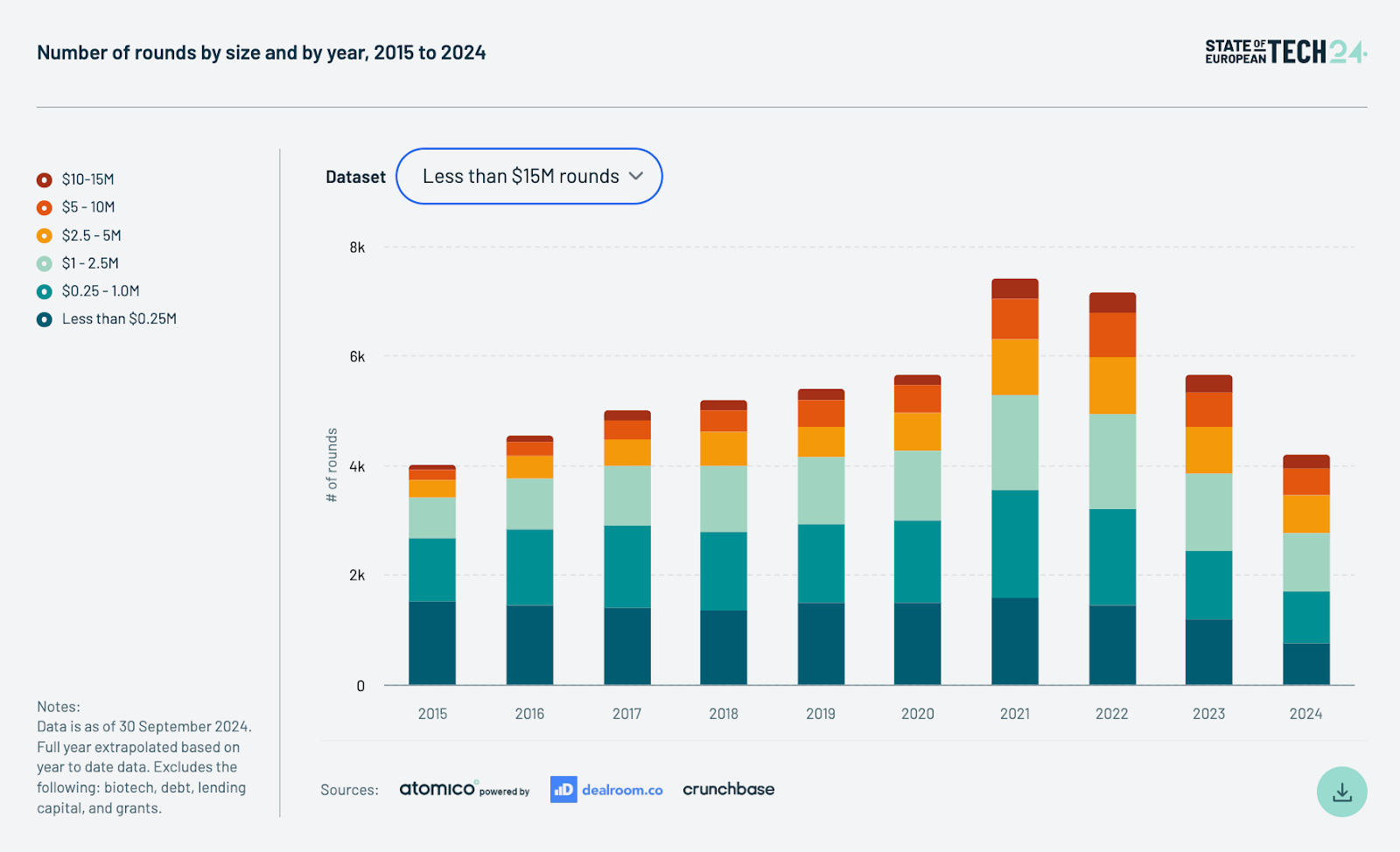

Early-stage round drop

The report predicts that there will be just over 4,000 early-stage deals (of less than $15m) in 2024 — the lowest number since 2015.

Things look rosier at the other end of the spectrum, with more $100m+ rounds being raised than in 2023.

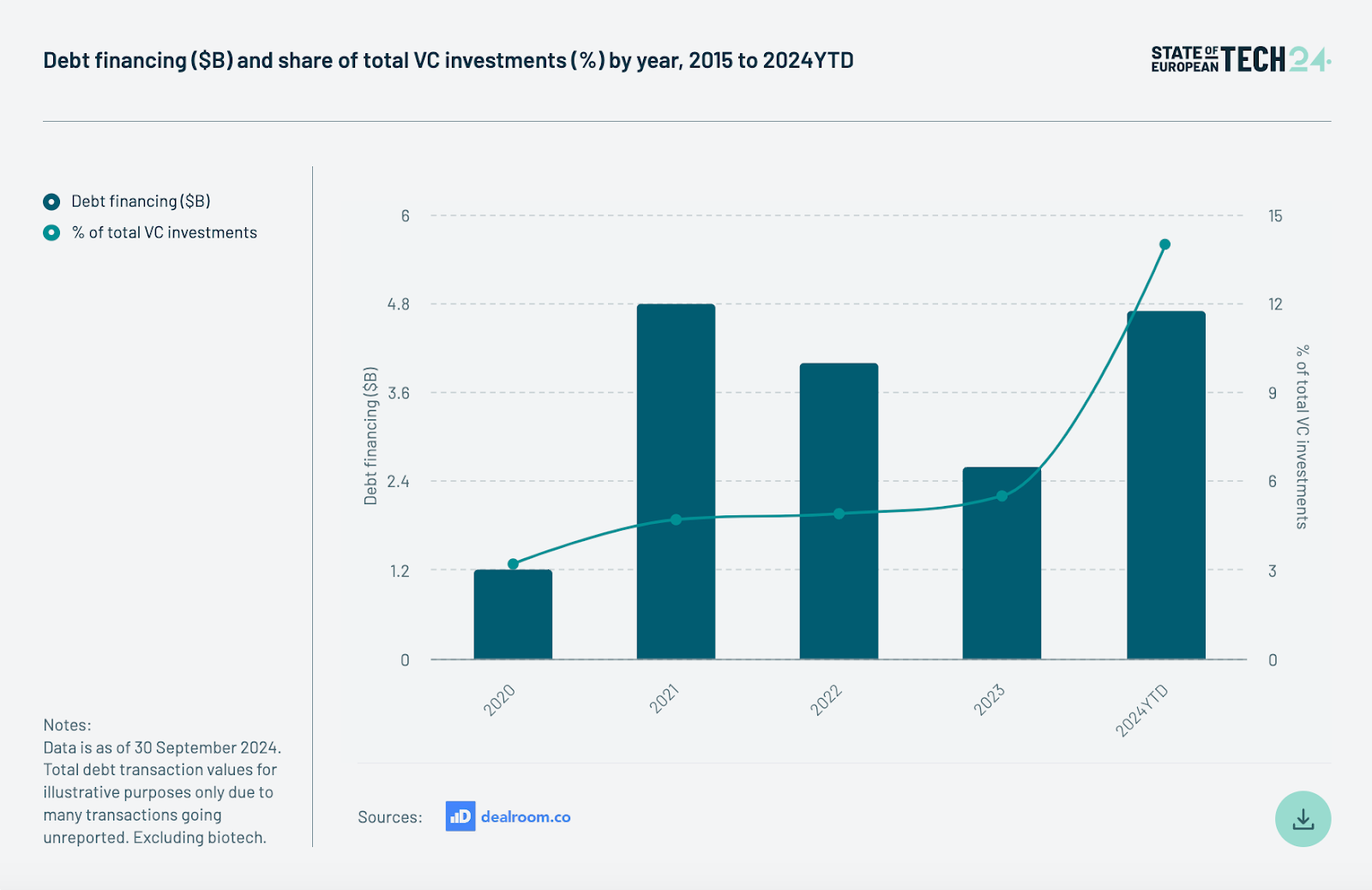

Venture debt has a record year

In the first three quarters of 2024, European startups raised $4.7bn in venture debt, equal to 14% of the total share of VC funding — the highest figure on record. The report notes that some debt funders don’t make debt deals public, so the actual debt funding figures may well be higher.

The Europe-US funding gap is big

A similar share of startups founded in the US and in Europe in 2015 have gone on to raise at least a $1m round (22% for the US and 18% for Europe), but the picture is starker at the later stages.

When you look at companies that went on to raise $5m or more, those figures are 13.6% for the US and 8.7% for Europe. At $15m or more, it’s 8.3% of US companies compared to 4.1% of European startups.

The report estimates that means Europe has missed out on around $300bn in funding since 2015 as a result.

European deeptech startups entice investors — but lag far behind US

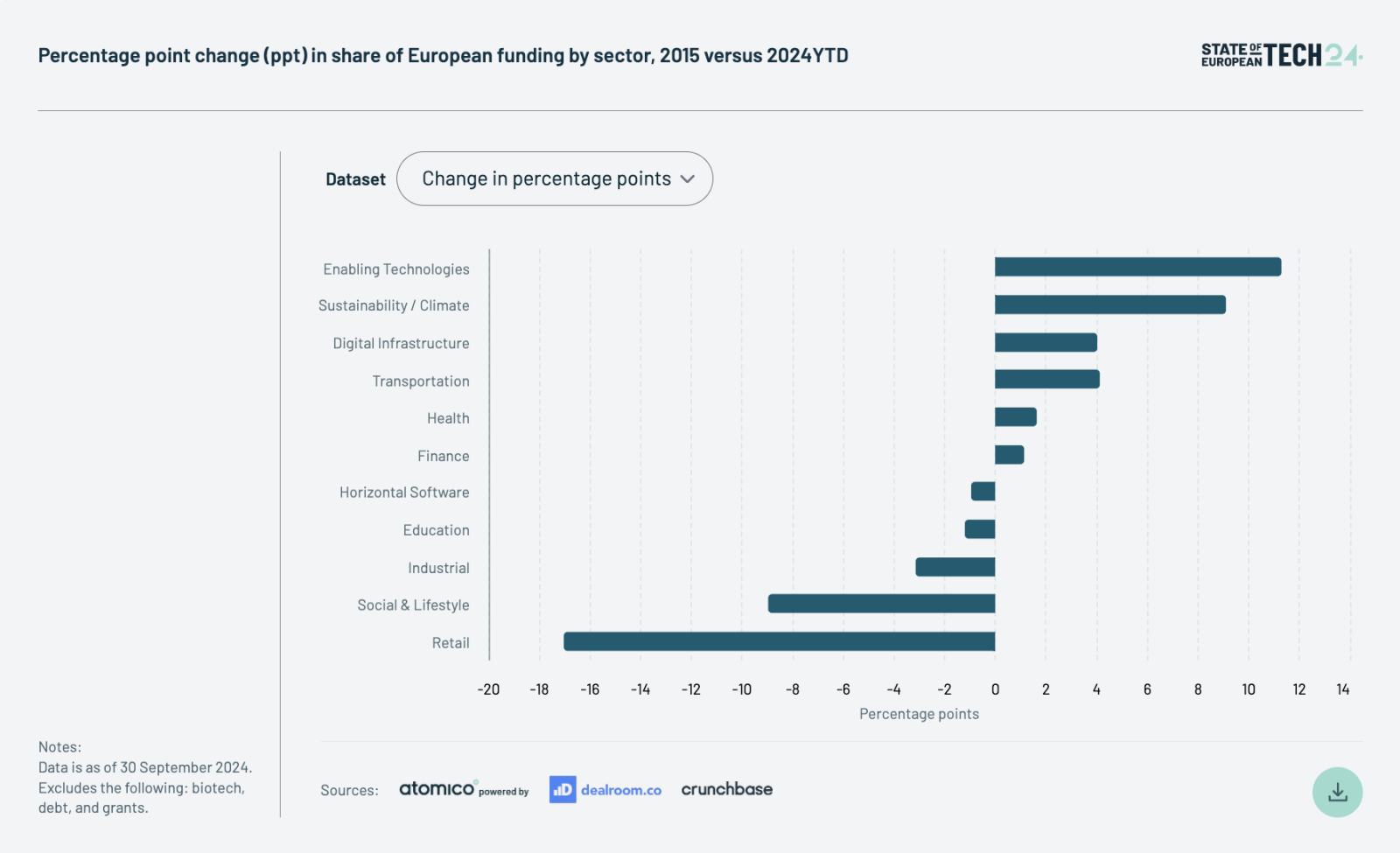

The AI boom continues to see deeptech startups capture large portions of the European funding pie. They picked up 33% of total capital in 2024 — the same figure as 2023.

Europe lags way behind the US for AI funding in 2024, though. This year, the report predicts US AI startups will pick up $47bn, compared to Europe's $11bn.

Those numbers look similar over the past decade, too — deeptech startups in Europe raised $94bn during that time, compared to $123bn in Asia and $300bn in the US.

Europe’s sustainability credentials shining

There are positive notes to be found in funding for Europe’s climate tech sector, though. 21% of funding in the region goes towards startups working in climate tech — compared with just 11% in the US.

Talent

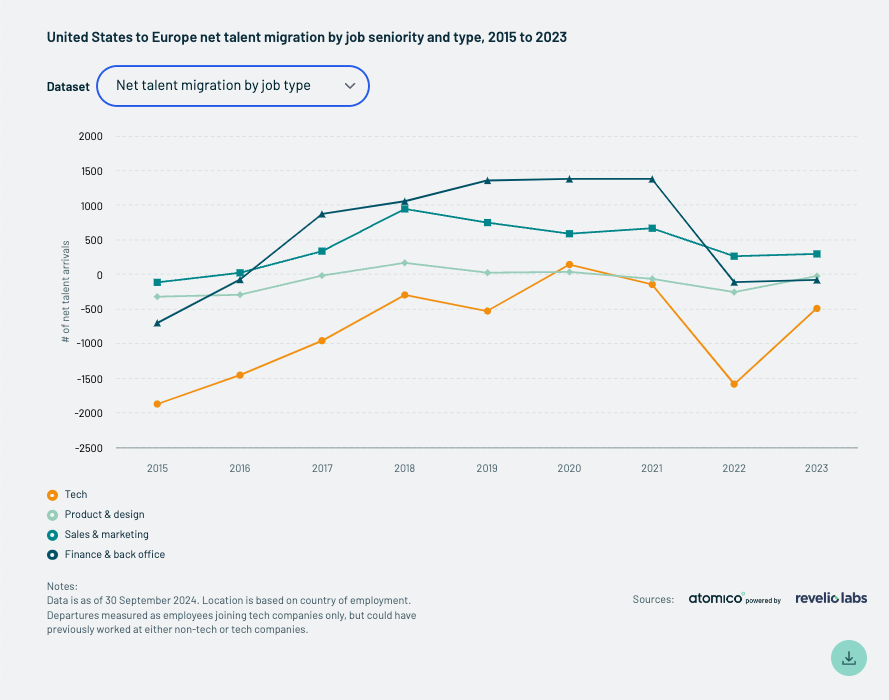

The US is luring European technical talent

Europe lost a net of 492 technical workers to the US in 2023. That’s down from a net loss of 1,585 in 2022 but roughly the same as the net loss of 530 in 2019 (figures for 2020 and 2021 were lower, but Covid would have played a large role there).

The report says the pull of big tech companies like Google, Microsoft, Amazon or IBM — and the inflated salary packages they offer — is one factor for talent moving.

European founders are also drawn to the bright lights of the US

European founders are behind about 10% of US startups — compared to US founders being responsible for 6% of European startups. The report estimates this leads to around 800 companies being founded in the US instead of Europe each year.

European talent pool scales 7x over past decade

The tech talent pool in Europe is now 3.5m-strong — 2.9m of those people have joined the sector in the past 10 years. Europe has experienced a 24% compound annual growth rate in tech talent — similar to the US, according to the report.

Europe’s AI talent pool looking strong

Europe has seen a sixfold increase in AI roles over the past decade.

In 2024, the UK has the most AI roles in Europe, with 60k — up from 12k 10 years ago. The Netherlands and Germany are next, with 50.6k and 50k, respectively. France is fourth on the list, with 44.3k.

While Europe was hiring for more AI roles than the US in 2023 (120k vs 112k) that trend has reversed in 2024, signalling that startups in the US are hiring faster in AI than those in Europe. As of September 2024, US companies are hiring for 169k AI roles, compared to 159k roles in Europe.

Diversity

There’s a very big gender funding gap (and it’s not getting better)

There’s been no marked improvement at any stage on Europe’s dire gender funding gap figures — and in the case of pre-seed and Series A, things have got worse.

At pre-seed, all-women founding teams picked up 4.9% of capital between 2021-2024, way down from 13.2% between 2017-2020. At Series A the gap also widened, with all-women founding teams raising just 3.2% of capital in 2021-2024, down from 4.6% in the three years before then.

Small improvements were made at seed and Series B and above. All-women teams raised 5% of capital between 2021-2024 at seed — up from 4.4% in the three years prior — and 1.7% at Series B and above — up from 0.4% during the previous period.

Men outnumber women 2-1 in tech

Today, women make up 34% of tech talent in Europe, roughly the same as the 35% in 2015. They’re comparable figures with the US, where the tech talent pool is made up of 36% women.

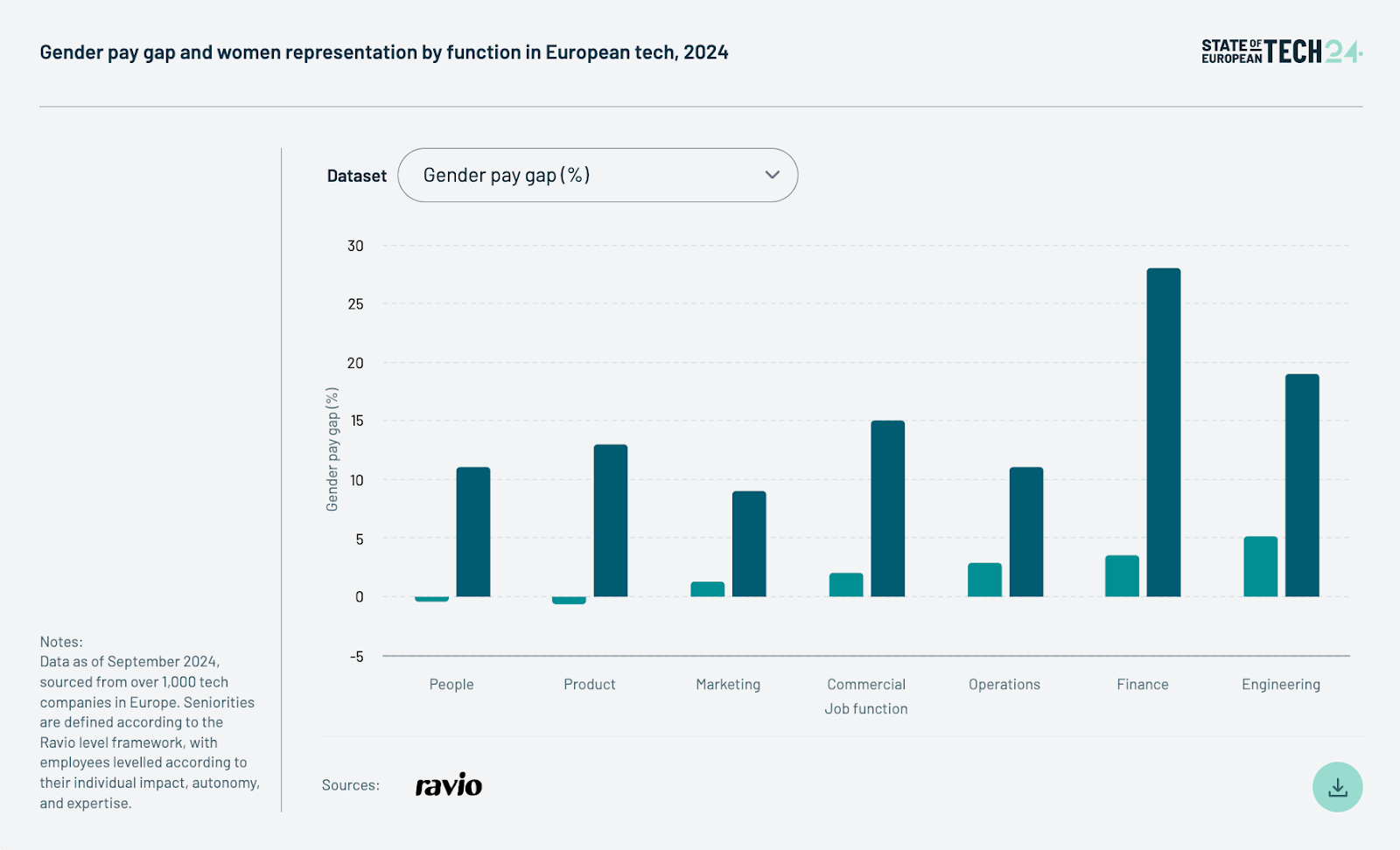

All roles have a gender pay gap

Women are paid less than men in pretty much every department at startups, including engineering, finance, operations, sales, marketing, product and people.

While a pay gap doesn’t necessarily mean a company pays women less for the same jobs as men — and adjusted pay gap figures (which compare salaries in the same job, function and country) bring men and women’s pay closer together — it does point to a lack of women in the highest-paid roles at startups.

VC

Estonia is the world leader in VC funding to GDP

Tech companies in Estonia have raised the equivalent of 1.17% of the country's GDP over the past decade — the highest share of any country in the report. Singapore and Israel are next with 1.14% and 0.93%, respectively. The US sits just below them, with tech companies there raising the equivalent of 0.53% of the country's GDP in VC funding over the last 10 years. Sweden is next with 0.52%. In the UK that figure is just 0.48%.

European LPs love deeptech

While the report notes that most LPs still want to back generalist funds, it adds that there’s increasing interest in thematic funds — with deeptech emerging at the frontrunner.

57% of LPs said they’re conducting due diligence on deeptech funds, compared to 42% on climate tech — the next highest thematic focus.

There’s still a lot of dry powder kicking about

In 2023, VCs were sitting on a record $104bn in dry powder — a threefold increase from the $34bn they had in 2015.

That growth curve is now flattening, the report says. While the amount of dry powder rose by 44% between 2018-2020, it increased by just 13% between 2021-2023.

Pension fund investment up — but still low

Pension funds have doubled their investments into VC between 2015-2023. In 2023, they contributed $858m, up from $359m in 2015.

But nowhere in Europe do they invest more than 0.02% of their assets under management into VC — and in the DACH region pension funds invest 0.001%.

There are signs that this could change though. Last week, the UK government announced plans to mobilise up to £80bn from pension funds for investment — including into VC funds. Germany also recently announced a pension fund-backed initiative to pour €12bn into its startup scene.

LP appetite for VC increases

29% of LPs say they’re more interested in investing in European VC than compared to 12 months ago — up from 18% in 2023.

That figure is still lower than the numbers set during the boom times — 64% said the same in 2021, and 32% did in 2022.

Exits

VC are looking for exits

More than half of VC respondents say they have been looking for liquidity opportunities for their portfolio in the past 12 months — but 74% say it’s taking longer than expected.

IPO market looking bleak

Half of the M&A advisers and investment bankers surveyed say conditions for IPOs have worsened over the past year — with 55% of those with a decade or more of experience saying today’s conditions are worse than they were 10 years ago.

There are some positive signs. There are signs of recovery in the US, with six $1bn tech IPOs happening in 2024 so far, compared to just two last year.

There are signs that Europe could see some of its tech darlings take to the public markets in the next couple of years — buy now, pay later giant Klarna filed for an IPO in the US last week.

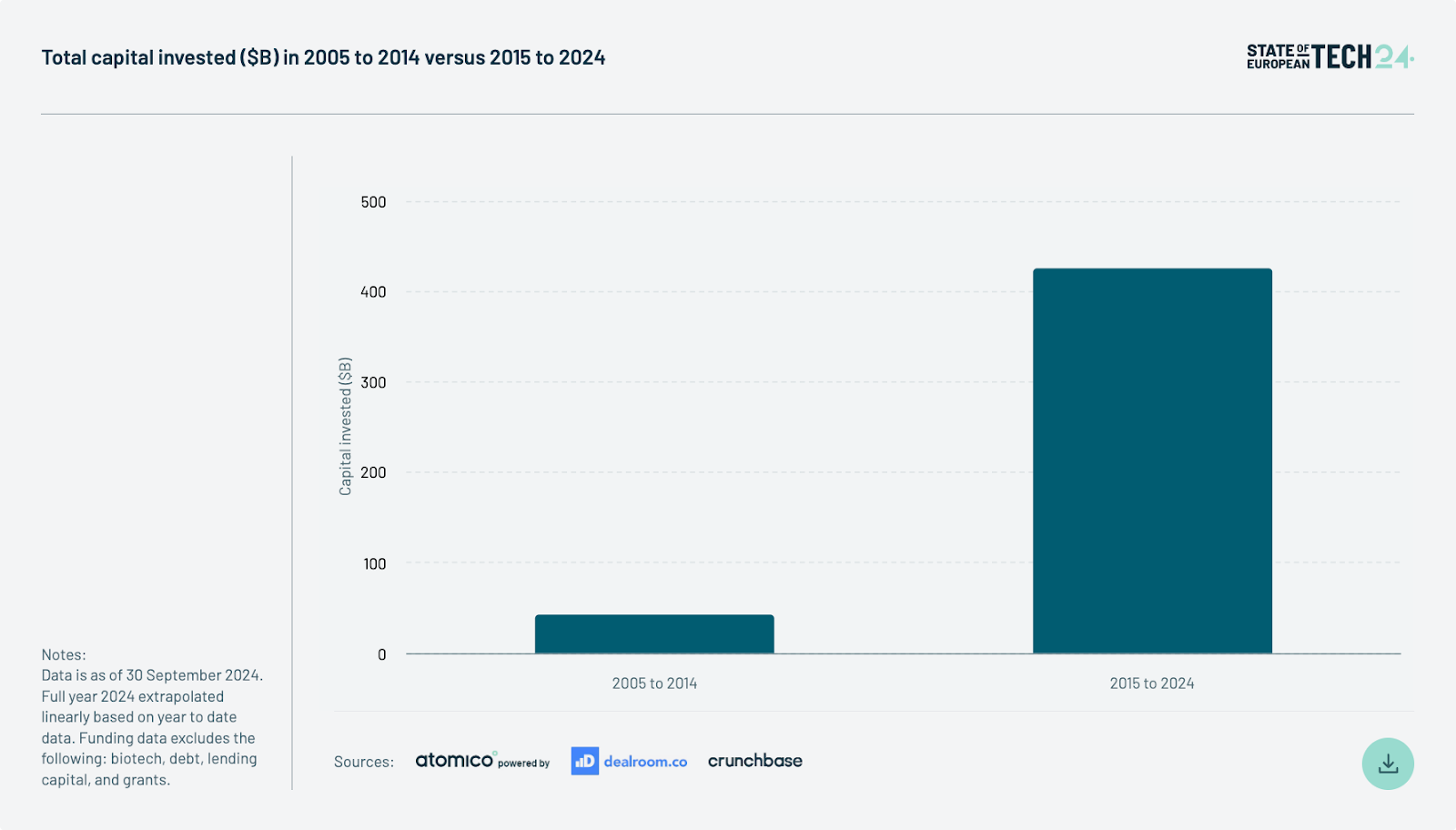

A decade is a long time in tech

Tech funding has increased 10x

Capital invested into European startups has grown from $43bn in the 10 years up to 2015, to $426bn in the 10 years since. To put that figure in some perspective, the $45bn Europe is on track to raise by the end of 2024 is more than a decade worth of funding up to 2015.

That growth rate is a lot faster than the US, which has seen funding increase 2.8x over the same period, from $249bn to $1.2tn.

Seed rounds in Europe have also increased in size. The median size of today’s seed round is five times bigger than it was a decade ago, rising from $300k to $1.4m.

Startup numbers balloon but exits not yet realised

In 2015, there were just 8,000 early-stage startups in Europe — a number which has quadrupled to more than 35k in 2024.

The volume of exits in Europe has only grown by 150% in the same period, though, meaning there’s much unrealised value still tied up in startups.

Number of European unicorns increases by 500%

By early 2015, 72 European tech companies had hit the $1bn milestone. Since then, 358 have joined them in the unicorn stable. Those companies span 30 European countries and 127 different cities.

From B2C to B2B

While consumer focused startups were the defining companies of Europe’s tech ecosystem a decade ago — think Spotify and Booking.com — B2B startups are now on a march, picking up 75% of funding in 2024. 31% of funding went to D2C business models in 2015, compared to 16% in 2024.

A changing European tech landscape

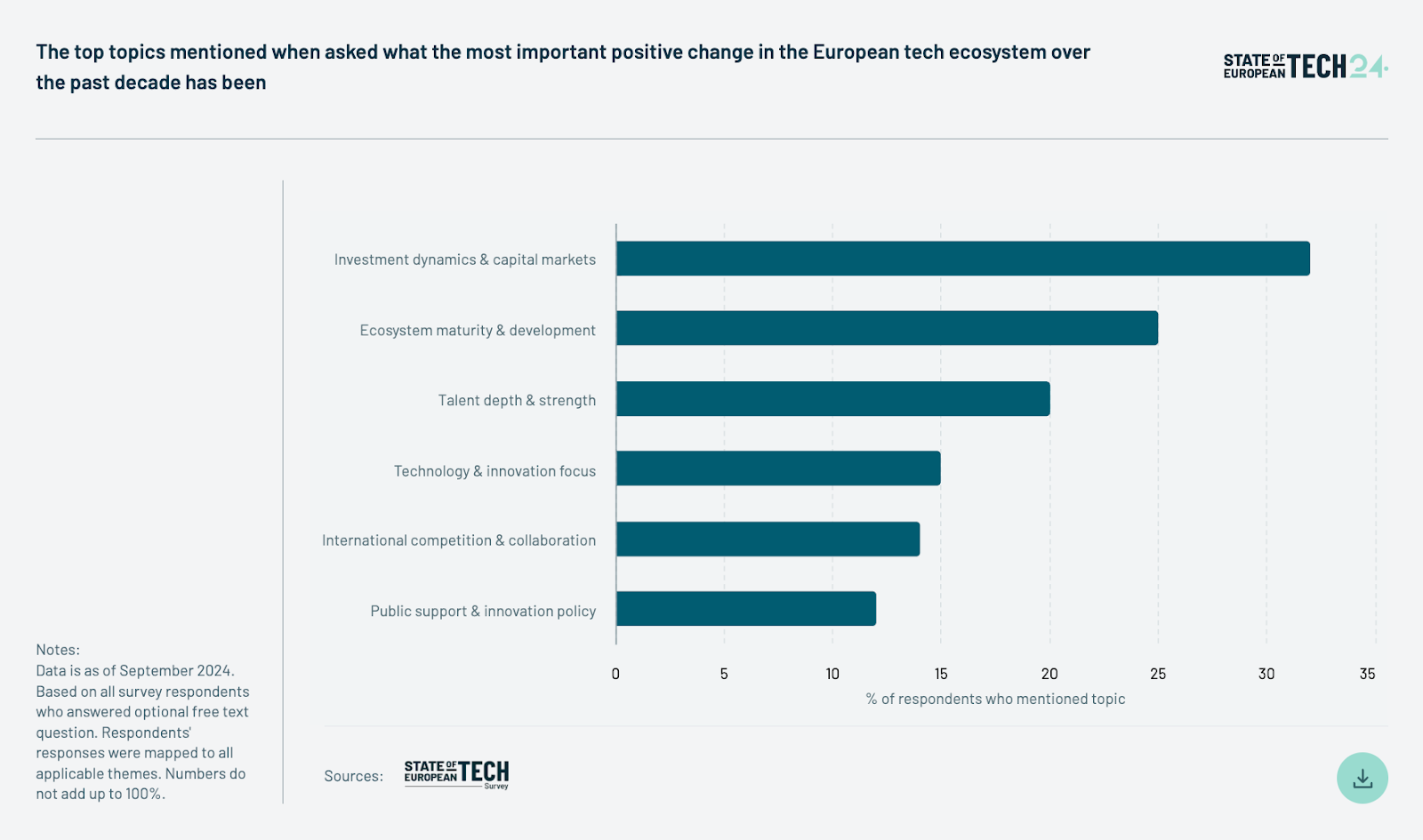

So what’s brought about all this growth? More funding was the most commonly cited reason — with 32% of survey respondents saying it had been the most important factor. 25% say ecosystem maturity was the top reason and 20% said talent depth and strength.

The future

Predictions for a decade on

More growth, according to the report’s authors. The report predicts that the European tech sector will create 15m new jobs, be worth $8tn and produce its first $1tn tech company.

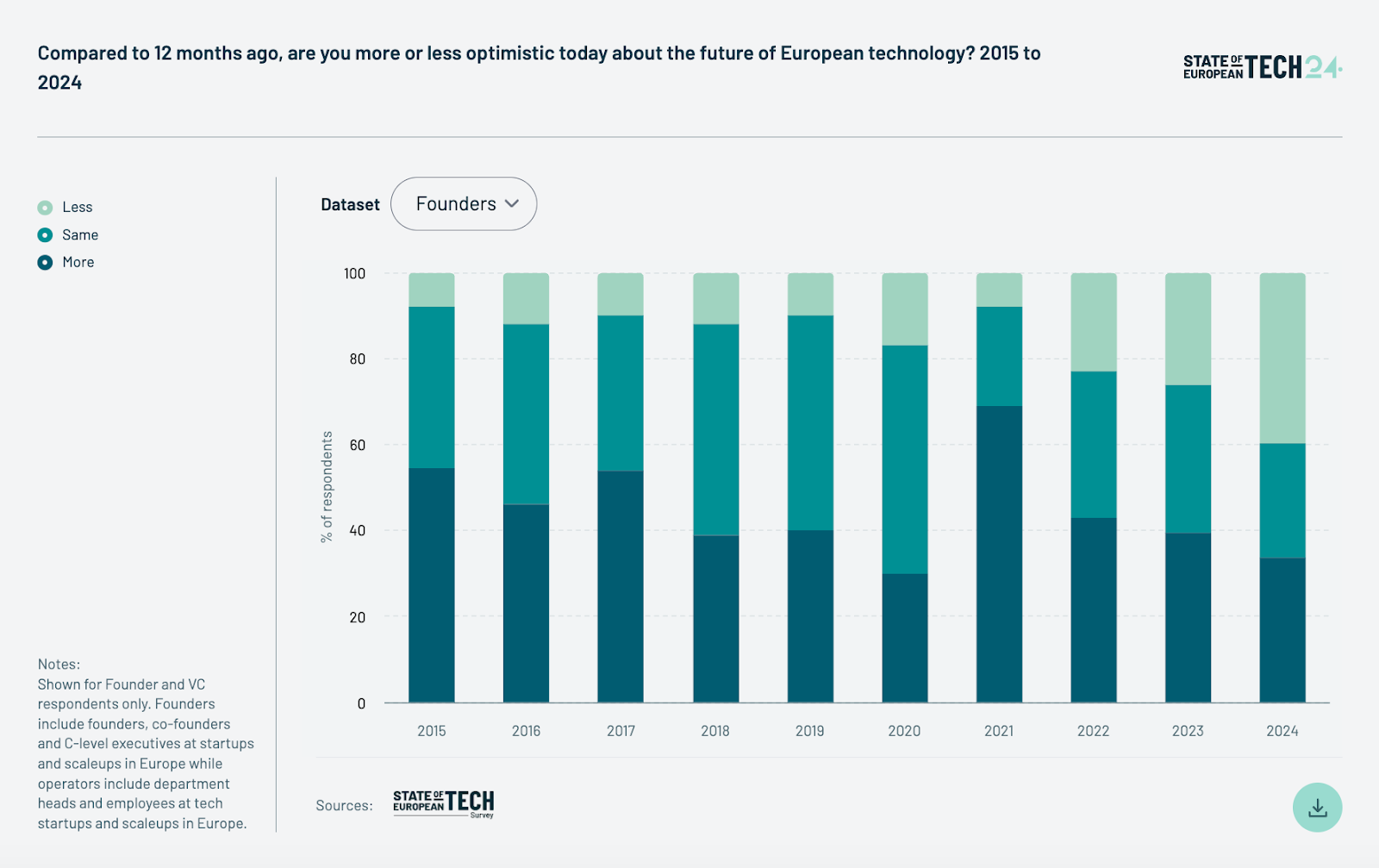

Founders and VCs aren’t so optimistic

For the first time since Atomico first ran its report in 2015, more founders and VCs say they are less optimistic about the future of European tech than they were 12 months previously.

This year, 40% say they are less optimistic, with just 34% saying they were more optimistic. It’s a big shift from the sentiment a decade ago, when 55% said they were more optimistic about the future of European tech than they had been a year earlier, and just 8% said less.