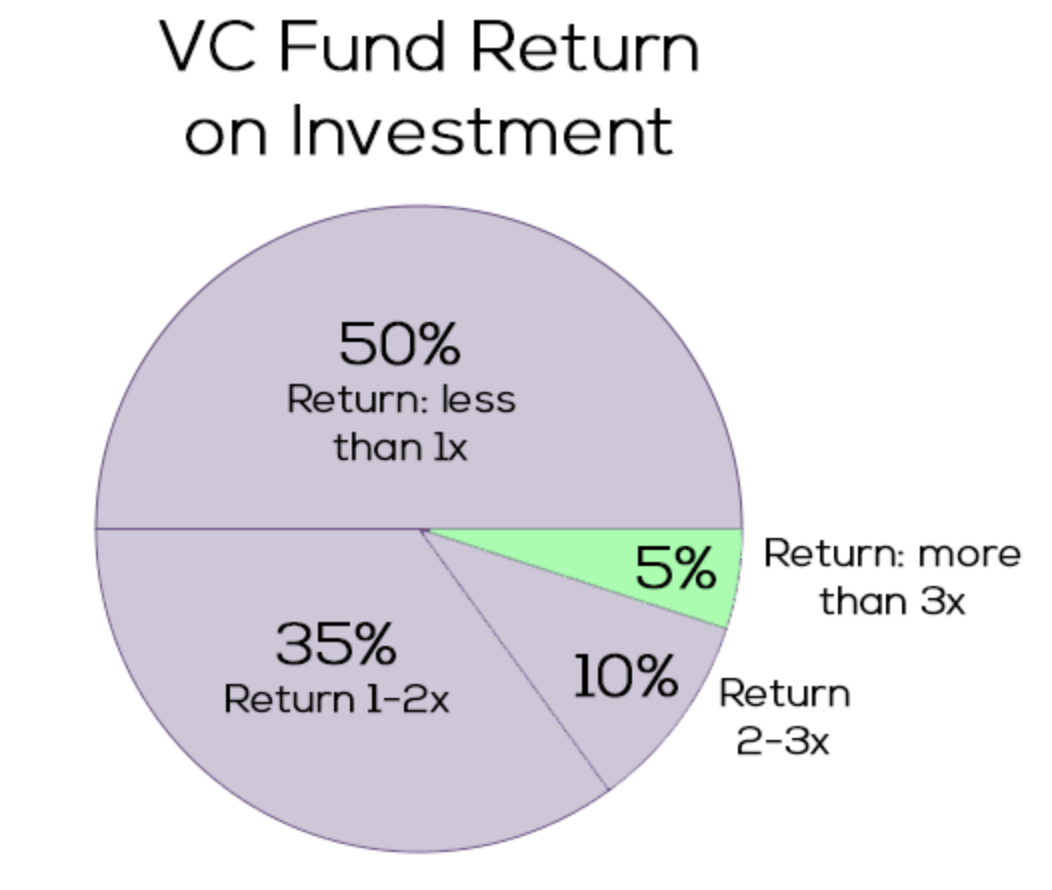

The venture capital model is broken: 95% of VCs aren’t profitable.

That’s no secret.

For the brutal realities, just look at these graphics in TechCrunch: only 5% of funds make the 3x returns that are needed to make this risky and high-effort form of investing worthwhile.

It’s not all rosy for startups either; many find the VC model unsatisfactory, too. They spend months chasing potential investors, rather than running their businesses, all to give up control of their companies.

And yet we see more funds and more funding rounds because there aren’t many good alternatives. Crowdfunding? Debt? An Initial Coin Offering? None of these has really replaced VC funding in a major way.

Until now. Maybe.

The idea

London’s Consilience Ventures has a new idea: a member-only funding club for startups, investors and advisors. Risks is pooled and money circulates around the club using a blockchain-based token (bear with us).

The concept takes a while to explain — but hold with us.

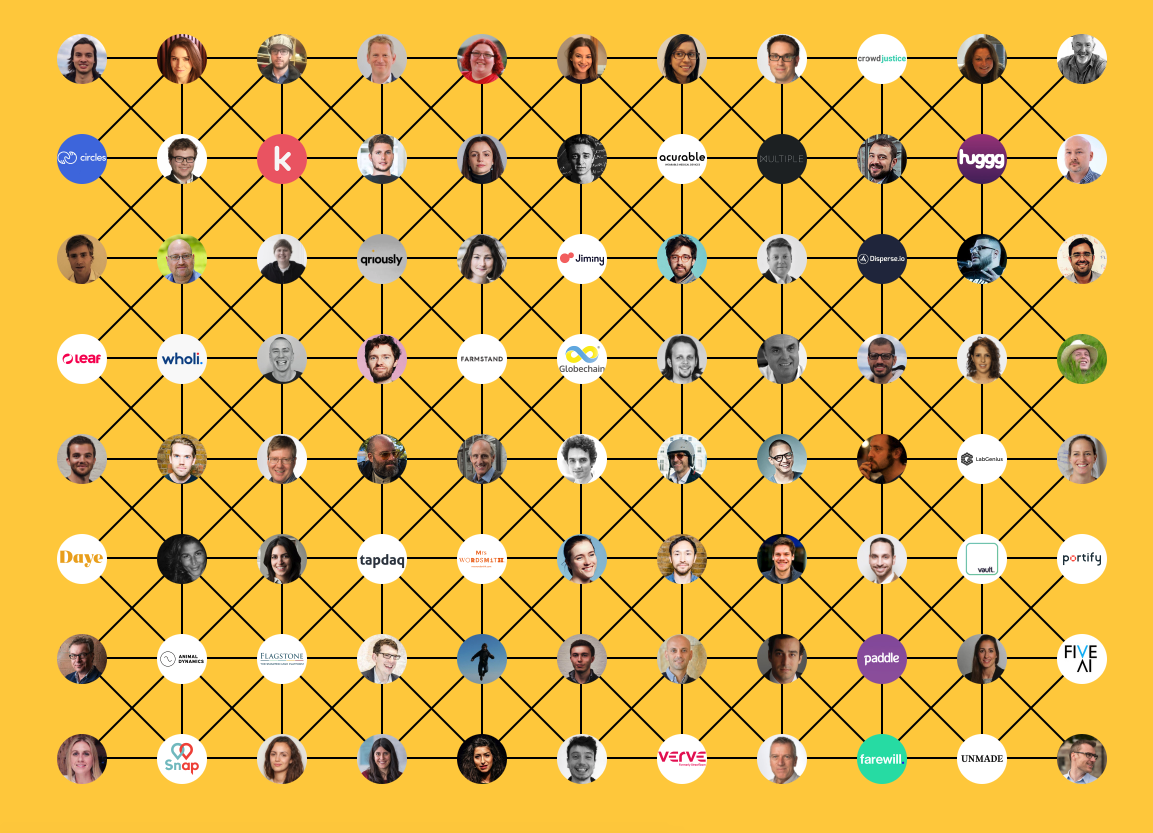

60 startups 500+ investors 1200+ experts

Consilience Ventures carefully selects a group of startups (probably around 60) investors (500+) and about 1200+ experts — advisors, accountants, lawyers — for the club. You can’t apply, you can only get in if you are referred by someone trusted.

Then Consilience creates a mini financial ecosystem for this club, based around a blockchain token. Investors put in money (a minimum starting investment of £25,000) and the startups all put in a portion of equity (1-3% to start with) in their companies. In exchange everyone gets these blockchain-based security tokens, CVDs. (Hold in there.)

The token’s value is based on the collective value of all the startups in the club. If one startup does really well, the value of the token goes up (a bit) for everyone. If one startup tanks, it takes the value of the token down (a bit) for everyone. But the risk is pooled, so in theory this is less chancy than putting all your money in just one startup.

The tokens can be bought and sold within the system, creating some liquidity for investors and startups. If a startup needs more money, it can sell more equity for tokens within the system, in theory with much less hassle than going on a six-month investor roadshow to raise its next round.

Investors, meanwhile, can sell their holdings (provided they can find a buyer within the system) more quickly than they can do with traditional VC investment, where money is locked up for a long time — 13 years is typical.

If a company is bought or IPOs, everyone in the club gets a share of the proceeds, according to how many tokens they own, making venture investing easier.

The big question is — will it work?

Kevin Monserrat, chief executive of Consilience Ventures, admits he is facing initial scepticism.

“Investors are worried because this is such a new, unproven model,” he says.

He’s also very worried about the venture simply being dismissed as another ICO or cryptocurrency venture. There have been previous attempts at tokenised equity as a way of investing in startups but none has taken off in a big way. Blockchain Capital raised part of a VC fund like this in 2017 but the following year reverted back to a more traditional model.

But Monserrat says the point isn’t the technology or the token. You could be using coconut shells or bottle caps as tokens if you wanted. The it is the combination of token and network quality that is the point.

Success will depend on just how good the companies in the club are. Pooled risk or not, if they all fail, the value of the token will be nil before too long.

So does Monserrat have a secret for ensuring really high quality? Not really.

I am not going to say that we have some method that makes us better at choosing companies. But we will be better at helping them outperform,

“VCs all claim that they have the secret sauce that makes them the best at spotting winners, but in reality they are all pretty similar. Their network is the difference. I am not going to say that we have some method that makes us better at choosing companies. But what I would say is that we will be better at helping companies outperform using our sprint financing model,” says Monserrat.

This is the other big idea. Everyone helps each other — shares ideas, makes introductions, collaborates on tech — because everyone in the club has a vested interest in making sure the value of the token stays as high as possible. Monserrat’s theory is that this will give the portfolio a higher success rate.

Encouraging collaboration between portfolio companies isn’t itself new. Over in the US, Kleiner Perkins and First Round Capital have been brokering relationships between their startups for yonks — and just this week SoftBank revealed it plans to do the same.

Back in London, Kindred Capital makes every founder it invests in a “co-owner of the fund”, allocating them carry. And sure, those founders do occasionally meet up and offer each other advice — but is that really edging Kindred closer to being one of the magical 5% of funds that do return 3x? And would helping each other out really get Consilience there either?

So far Consilience has secured a few initial investors and is in talks with more. It’s also selected three startups to invest in — but needs to find plenty more before launching later this year. It’s a long shot. But hey, VC needs all the innovation it can get.

What do Sifted readers make of it: Good idea? Bad idea? Would you invest in it? Would you put your startup in the pool? Tell us in the comments field.