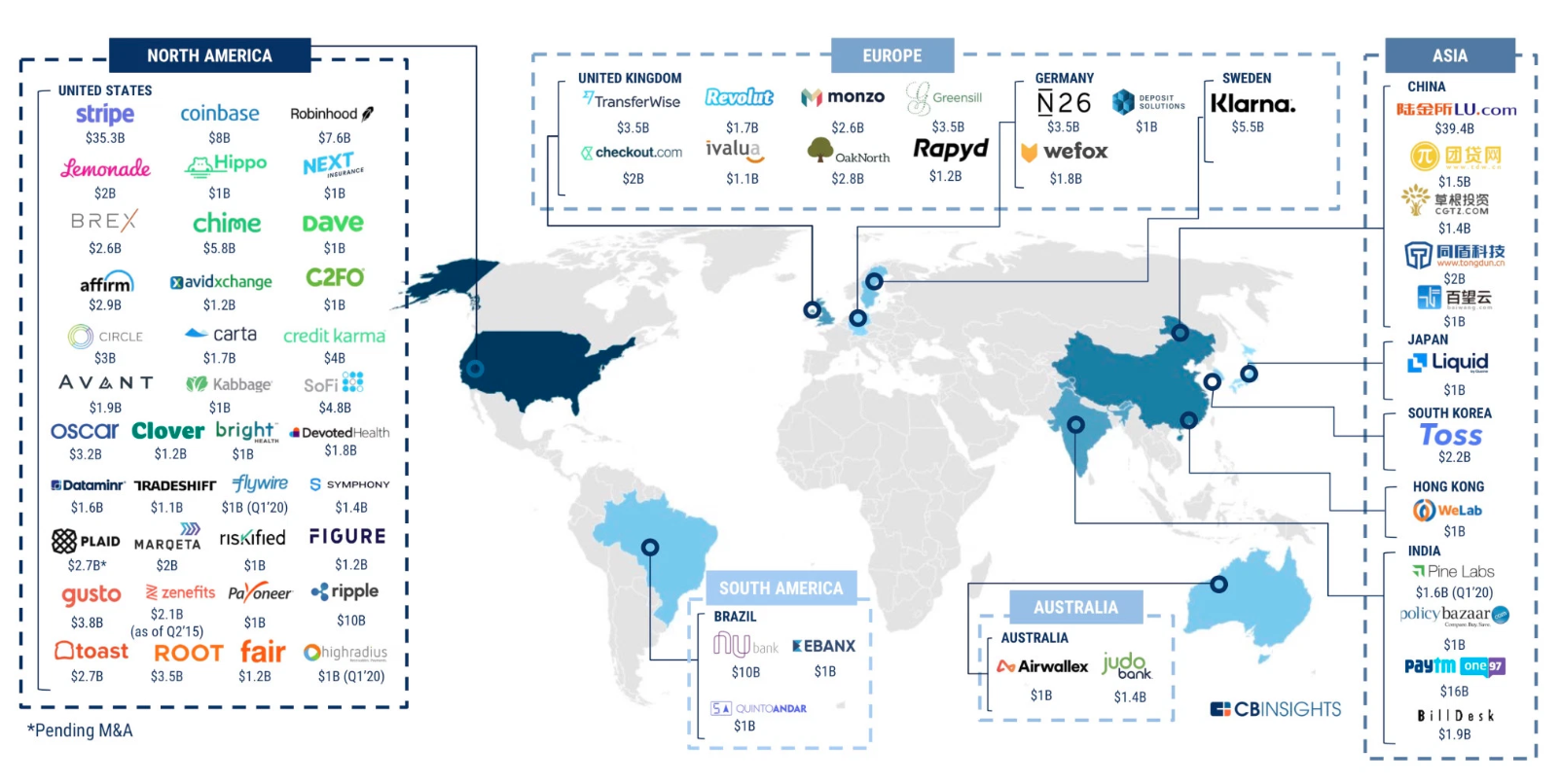

The world is now home to over 70 fintech "unicorns" — startups worth over a billion dollars.

If nothing else, this highlights the continued hype around the fintech sector, with investors tripping over themselves to fund companies promising to disrupt banking and payments.

A small handful of fintechs have also reached this billion-dollar milestone in record time.

This is partly dependent on external factors, like funding circumstances at the time of a capital raise. Nonetheless, comparing valuation timelines helps differentiate the herd of unicorns, and showcases where the "hype" has been most intense.

The table below reveals the 10 fastest fintechs to reach a $1bn valuation.

|

Rank |

Company |

Country |

Sector |

Year Founded |

Year $1bn Valuation announced |

Months Taken to $1bn Valuation |

|

1 |

Brex |

United States |

Lending |

2017 |

2018 |

21 |

|

2 |

Figure Technologies |

United States |

Lending |

2018 |

2019 |

21 |

|

3 |

Zenefits | United States | Insurance | 2013 | 2015 | 28 |

|

4 |

Symphony |

United States |

Multi |

2014 |

2017 |

32 |

|

5 |

Linklogis |

China |

Lending |

2016 |

2018 |

32 |

|

6 |

Dave |

United States |

Banking |

2016 |

2019 |

35 |

|

7 |

Airwallex |

Australia |

Payments |

2015 |

2019 |

40 |

|

8 |

Cgtz |

China |

Wealth |

2013 |

2017 |

41 |

|

9 |

wefox Group |

Germany |

Insurance |

2015 |

2019 |

41 |

|

10 |

SoFi |

United States |

Lending |

2011 |

2015 |

42 |

Source: Data compiled by online blog, Traders of Crypto, and adapted for accuracy by Sifted

Topping the leaderboard is Brex. The startup's 22-year-old founders took just under 2 years to grow it into a billion-dollar company.

Just one European firm — WeFox, a German insuretech — made the top ranking; suggesting the continent still lacks the capital allocation of the US and China.

Overall, the 10 fastest fintechs all took less than 4 years to reach billion-dollar status.

By comparison, it takes the average fintech unicorn 7 years to reach the $1 billion dollar mark, according to one study.

Sifted also conducted a closer analysis of the averages across different European countries.

The UK's 8 fintech unicorns took 5.5 years to reach the billion-dollar milestone, on average. Among them, Rapyd and Monzo were the fastest.

Meanwhile, it took Germany's fintechs an average of 7 years, while Sweden's sole fintech unicorn — Klarna — took 6.5 years.

Mambu, a Berlin-based banking platform, is Europe's newest fintech unicorn. The company recently announced it had secured a $2bn valuation — exactly a decade after it was founded.