VC funding is expected to continue its slowdown into 2023 amid the tech crunch. As such, growing numbers of startups are turning to venture debt as a means to ride out the rocky period and wait for calmer — more cash-heavy — seas.

European startups raised record amounts of debt last year — with a large part coming from US investors. Debt financing can involve interest payments or give lenders a cut of exit proceeds, as opposed to equity investors who take an ownership stake when they invest.

But how does venture debt really work and what do founders need to know about it? Taking inspiration from venture debt adviser Klymb’s new report and insights from the experts, this guide will give you the what, when and how of venture debt.

Why is venture debt important during a downturn?

Many companies that were planning a round in Q1 of this year have decided to hold off in order to achieve better numbers and growth, says Lourdes Alvarez de Toledo, a partner at early-stage investment firm JME Ventures.

“During these times of downturn, it’s a good way to extend runway and wait for a better moment to raise equity,” she says.

During these times of downturn, it’s a good way to extend runway and wait for a better moment to raise equity

According to Klymb’s two general partners in venture debt advisory, Faÿçal Hafied and Yohan Obadia, as the average ticket in equity fundraising has fallen, the proportion of debt top-ups in equity rounds has increased to complement funding and reach sufficient investment size.

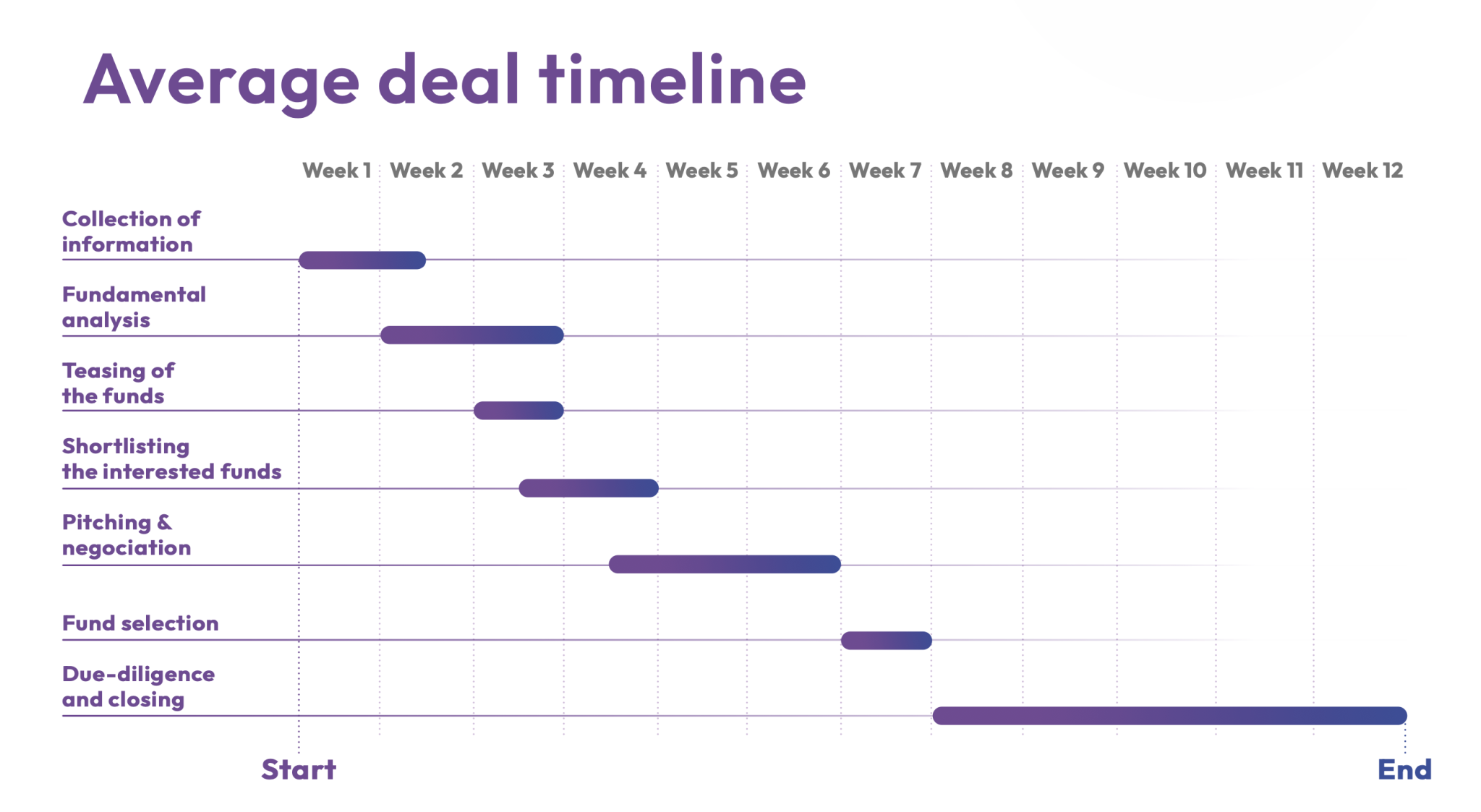

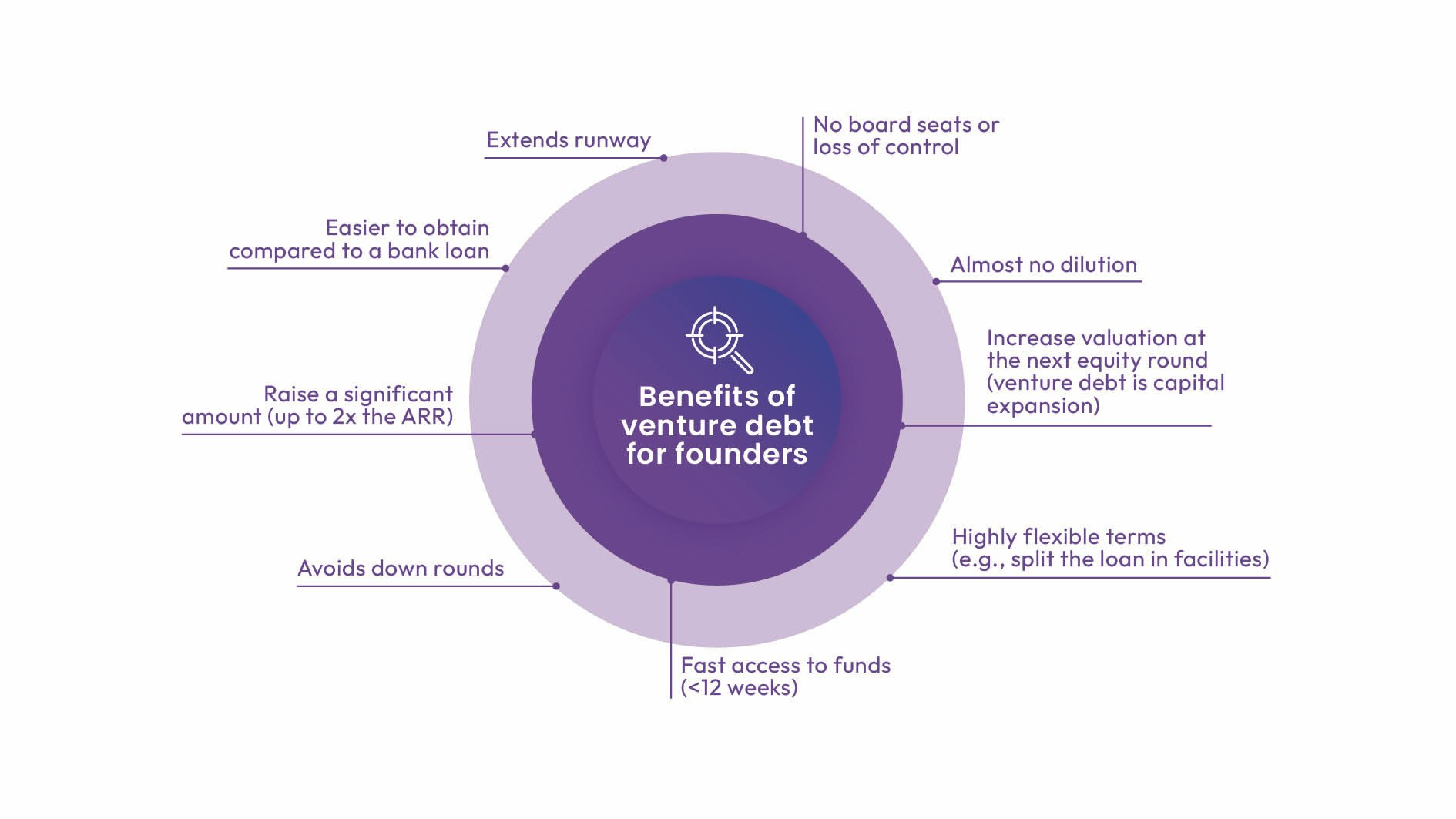

It's a “great instrument at any given time but particularly during a temporary downturn to avoid a downround, keep focusing on growth and ultimately achieve a higher valuation,” says Obadia. It also enables startups to raise lots of cash and fast: up to 1.5x the annual recurring revenue, with an average three months or so to get funded, he adds.

Which startups are viable for venture debt and what type of assets does it finance?

But not every scaleup can — or should — pursue venture debt. Venture debt emerged in the wake of venture capital to fund the intangible economy. Unlike traditional loans which take tangible assets as collateral, venture debt takes intangible assets like VC backing, predictable future revenue and intellectual property (IP). Bootstrapped companies are generally not suitable for venture debt.

So the main targets for venture debt tend to be deeptech companies with IP, typically in life sciences, or recurring revenue companies, like SaaS.

When should you use venture debt?

Obadia and Hafied emphasise that venture debt is an instrument made exclusively for a company’s growth.

This is echoed by Ross Ahlgren, general partner at Kreos Capital, Europe’s largest venture debt/growth debt fund manager. He advises founders to always approach it “from a position of strength as a team — when you have an existing cash runway — and to think about what you want it for: make sure you understand the value of that expansion capital whether it’s acquisition or something else”.

Venture or growth debt is best employed for specific use cases such as breaking into new markets or internationalising, generating new customers or acquisition financing. As companies grow, these use cases evolve.

“If you’re looking at the earlier stages, a lot of it is about giving the company more ‘firepower’ or extending existing cash runways,” says Ahlgren. “In the mid and late stage, it’s really about expansion capital — the debt is never used to leverage up the balance sheet.

“One of the nuances of the companies that we invest in is that the majority of our companies have traded profit for growth.”

While some investors believe venture debt is suitable for the entire funding continuum, Alvarez de Toledo warns early-stage seed companies against it due to the risk of still needing to find their product-market fit.

Whether a startup should consider venture debt is based on three criteria. First, how much debt the company already has. “If there’s debt, I don’t advise venture debt because the repayment is very aggressive,” she says. Second, the burn rate. A breakeven or cash-efficient company will likely find a way to repay the money but for companies with a high burn rate it’s riskier. Lastly, the track record of the company.

One of the defining things about the debt that we do is that the majority of our companies have traded profit for growth

“When I think it’s advisable to take venture debt is for companies in Series A with nice growth and good unit economics that won’t have problems raising the next round so having more runway is advisable,” she says.

What do investors look for?

The venture debt industry can be divided into two categories: Banks with venture debt arms and specialised investment funds. According to Hafied and Obadia, investors are looking for a “mission-critical product that is not easily replaceable — ideally sticky which means with low clients churn rate — as well as substantial revenue growth over the past 12-24 months and a current runway of at least six months”.

For Ahlgren, a web of factors are considered: management teams, underlying business models, unit economics, scale vs competition positioning and vision. Working alongside equity sponsors is a prerequisite for Ahlgren’s loans: “It creates a three-legged stool so if there are possible issues everyone works together to find solutions.”

There’s a larger relationship and a bigger ecosystem that we all play in. So start small. And hopefully, as the balance sheet grows, the company grows

When it comes to advice for VCs or growth equity sponsors, Ahlgren says it’s pretty much the same as what he’d give founders. “It’s a very symbiotic relationship,” he says. “It’s not like any of us wants to maximise our position to the detriment of the others. There’s a larger relationship and a bigger ecosystem that we all play in. So start small. Never over leverage. And hopefully, as the company grows the use cases for further debt grow.”

What are the risks?

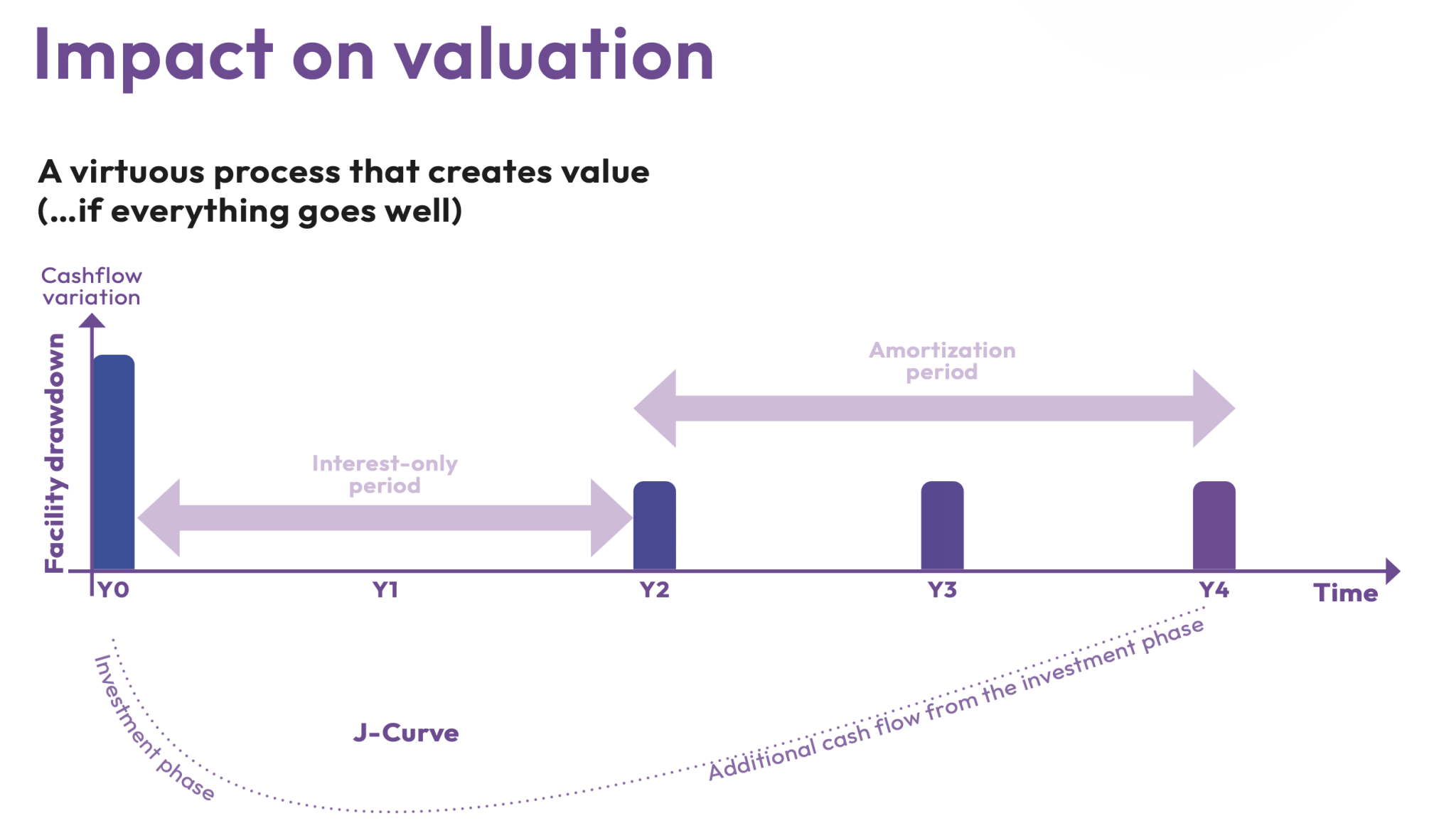

Done right, venture debt can be a less diluting option than an equity raise, offer flexibility of terms, quick fund allocation and increase a startup’s valuation ahead of the next equity round.

“Most of the time,” Ahlgren says, “because the loan-to-value ratio is very low, these monthly payments are very granular and baked into the business plan. We never do large balloon payments or anything that can impair the growth prospects of the business.

“These are loans that you pay back in very, very small increments over time. And hopefully whatever acquisition was completed, or expansion into new markets or new products, has accelerated the business to such an extent that the debt repayments are just another part of the funding process.”

But venture debt is not a risk-free product. Venture debt investors can be flexible over the life of a loan but if debt is not repaid, default will be the last resort.

“Venture debt is not capital for survival but capital for expansion” says Hafied. “We are coming out of a period where equity was abundant and available, which led many founders to think that they could always trade on their ownership with an equity round in case of capital needs... In the venture debt world, the debt is supposed to be repaid in terms set in advance. It’s a mental paradigm shift founders need to make.”

What do founders need to know about terms?

There are about five or six moving parts to be aware of, says Ahlgren: interest rate, transaction fee, a term to draw down the money, potentially an interest-only term and yield enhancement component.

“Entrepreneurs need to work with people, whether it’s equity investors or venture debt providers, that are happy to explain every aspect of the terms and how they work,” he says. “Part of the key is understanding if there are use of capital restrictions or financial covenants, but for a growth business we almost never have them.”

Entrepreneurs need to work with people, whether it’s investors or venture debt providers, that are happy to explain every aspect of the terms and how it works

Hafied and Obadia say that the flexibility of venture debt term sheets can make them complex: “Certain clauses have sequenced effects over time, others can lead to cascading effects if they have not been limited upstream, like financial covenants that can ultimately trigger a default. The founders must model all these side effects before signing the loan contract.”

Interest rates vary from deal to deal — the smallest rate 8%, according to Alvarez de Toledo, and the highest 12%, “depending on your power of negotiation”. The equity kicker — which allows the fund to invest in equity — is usually set at 10% of the committed amount at a discount between 15-25% at the next equity round and is up for negotiation, too. There might be a grace period: a time without repayment, typically up to one year. Some also opt to extend the time the money is deployed and thus when interest rates begin.

While there’s no aggregate study on success vs failure, looking at the performance of venture debt funds gives some indication. Hafied and Obadia say that default rates are mostly correlated with firm size — a company in its Series D will therefore be less likely to default than a company in its Series A.

“The portfolios of the best venture debt funds have default rates below 5%.”

Interested in venture debt? Check out Klymb’s guide here.