When founders raise early money they need to ask three questions, which have previously been hard to answer, says Saul Klein of LocalGlobe.

- How much they need?

- How long before they pitch for Series A funding?

- From whom should they raise seed money?

The latest report from Dealroom in collaboration with LocalGlobe and Atomico provides probably the most systematic analysis of Europe’s early stage companies, the related funding scene and the best answers to all of Saul’s questions.

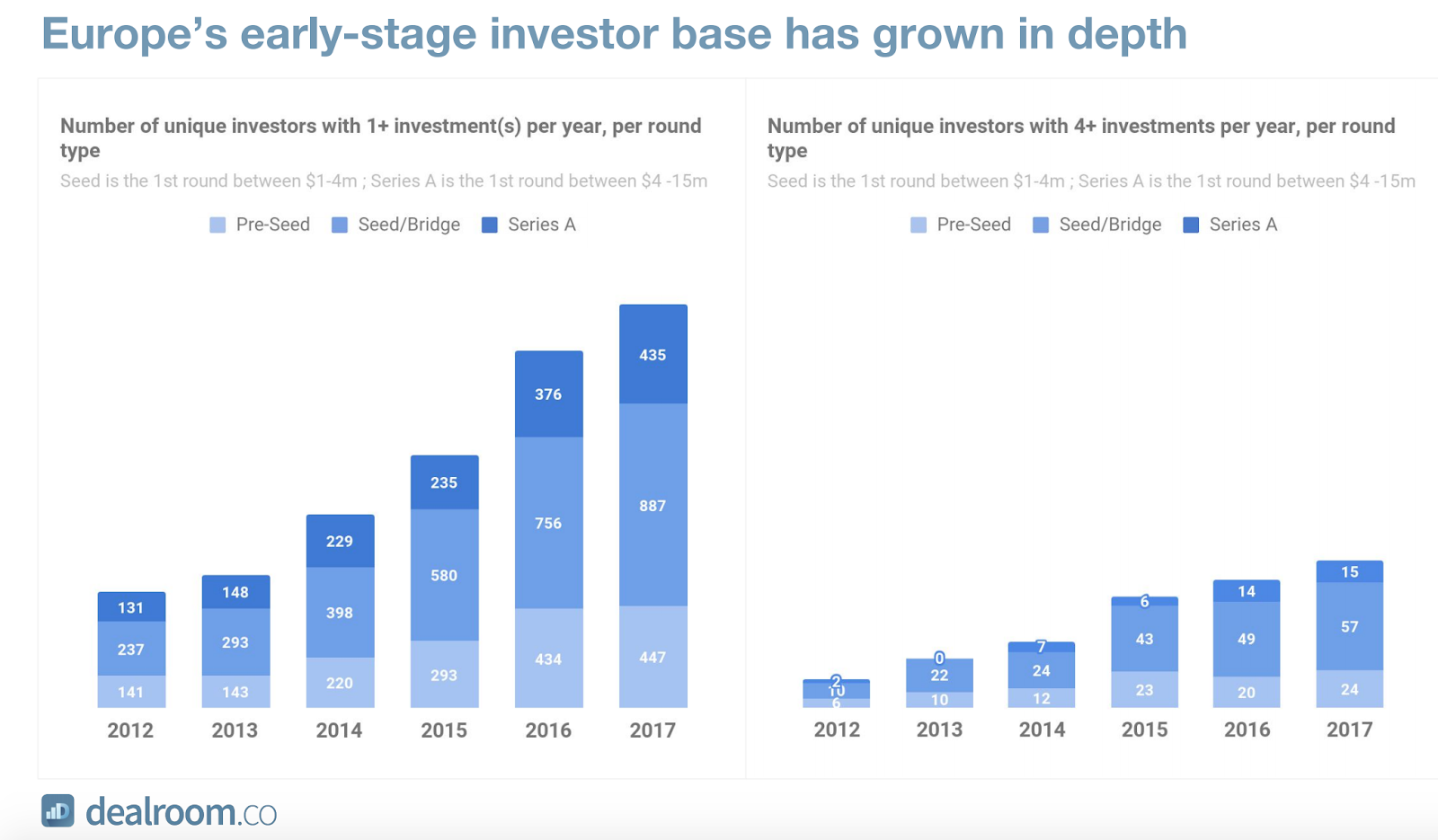

Overall, the survey confirms Sifted’s view that Europe’s startup scene is both multiplying and rapidly diversifying. The number of seed funding rounds across Europe has risen from 254 in 2012 to a projected 875 this year. Total funds raised have risen from $486m to a projected $1.5bn over the same time. The origins of those companies is spreading well beyond London, Paris and Berlin. The number of investors committing money to this sector is also increasing fast (see above).

Part of the confusion surrounding the state of early stage funding is that so many of the seed rounds are self-reported (often with a time lag) and there is no agreed classification for deals. This report develops a clearer taxonomy. It defines seed rounds as being more than $1m and Series A as between $4m and $15m.

Having analysed the data, Saul Klein suggests that a seed raise of between $2m and $3m normally hits the “sweet spot”, that it’s advisable for founders to aim for a Series A round between 18-24 months after their seed funding, and that it pays to be backed by big-name investors. “Venture is to some extent a network effects business,” he says.

Other recent reports on startups around the world have suggested that their number has fallen while their average size has increased. But Tom Wehmeier, head of research at Atomico, says that startup activity in Europe remains intense and is now spreading way beyond the mature hubs. “There are dozens and dozens of other cities where all the right ingredients for entrepreneurship are happening,” he says, pointing to Amsterdam, Madrid, Zurich, Cologne and Vienna.

The Dealroom data is far from perfect but it’s well worth scrutinising by any founder looking to raise money.