Every year, dozens of reports are published that show just how abysmally little VC funding goes to female founders.

In 2020, female founders received just 1% of VC funding in central and eastern Europe. In 2019, all-women startup founding teams received just 1.3% of capital raised in the Nordics. Across Europe, 90.8% of all capital went to men-only teams in 2020.

And yet, until recently, far less focus has been placed on the socioeconomic backgrounds of founders.

Today, finally, a new report from angel network Cornerstone Partners, diversity and inclusion consultancy Engage Inclusivity and non-profit Diversity VC has looked at just that, showing that most UK founders who land VC funding have one thing in common — and it isn’t necessarily genius. It’s privilege.

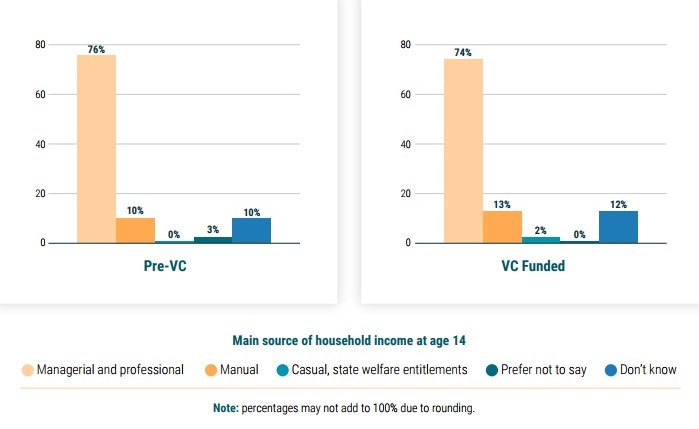

75% of founders come from advantaged socioeconomic backgrounds

Cornerstone surveyed 1,186 businesses that were ‘pre-VC’ in 2019 (had yet to raise VC but were VC ‘eligible’) and 696 companies which announced VC investment in 2019.

It found that 75% of these founders come from advantaged socioeconomic backgrounds, with parents or carers in managerial or professional roles, and barely any of these founders come from families living on welfare entitlements.

These founders from advantaged socioeconomic backgrounds are more likely to hear of VC earlier, says Rodney Appiah, chair of Cornerstone, and understand its benefits for startups.

"If we truly want to create a funding environment that gives each exceptional business idea the opportunity to grow with VC support, we need to devise systems and models that remove the barrier that those who come from less advantaged socioeconomic backgrounds are less likely to be aware of and encounter venture capital," adds Appiah.

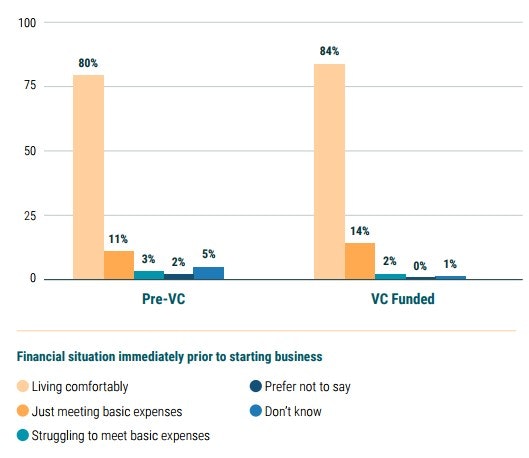

Most founders are in a comfortable financial position when they start out

80% of pre-VC founders say they are 'living comfortably', compared to just 3% who say they are 'struggling to meet basic expenses'. This then rises to 84% of VC funded founders who are 'living comfortably'.

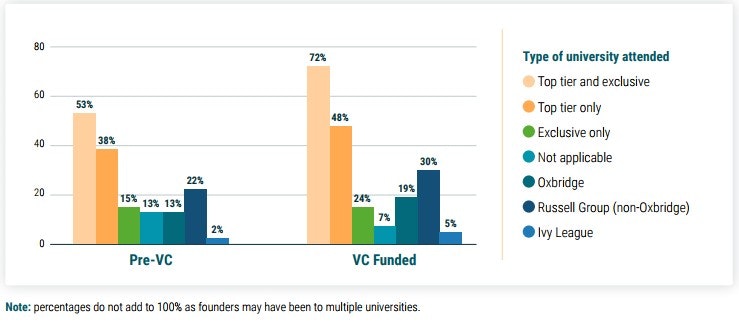

The majority of founders are graduates of ‘prestigious’ universities

72% of VC funded businesses have founders who went to ‘top tier’ (ie. Russell Group) and ‘exclusive’ (ie. Oxford and Cambridge) universities.

Notably, funded founders were more likely to have been to Oxbridge, a Russell Group or Ivy League university than pre-VC founders.

Just 7% of VC-funded founders did not go to university

93% of VC-funded founders went to university. 21% even have a PhD.

For founders yet to have landed VC funding in 2019, those numbers were lower: 8% had a PhD and 83% had been to university, suggesting that investors are more likely to back founders with a highly academic background.

For context, 42% of the UK population has been through higher education, meaning degree-level qualifications.

An investment landscape that continues to favour and fund founders that previously attended university would suggest a missed opportunity to back talented founders from non-higher education backgrounds.

"Whilst university is a fantastic experience for many, it is not in our view a prerequisite to building a successful business," says Appiah.

"There are a number of examples of highly successful founders that never attended higher education such as Richard Branson, Deborah Meaden and John Caudwell. An investment landscape that continues to favour and fund founders that previously attended university would suggest a missed opportunity to back talented founders from non-higher education backgrounds."

Black founders are underrepresented

Just 1% of pre-VC and 3% of VC-funded founders in the UK identify as Black. To put that into perspective, 3% of the UK population identify as Black — but in London, where 53% of the startups surveyed are based, it’s much higher: 16% of Londoners identify as Black.

10% of pre-VC founders identify as Asian, dropping to 7% of VC-funded founders.

Black women received almost no funding whatsoever.

Underrepresented founders rely less on VC funding

All-white founding teams rely less on ‘family and friends’ rounds than teams with at least one founder from a racially minoritised group. Underrepresented founders are also far more likely to apply for government loans (57%) than white founders (27%) and more likely to use crowdfunding platforms (64%) than white founders (50%).

"Our research suggests that founding teams with at least one member from a black or racially minoritised group are 10% less likely to have a friend or family contact they can reach out to for an introduction to an investor vs all-white teams," says Appiah.

"Being exposed to venture capital at an earlier stage, and being in a position where you are more likely to have the social capital networks required to access potential investors, seems to suggest a lower reliance on government loans and family and friend rounds."

Recommendations from the report

1. VCs need to stop relying on their networks

Many VCs take ‘warm introductions’ to founders because they seem less risky if they come from somebody the investor already knows and trusts.

“But these trust networks are by definition small, so the danger is that you only see opportunities from a limited number of already well-connected founders,” argued angel investor Sarah Turner in an op-ed for Sifted recently.

In 2019, Diversity VC found that startups that land in VCs’ laps via ‘warm introductions’ are 13 times more likely to be funded by them than those that come in ‘cold’. “Founders without links to a VC are at a significant disadvantage,” Diversity VC founder Check Warner told Sifted at the time.

Accelerators play a critical role in building out the social capital networks of underrepresented founders.

2. Support angel groups and accelerators that invest in businesses run by underrepresented founders

"Accelerators play a critical role in building out the social capital networks of underrepresented founders, by facilitating introductions to mentors, entrepreneurs, consultants and other investors in the ecosystem," says Appiah.

3. Encourage more transparency amongst VCs

The report argues that there needs to be more of an ‘Open VC’ model whereby VCs work with organisations like the BVCA and UKBAA “to create guides that abolish exclusionary practices and enable businesses with less social capital to gain access to investment networks”.

Work is underway on this front. Dozens of VCs have signed up to the Investing in Women Code, which means they’ve agreed to annually report on the gender split of their investment activity, as well as improve internal practices to support more female entrepreneurs.

But clearly much more could — and should — be done. Tech for good VC firm Bethnal Green Ventures is calling on its peers to share far more data on the makeup of their portfolios. Diversity VC has launched the ‘Standard’ to assess and accredit those VC firms which are following diversity and inclusion best practice.