94% of VC-backed startups are going to survive the next six months, according to a survey by Paris startup campus Station F, which polled investors about the impact of the Covid-19 crisis.

Station F asked some 100 investment funds about the startups in their portfolio over the month of May.

While nine out of every 10 startups said they’ve been impacted by the Covid-19 pandemic one way or another, most have adapted to the changing context very quickly, says Roxanne Varza, Station F’s director.

“The main lesson from this survey is the immense agility that startups were able to demonstrate through the crisis,” Varza says. “It’s a solid ecosystem that’s made changes, but really hasn’t been shaken up to the point of in-depth soul-searching.”

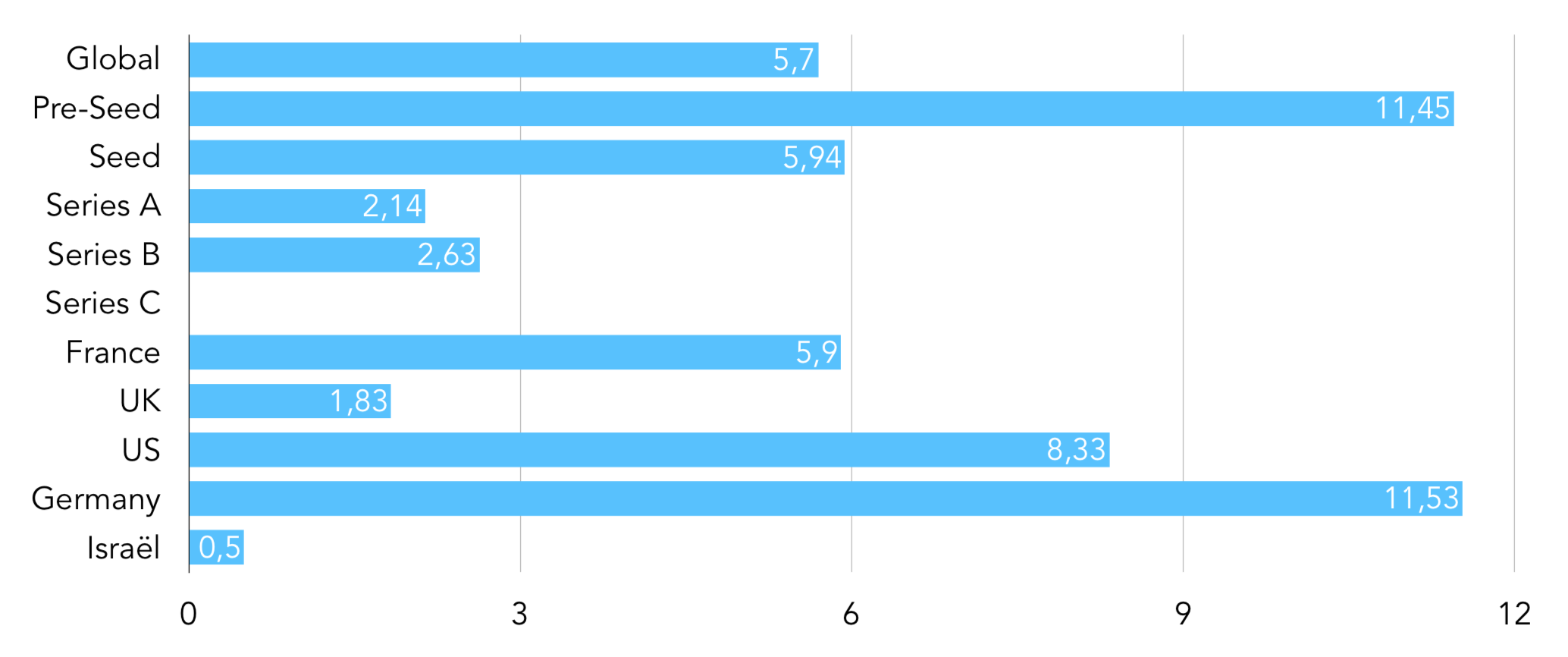

The survey covers about 1,000 companies across Europe — in France, Germany and the UK — as well as in the US and Israel, with a slight over-representation of seed-stage and SaaS (software as a service) startups relative to other categories.

Here are the 10 key data takeaways:

- There’s no field of corpses. Less than 6% of startups say they’re likely to shut down in the coming six months as a result of the crisis.

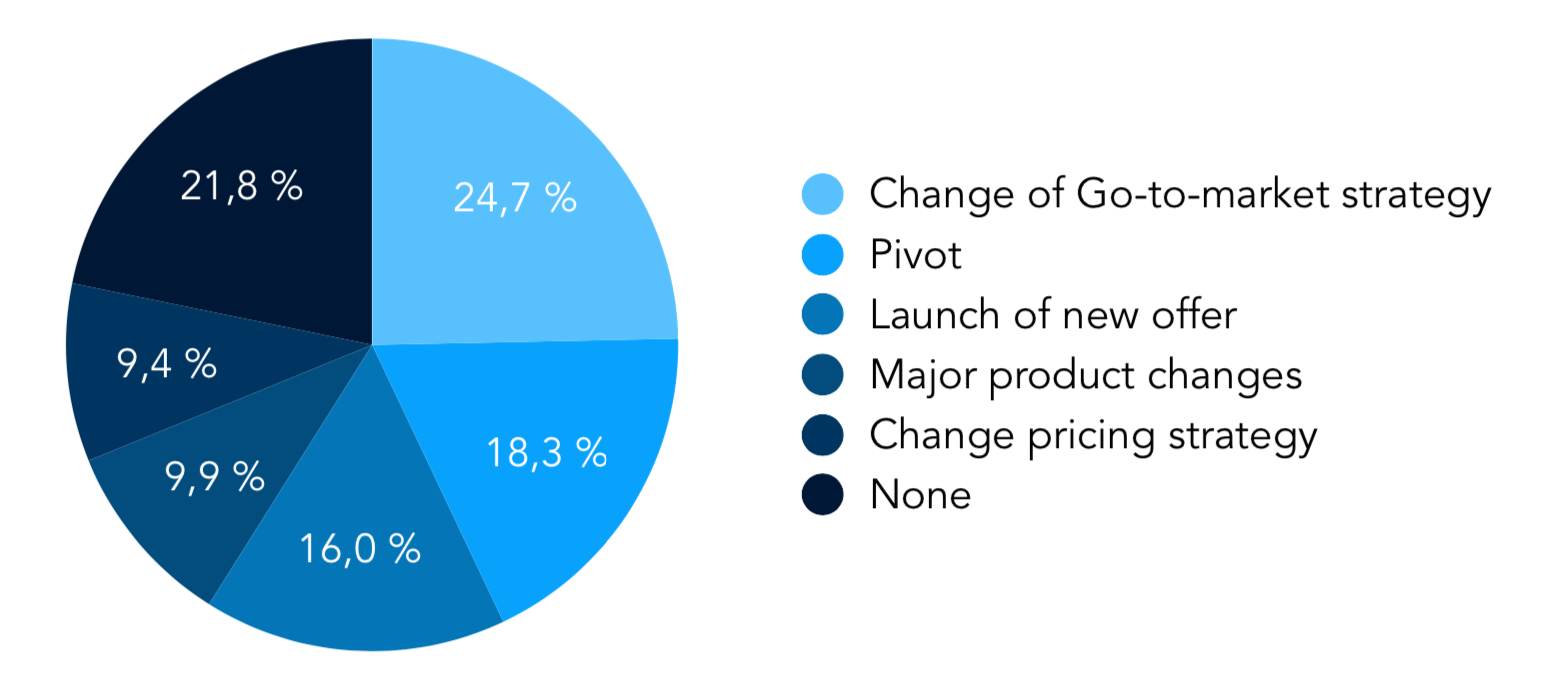

- 80% of startups had some sort of pivot. The most common decisions involved changing the go-to market strategy (advertising, sales approach...). Less than 20% went so far as to pivot entirely to serve a new market, and only 16% launched a new offer.

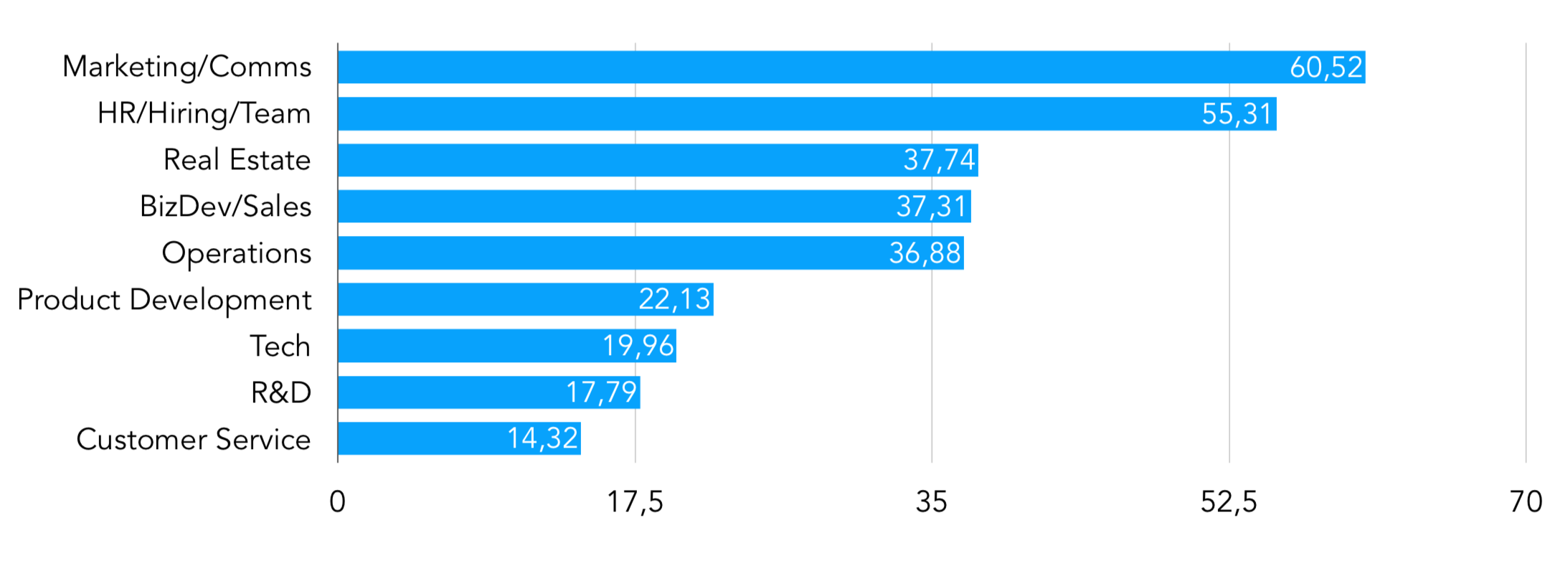

- Yes, startups cut costs. 60% shrank marketing and communications expenses, while the share of companies that reduced customer service budgets was more limited (14%).

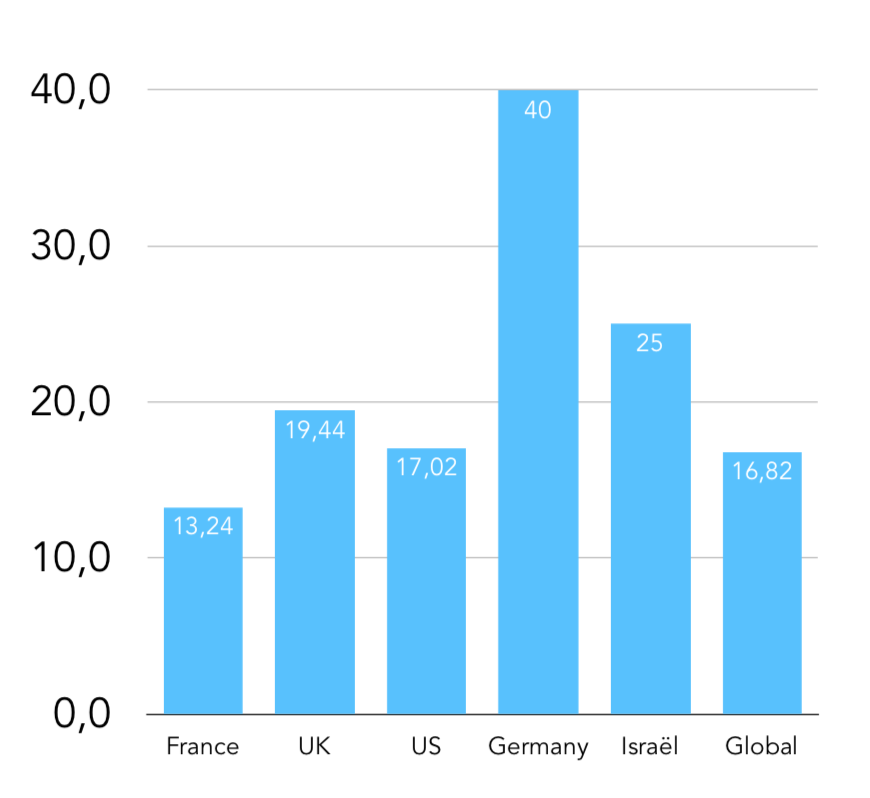

- And there were firings. 24% of startups polled used some form of temporary unemployment, while about 17% implemented firings since the beginning of coronavirus. That number was significantly higher in Germany than in other countries, including the US.

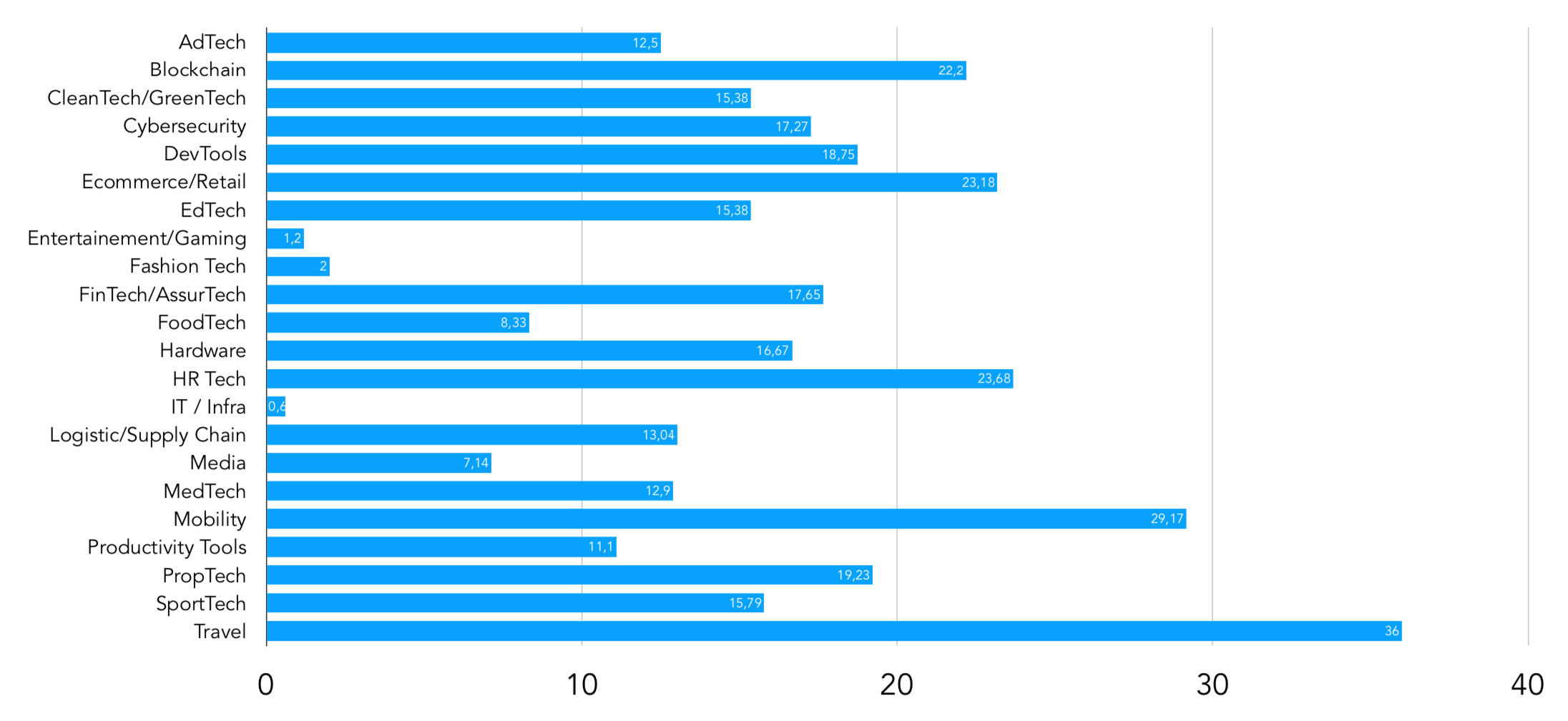

- Travel and mobility took a hit. As investors make their bets on who the winners and losers of the Covid-19 will be, it’s no surprise to see travel and mobility on the side of things being more complicated. Those two sectors had to resort to firings more than other businesses.

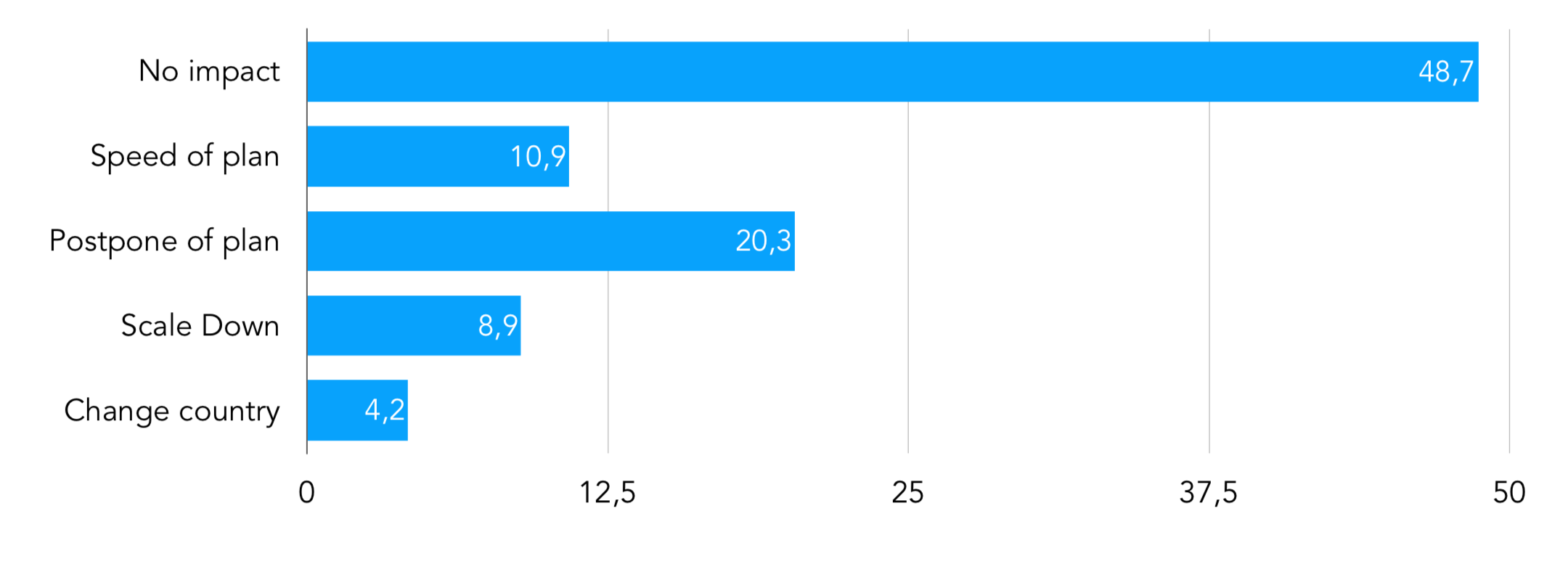

- But startups aren’t pulling back on international expansion. Almost half are maintaining plans to expand into new markets intact despite the Covid-19 crisis.

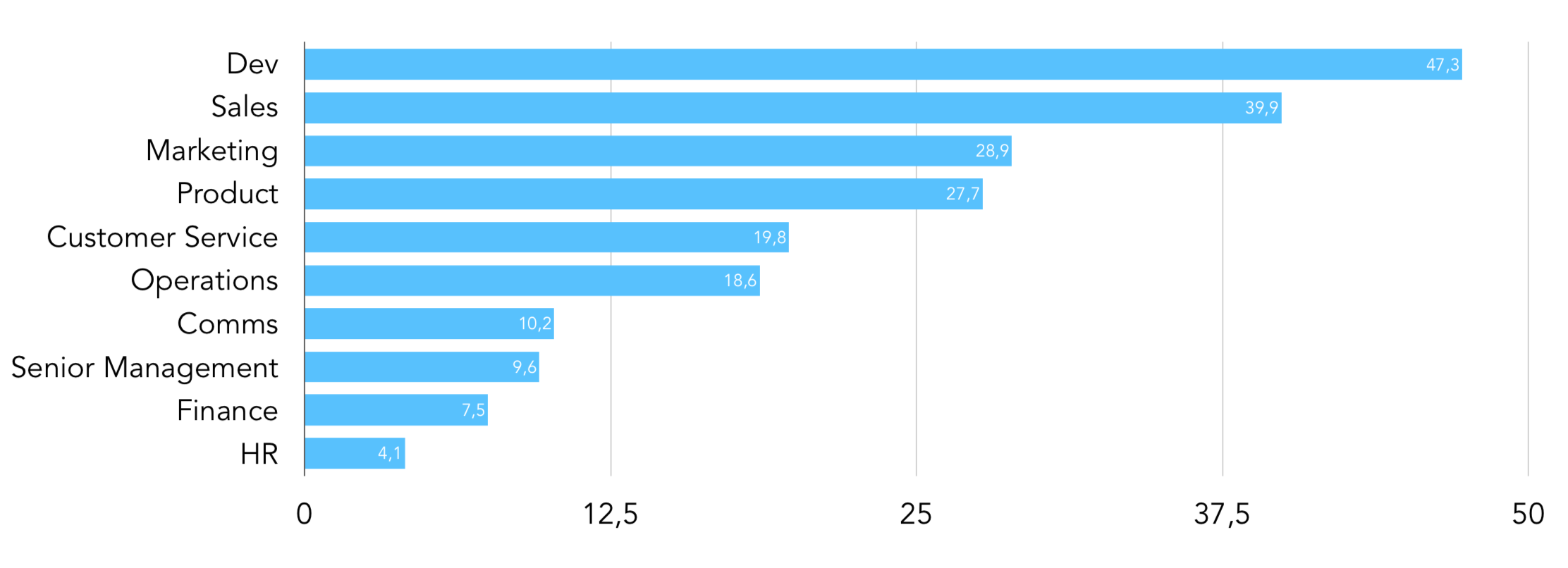

- There are post-covid hirings in sight. 78% of companies represented in the poll are planning to hire new staff by the end of the year, with developer jobs on top of the list. 49% onboarded new employees during the crisis.

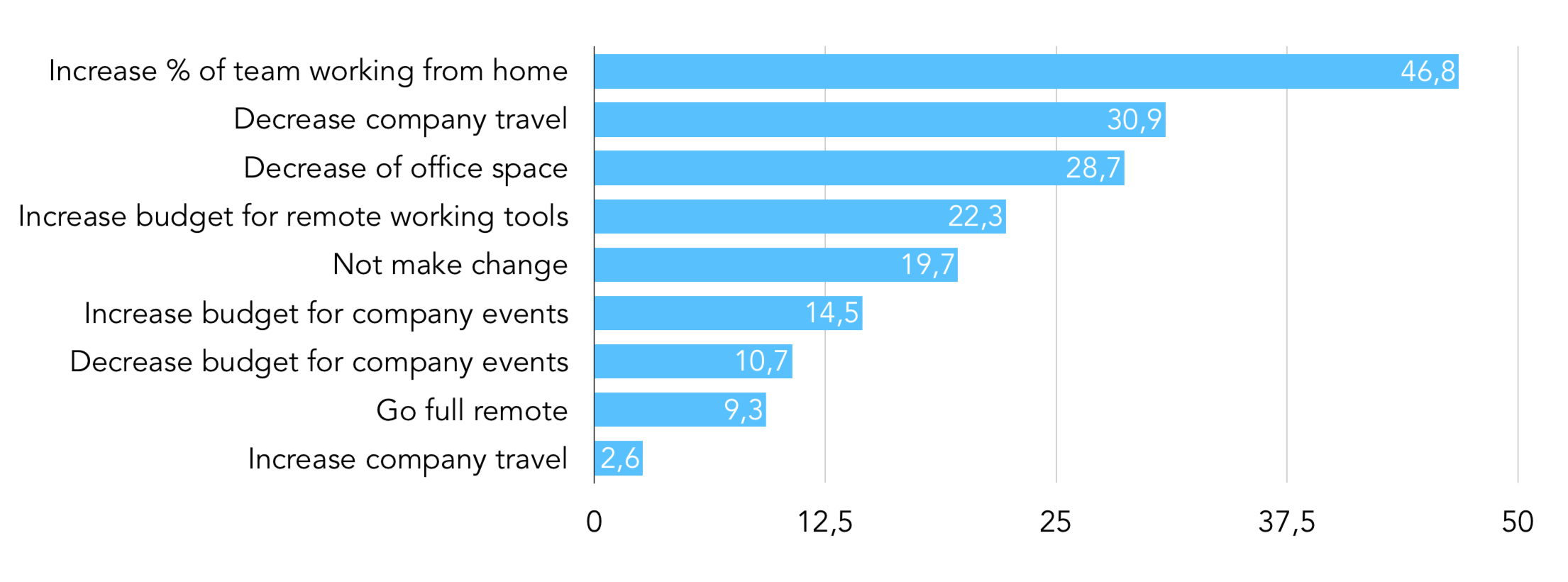

- Going full-remote isn’t catching on. Less than 10% of startups are planning to implement remote work for all employees. The rest are deploying work from home schemes of course, albeit looking forward to regaining at least some real-life time in the office.

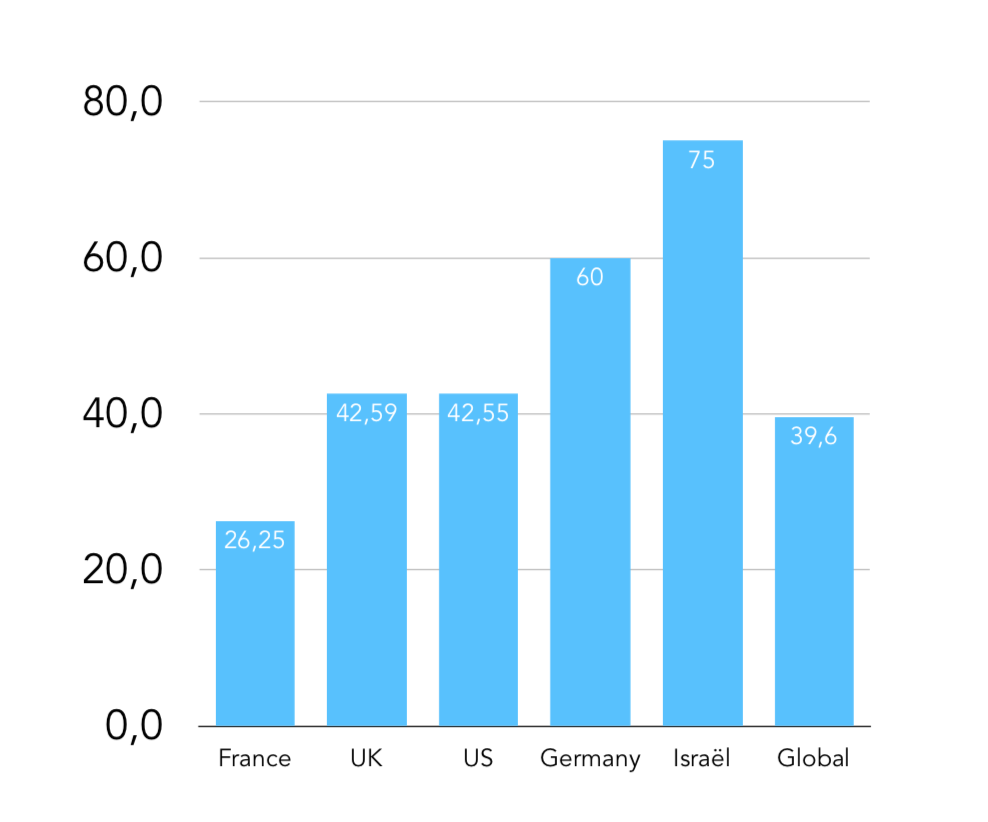

- Startups are raising money now. Fundraising rounds were delayed for 40% of startups during the crisis. That’s roughly the percentage of companies that are trying to tap investors for money now, albeit less so in France than in other countries.

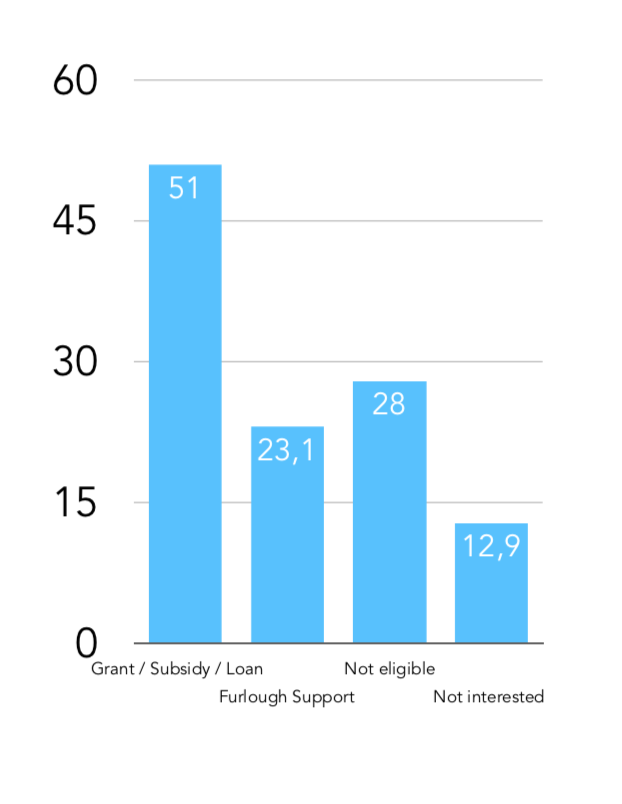

- Government support did help. More than half the startups polled got some money from government through grants or loans, while 23% tapped furlough support. Looking forward, heavily hit sectors like tourism and mobility still need some firefighting from policymakers, but it makes sense for bailouts to become more limited — and the ecosystem can handle it, Varza says.