Revolut has announced its long-awaited $500m Series D at a $5.5bn valuation, making it the most highly valued fintech in Europe, alongside Swedish lender Klarna.

In just under two years, the London-based fintech has more than tripled in price, having been valued at $1.7bn at its April 2018 raise.

Revolut's new valuation will raise eyebrows; indeed, the whole fintech space has been accused of being a price bubble, buoyed by investors who make backroom deals to make their shares and exit agreements more appealing.

But what's in a number?

Valuations are complicated things, but at their core they're an indication of how much a company could earn, and how much shareholders are willing to pay for a piece of equity. They can be grossly inflated, like WeWork and Uber are deemed to have been, but there are some helpful pointers to go on.

Here's a breakdown of how to make sense — if at all — of Revolut's new multi-billion-dollar valuation.

Future gains?

Revolut's valuation follows a similar logic to Plaid, the US fintech recently acquired by Visa for $5.3bn. Plaid is making revenues of $100m-200m according to Forbes, which is in line with Revolut's own projected income-stream of around £170m (three times the £58.2m it reported in 2018).

So they're both valued at around 25x their annual revenue.

Revolut's valuation should also be put into context against its peers N26, Starling and Monzo, who are all priced between $1bn and $3.5bn. According to an analysis by Sifted last year, Revolut leads in terms of downloads, deposits and revenues — even when adjusted for time; metrics that could justify its higher valuation.

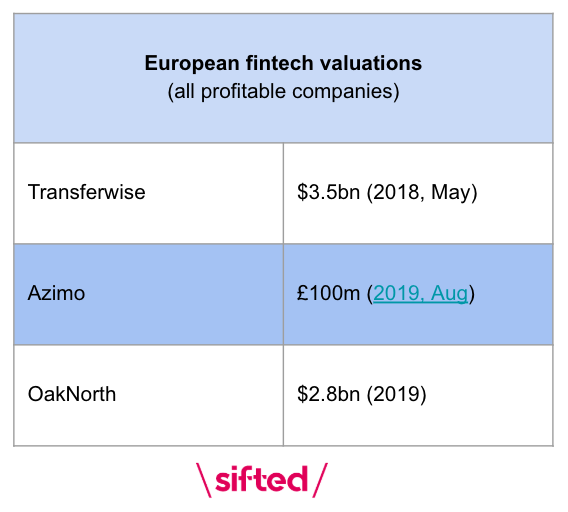

But it's noteworthy that Revolut, which is still haemorrhaging losses, is priced more highly than its profit-making peers (see below).

It's even become more valuable (at least on paper) than the likes of investment group Standard Life Aberdeen (with more than £2bn in revenue) and the InterContinental Hotels Group (boasting more than £4bn in revenues).

Meanwhile, Klarna - which shares its $5.5bn valuation - brought in 4 times more in revenue than Revolut last year, as well as having been profitable for the last 15 years.

"If you have drunk the cool aid perhaps you buy [Revolut's] increasing valuation but I don't see them as a bank, rather a convenient card especially for FX transactions, so I am sceptical on how they increase revenue to maintain an increasingly large fixed cost base," an investor, who asked for anonymity, told Sifted.

Indeed, to live up to its valuation, Revolut's margins will need to continue growing year-on-year, which begs the following questions about its income stream:

- How sticky are its premium-subscribers?

- Will its US audience (in the works) be as receptive to subscribing as those in the UK?

- Is Revolut really becoming more efficient as it benefits from economies of scale? Can it sustain its ever-growing costs and generate organic growth without venture capital funds?

- Will the launch of Robinhood in the UK affect the success of their stock-trading platform?

- How far away is it to getting its UK bank license, and will this prove lucrative from the outset (e.g. will its customer base be predisposed to loans?)

- Will card producers (Visa and Mastercard) continue to support them or compete?

- What other new products will generate revenue?

The last question is particularly key given Revolut's core income stream (around 80%) currently comes from collecting interchange fees: the 0.2% cut that European banks take from merchants every time you use your debit card. The company claims that on average 1.1m of its 10m users are active on a daily basis — a ratio it will be hoping to boost.

Note, in the US, the fee averages 2% of the transaction value, potentially providing a stronger income stream if it can secure a solid user base there.

Ultimately, profitability for Revolut is still a long way off, given its rising losses. But chief executive Nik Storonsky seems to pay growing attention to the question of profitability at last, remarking in an interview with CNBC on Tuesday that it's become a priority for venture capital funds.

Too big to fail?

The simple answer is no, Revolut is not too big to fail. Far larger financial institutions have been driven into the ground — remember 2008?

Andy Ellis, head of ventures at high-street bank NatWest, told Sifted earlier this year that he could foresee a digital bank running out of funds and collapsing, given how far they are from being self-sustaining.

“Let’s imagine that [the fintechs] don’t break even for five years… All it takes is for someone to kind of have a wobble. And for all that money not to be there for somebody and they’re in a bit of trouble,” he said.

Indeed, there are whispers that fintechs are riding a precarious tech funding bubble, given their main financiers have been tech investors. To date, Revolut has been largely propped up by tech investors, with Hong-Kong based DST Global having led its $250m round in 2018. Meanwhile, its latest $500m round was led by US venture firm TCV, an early investor in Facebook and Netflix.

“The question is how long will investors put up with Monzo and Revolut. If the tech bubble closes in…,” one ex-bank executive told Sifted last week.

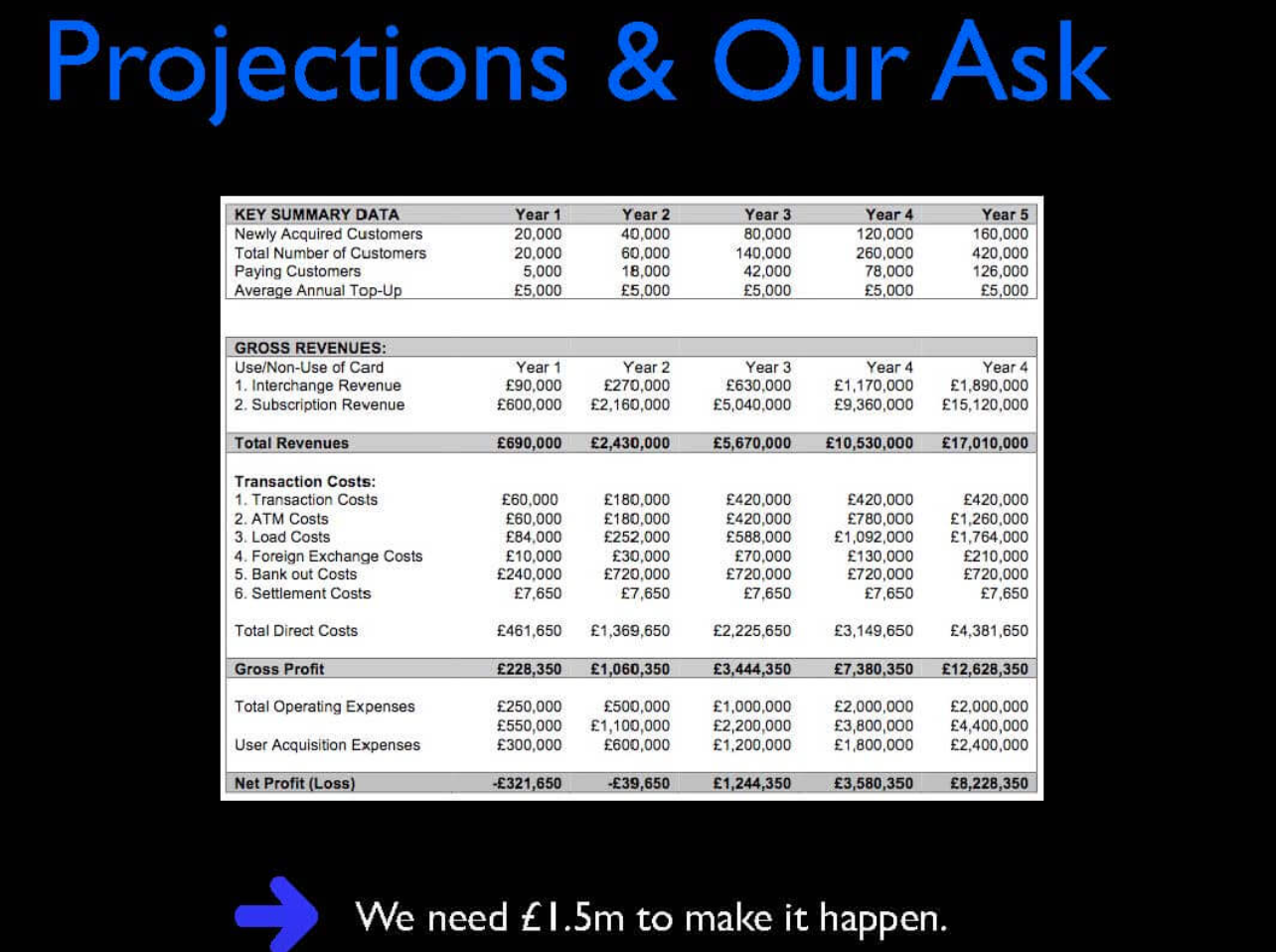

Regardless, Revolut has come a long way since its seed round pitch (check out the deck here). Even if they did expect to have £3m in profit by this year...

Now the question is not if the company will resign growth in favour of profitability, but when.