Bó, the digital bank developed by the high street lender RBS/NatWest to challenge the likes of Monzo and Starling, will be wound down — just six months after its public launch.

The announcement came after RBS reported its full-year results on Friday.

RBS chief executive Alison Rose hinted that the coronavirus pandemic had influenced the decision to close Bó, as the bank announced sunken profits and braced itself for heavy credit losses in a tough economy.

Bó itself also likely experienced a downturn in customer engagement during the crisis, with its fellow digital banks — including Monzo and Starling — seeing signups dive in March, according to Sifted analysis.

“The circumstances have changed,” RBS's Rose told Yahoo Finance UK.

RBS's landmark retreat from the digital frontline will be a sting. More broadly, it's another sign that big banks are struggling to emulate its digital-only peers, who have been vocal about their intentions to take market share.

A fleeting history

RBS began building Bó in September 2018 to take on the likes of Monzo, after short-lived conversations about buying the London startup.

Instead, RBS opted to allocate over £100m to launch Bó itself, introducing many of the same features that shot Monzo to fame. But the key differentiator was Bó's focus on “money-saving” tips and the security of being linked to a traditional bank.

Bó hired tech consultancy Oliver Wyman to help build it and also brought on team members from digital banking app Loot in June 2019, after the startup went into administration. Loot's chief executive Ollie Purdue joined Bó as chief product officer, who Sifted reported was leaving the bank last week.

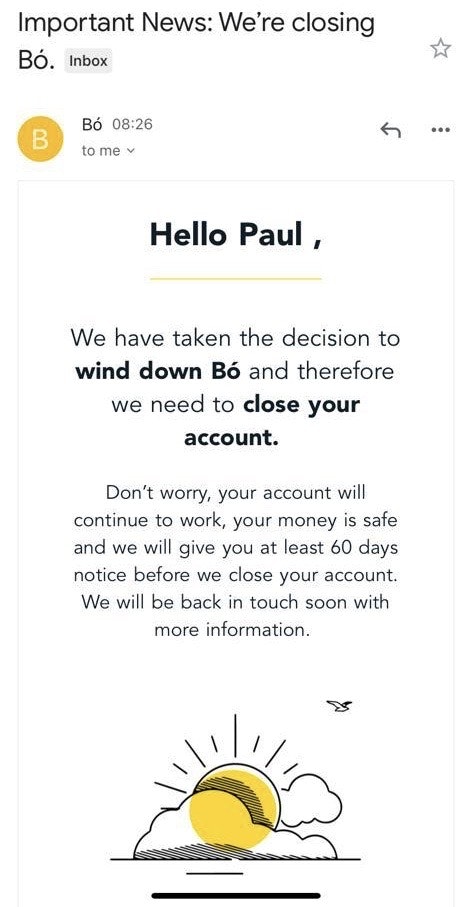

Bó 's 150-strong staff were alerted last night and its 11,000 customers were informed this morning.

Margin of error

Besides coronavirus and the need to cut costs, there are wider issues that may have played into Bó's decline — and why it's been cut instead of Mettle, RBS's digital bank focused on business customers.

- Politics

It's no secret there have been rumblings at the top of Bó and indeed RBS. Bó's chief executive and mastermind Mark Bailie stepped down in January. One insider close to Bó told Sifted there had been a long-standing clash between Bailie and RBS' Rose about Bó's future and survival. With Bailie no longer at the bank to defend Bó (and the ambition to see it attract "million[s]" of customers), Bó essentially lost its biggest advocate. - Tech flaws

Bó's tech stack is said to have been plagued with problems, with the team spending the first three months post-launch bug fixing and prompting worries from RBS investors. In addition, a compliance glitch forced thousands of users to replace their cards earlier this year. The early tech failings were also aggravated by a rush to go live to avoid the project being cancelled, one insider told Sifted. - Poor user feedback

Bó was hit by a string of critical reviews on the App Store when it launched in December last year. But things haven't gotten better — it's still rated 3.2 out 5 on iOS. Meanwhile, Mettle enjoys a 4.7.

- Limited engagement.

Insiders have told Sifted that although Bó had far more customers as a retail bank, Mettle had more engagement (transactions, deposit, spending, app usage). Engagement remains a crucial data point for most digital banks, and business clients also generate more revenue per capita given they generally hold larger deposits and credit applications.

RBS announced Bó and Mettle would be integrated, and a senior figure at the bank confirmed Bó's IT stack would not be up for sale.

Fintech, the corporate way

Like Mettle, Bó was a so-called “flanker brand” — sitting outside RBS’s core infrastructure. Yet it was still bound by its inherently cautious parent and key obstacles that come with that, said Mettle's chief executive Marieke Flament.

“The biggest challenge is probably that they’re two different cultures, Mettle and RBS… Our way of working is more like a tech company than a bank," she told Sifted earlier this year.

Anne Boden, a former RBS employee and now chief executive at Starling, also argued big banks can suffocate true fintech innovation.

“I came from that world… if I thought I was going to be able to create that I would have done,” Boden told Sifted last year. “It’s very difficult to replicate the energy and technology of a startup.”

Indeed, corporate innovation projects have a dismal survival rate.

The nature of banking innovation also means executives fail to fully invest mentally in side projects, according to a former Lloyds exec.

“That’s why they give these things a separate brand. If they want to close it without lasting embarrassment, they can,” they explained.

While RBS may be spared its blushes, Bó's decline comes as a serious blow to its digital planning.