Octopus Energy has quickly become one of the UK’s largest energy suppliers since launching in 2015. That's made it a rare example of a young company that’s managed to take a piece of the energy pie, typically reserved for age-old incumbents.

The company has also managed to remain relatively intact through a crisis that’s seen 29 other energy suppliers fail in the UK — the largest being fellow startup Bulb, which Octopus acquired in December last year.

And though Octopus's latest financials show a £141m loss, cofounder and CFO Stuart Jackson tells Sifted that it expects to hit profitability in 2023.

Navigating the energy crisis

Jackson held senior roles at Barclays before cofounding Octopus — a background he says made him naturally risk-averse. He’s the one credited with steering the company through the energy crisis.

In the year to February 2023 UK gas prices rose 129%, but Octopus — which supplies energy generated from both gas and renewable sources — was relatively inoculated against that because it chose to “hedge” throughout the crisis. That means it bought its energy supply in advance, at an agreed price, rather than the alternative of buying it on the gas market on a daily or weekly basis, where prices can fluctuate.

Energy companies often sell customers year-long contracts at a fixed price, so if you don’t hedge you can benefit from moments when the gas price goes down. But it's a risky strategy: as happened in the last two years, you can also end up supplying energy at a higher price than the consumer is paying for it. If that happens, energy companies have to foot the difference.

“If we sell you a 12-month fixed product at a particular price, we've already bought it, and we effectively lock in the margin that we know we're going to take. And that was key,” Jackson says.

Competitors, like Bulb, did not do that, and ended up buying energy for significantly more than it was selling it to consumers.

“I think it was fairly well understood that they [Bulb] were taking pretty significant risks in the market,” Jackson says.

But the last few years haven’t been all plain sailing for Octopus.

The December acquisition of Bulb has become a fraught topic for the energy industry — British Gas owner Centrica, E.ON and Scottish Power, have brought a judicial review over the terms of the deal. It’s understood the three suppliers will claim Octopus received preferential treatment from the government during the Bulb takeover.

And the company’s latest accounts — for the financial year ending April 2022 — show a net loss of £141m, which Jackson says was “more than explained by decisions we made in the retail business, fundamentally to shield customers from the cost of the crisis”. In September 2021, the company decided to hold prices below the UK government's price cap, which is adjusted every six months.

Jackson says Octopus’s board agreed that the energy crisis was not the right time to be delivering a profit.

'I expect that we will be profitable in this year'

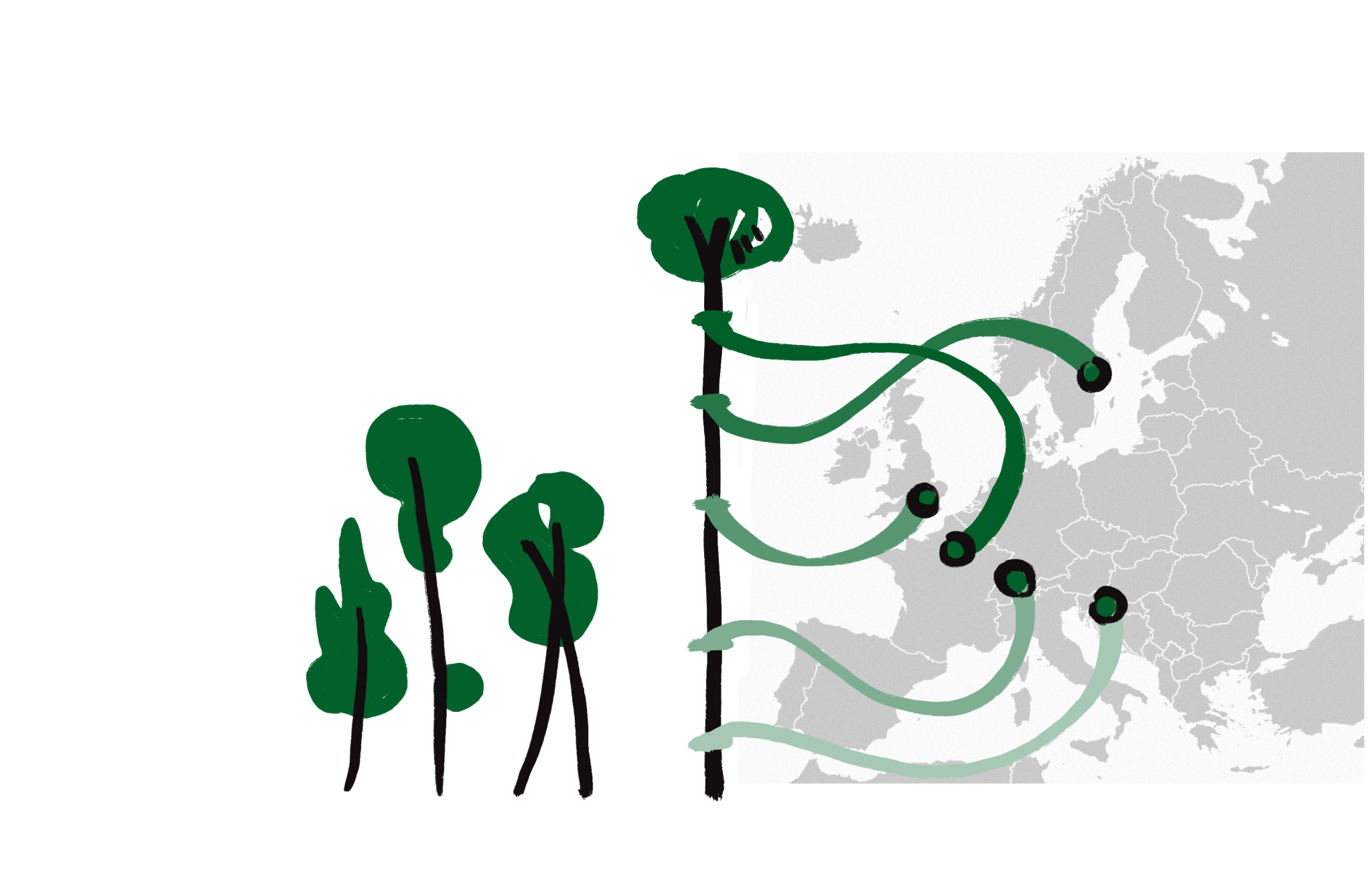

Octopus has eight retail energy businesses around the world, in the UK, Germany, Spain, Italy, France, the USA, Japan and New Zealand. The UK is its largest market by far — it had 3m customers in the country before taking on an additional 1.5m from Bulb. Its next biggest market is Japan.

Aside from the retail energy business, Octopus also runs an in-house tech platform, Kraken. It uses machine learning to offer customers insights into their energy usage — tech which has been licensed to incumbents like E.ON and EDF.

The Kraken platform also helps customers charge their EVs outside of peak times and then sell excess energy back to the grid. Vehicle-to-grid charging is part of the distributed energy network Octopus wants to pioneer — where energy is stored in assets like cars and renewables, rather than centralised power generation — and the company believes Kraken will be key to that.

Taken by itself, Kraken made a profit in the last financial year, and the losses for Octopus as an entity came from the energy supply side of the business. “I expect that we will be profitable in this year,” Jackson says — meaning the next tax year, up to April 2024.

Is an IPO on the cards?

Octopus has some big financial backers behind it. The company took its name from Octopus Group, a British asset management company, which wrote the company its first cheque. Since then, it’s secured a total of $1.7bn from the likes of Canada Pension Plan, Tokyo Gas and Al Gore’s Generation, according to Dealroom.

Jackson says Octopus doesn’t need to raise any more money at present, but “as a scaling business, you never really stop”. As the business comes out of the energy crisis, raising money to scale faster may become the appropriate thing to do, he says.

Asked if an IPO could be on the cards, Jackson says: “Everybody thinks about it from time to time. We have a natural preference for private money. There may come a time when that [an IPO] is appropriate but it's not something where we're actively planning like that.”

A pan-European energy business

Outside of the UK, Germany is Octopus’s next largest market in Europe, but it’s also expanding deeper into other countries.

Earlier this month, it announced a plan to invest €1bn into the French market. Octopus already has a branch of its Kraken business based in Paris, and acquired French energy provider Plüm énergie in early 2022 to gain a foothold in the country.

The €1bn announcement was made at a press conference alongside French president Emmanuel Macron and UK prime minister Rishi Sunak.

The company has strong connections with the UK government. According to Open Access, which collates government meeting records, Octopus has met with British officials over 60 times in the last two years — and Jackson says the team is developing connections to help expand across Europe.

“We're building sophisticated teams in other countries, and that dialogue with policymakers and regulators is super important,” he says.

Across Europe, Octopus will compete with incumbent energy companies but, similar to the UK market, there aren’t any other young energy companies that have managed to reach the scale it has. Becoming a pan-European energy company is difficult, Jackson says: it requires huge amounts of capital and each country has quirks in the way its energy is supplied.

Jackson declines to name the countries Octopus is looking at next. “We're in the biggest ones obviously,” he says. “The opportunity to grow into those is very significant, but there are others that are interesting to us, too.”

*This article was amended on March 23 to say that Octopus CFO Stuart Jackson expects the company to hit profitability in 2023. It previously said he expected the company to hit profitability this financial year.