It’s well known that the tech and startup world is a boys club.

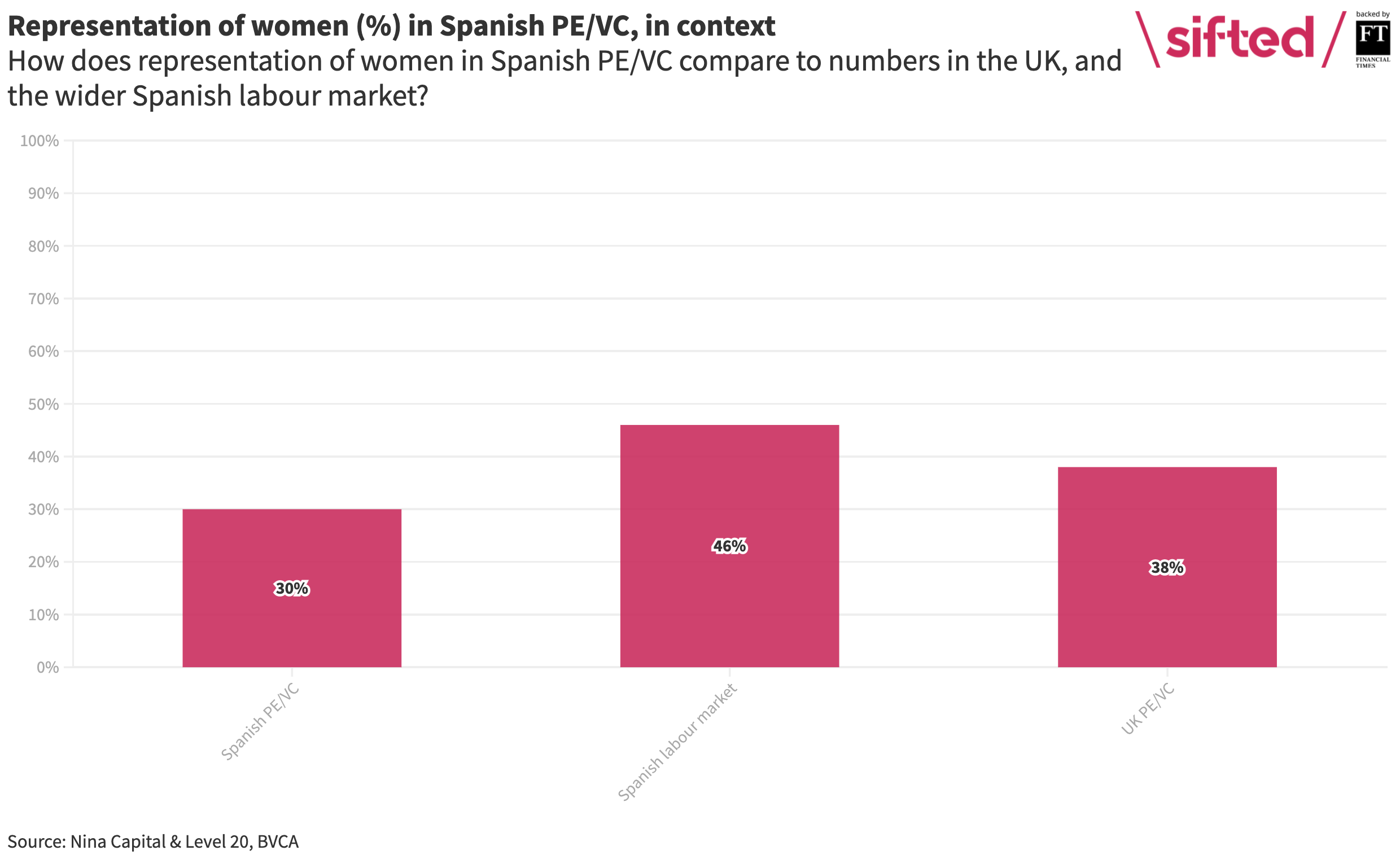

Recent data reported by Sifted found that women make up 38% of the workforce in private equity (PE) and venture capital (VC) in Europe. Spain is lagging even further behind when it comes to gender parity, according to a new report from Nina Capital and Level 20.

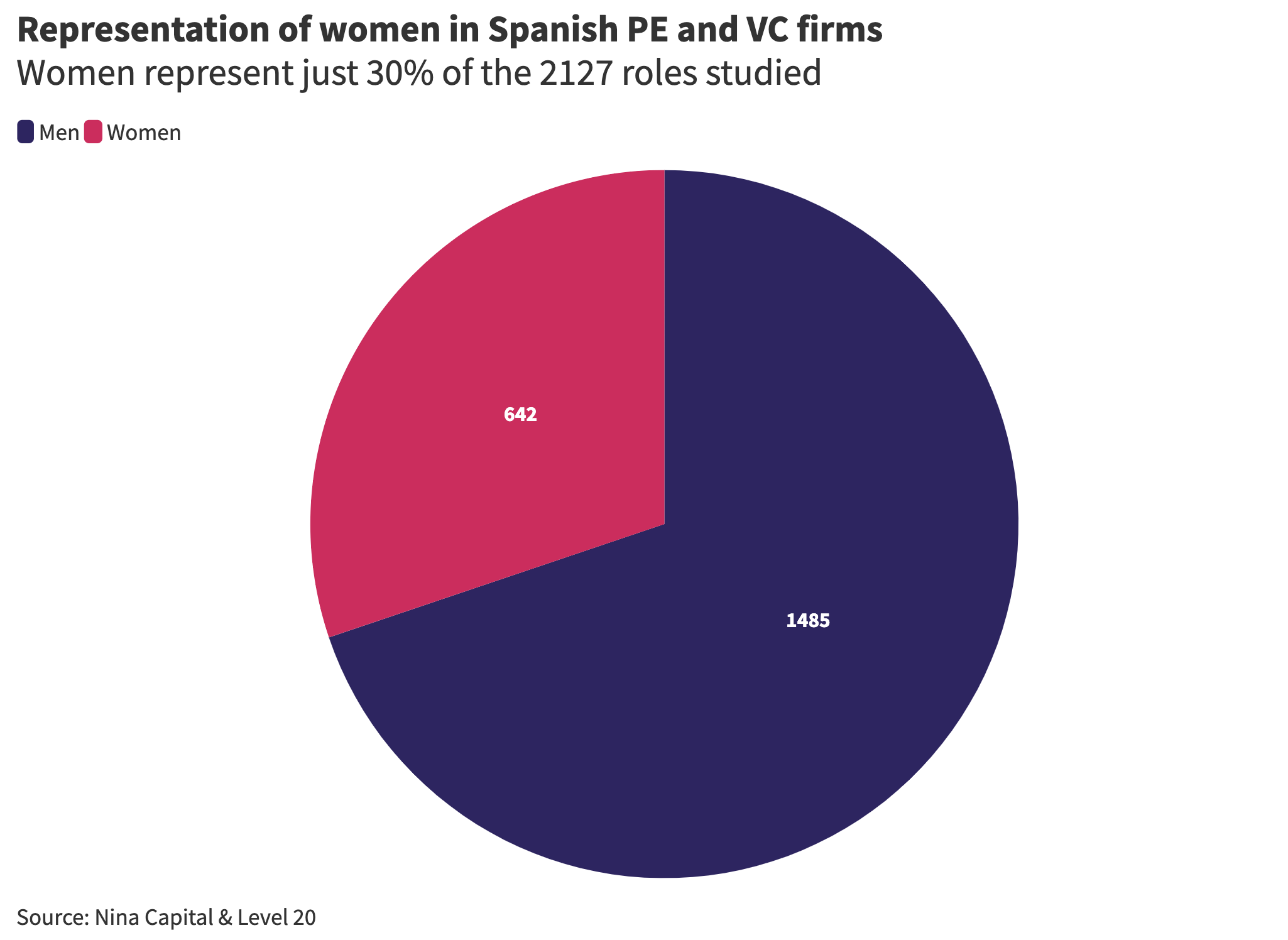

In what the authors claim is the first piece of major research into gender diversity in PE and VC in Spain, women were found to hold only 30% of jobs in the sector.

Marta-Gaia Zanchi, founder and managing partner of Nina Capital, told Sifted that the report will serve as a benchmark for the country’s investment industry going forward.

“There was actually no understanding of where we were in terms of gender diversity in Spain. So how do we know if we're doing better if we don't even know where we are today?” she says. “We wanted to help establish a baseline. And then as we continue to have initiatives to improve gender diversity in our industry, we'll be able to know actually working or moving the needle.”

There’s clearly a lot of work to do, given that women make up 46% of the country’s labour force, and due to the fact that Spain lags behind the European average for women in investment.

A huge lack of representation at senior level

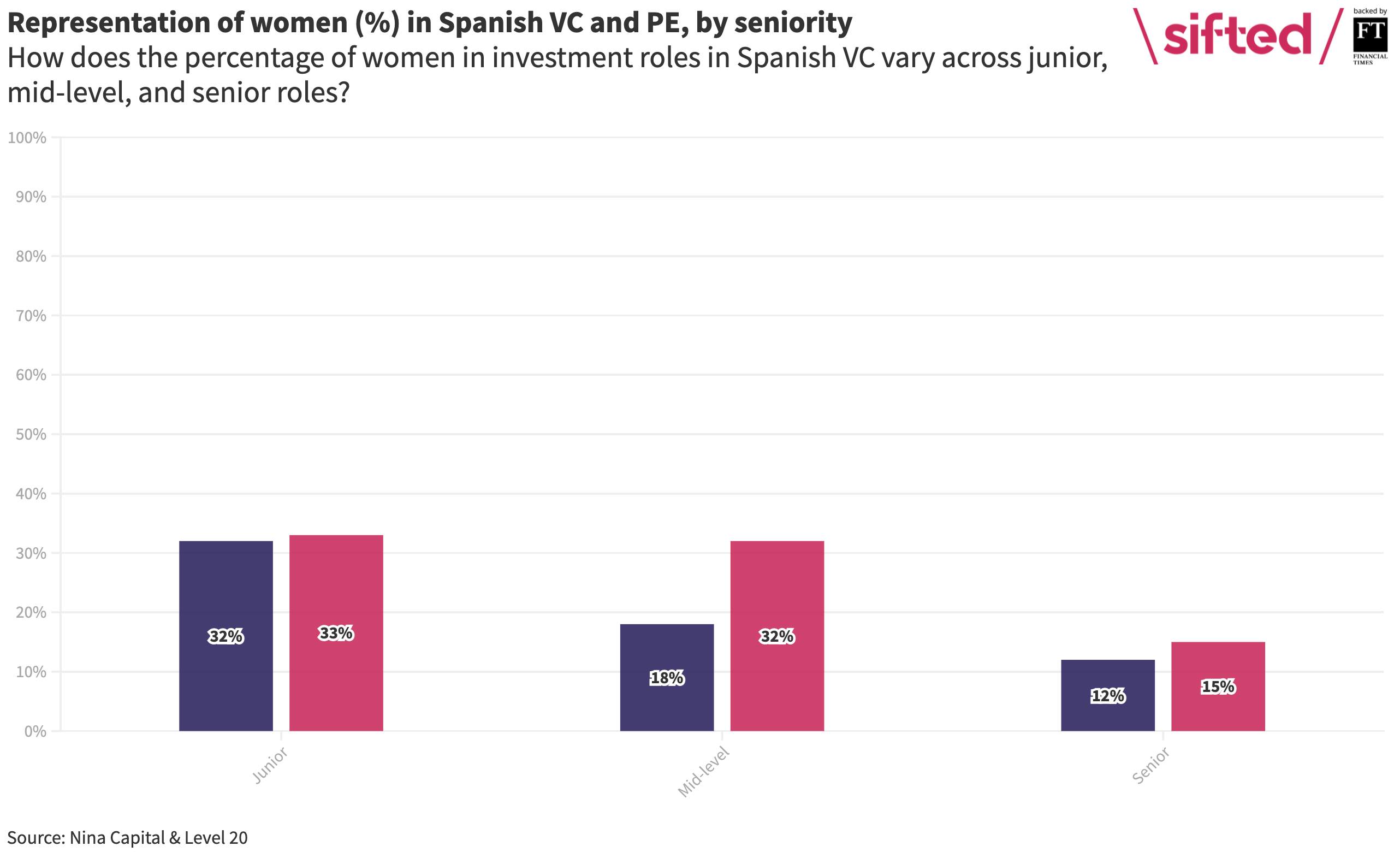

The picture gets worse when broken down by seniority.

When it comes to people working in investment roles (as opposed to those working in operations, marketing or investor relations), women hold just 12% of positions in PE, and 15% in VC, according to the report.

That said, Zanchi believes that the numbers of women joining the industry at junior level offers some room for optimism: “Some results were encouraging, for example, to see that the pipeline at junior level is actually good in venture capital and private equity makes us hopeful for the future.”

When it comes to mid-level positions though, Zanchi was less buoyed by the research, particularly when it comes to PE.

You have just 18% of women in mid-level investment roles in private equity, whereas it’s 32% in venture capital.

“Some of the results are a little bit more surprising and slightly alarming. For example, at the mid-level, we find that a lot of that gain is lost in private equity. That's where we saw the biggest difference between venture capital and private equity,” she says.

“You have just 18% of women in mid-level investment roles in private equity, whereas it’s 32% in venture capital. So something is not working. Something is blocking women from progressing in private equity from junior to mid-level and therefore, obviously, to senior level.”

Alongside building a comprehensive database of all jobs held at Spain’s PE and VC firms, Nina Capital’s research team also conducted more than two dozen interviews with people working in the industry.

“Having qualitative information — and not only the quantitative information — was very key because when you speak to people, they mention culture every single time,” says Yahel Halamish, Nina Capital head of investor relations. “This is the main reason for the big gap going from junior to mid-level to senior level.”

One of the interviewees quoted in the report, a senior-level employee at a PE firm, echoed this sentiment: “You are surrounded by males. You don’t have a group you feel comfortable with next to you.”

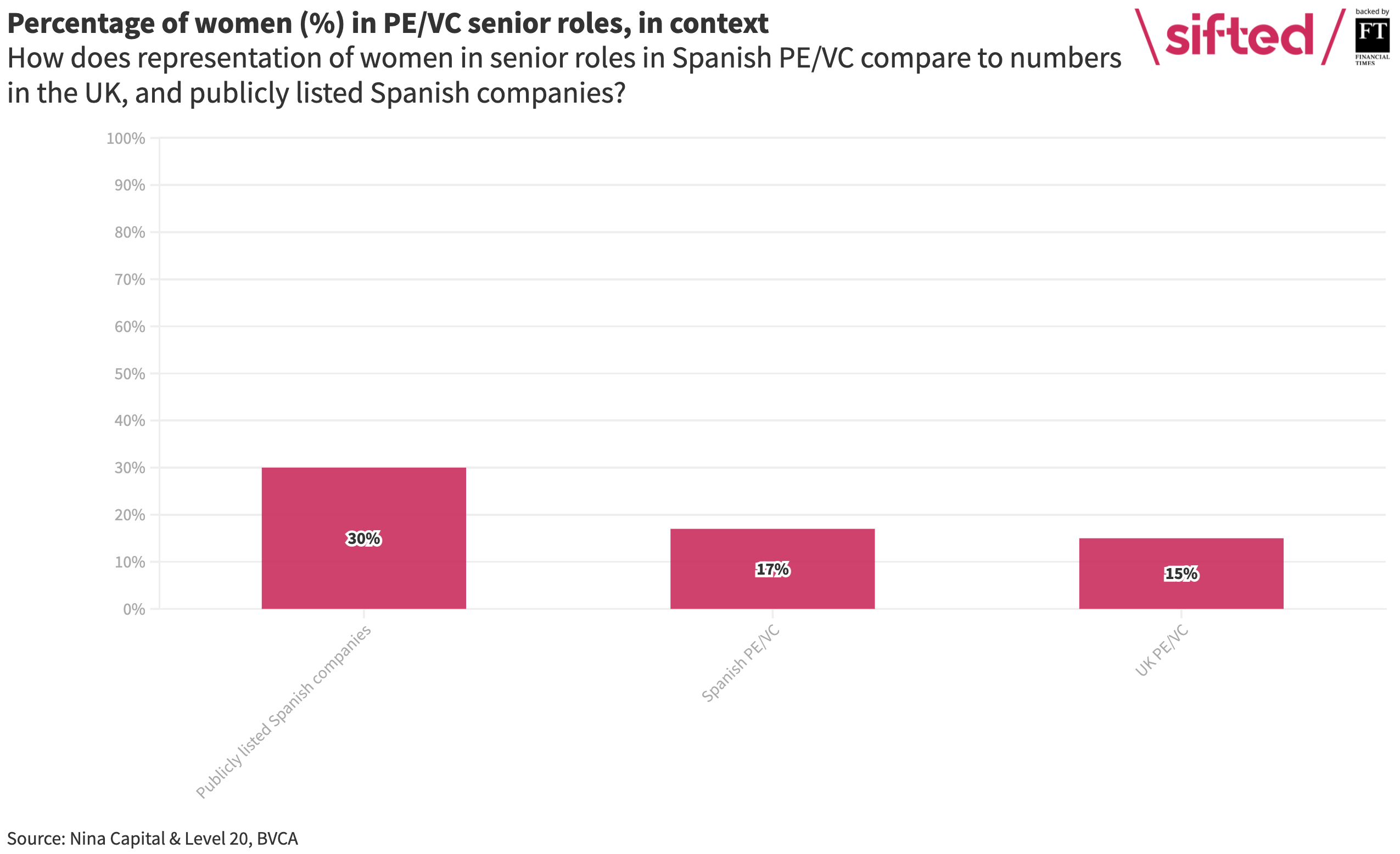

And even when non-investment roles were included, the report found that the percentage of women in senior positions at PE/VC firms was significantly lower than at publicly-listed Spanish companies.

Size matters

The fact that large Spanish corporations boast better gender diversity numbers at senior level than PE/VC firms demonstrates that smaller organisations often perform worse when it comes to diversity and inclusion.

Speaking to Sifted last year, Nerea Torres — chief executive of Siemens Logistics in Spain and president of EJE&CON, a Spanish association of women executives — said that macho behaviour in Spain was more common at smaller companies: “I think we really have to take care because this macho attitude and behaviour is even stronger in small companies where people feel more comfortable and reinforced in these attitudes.”

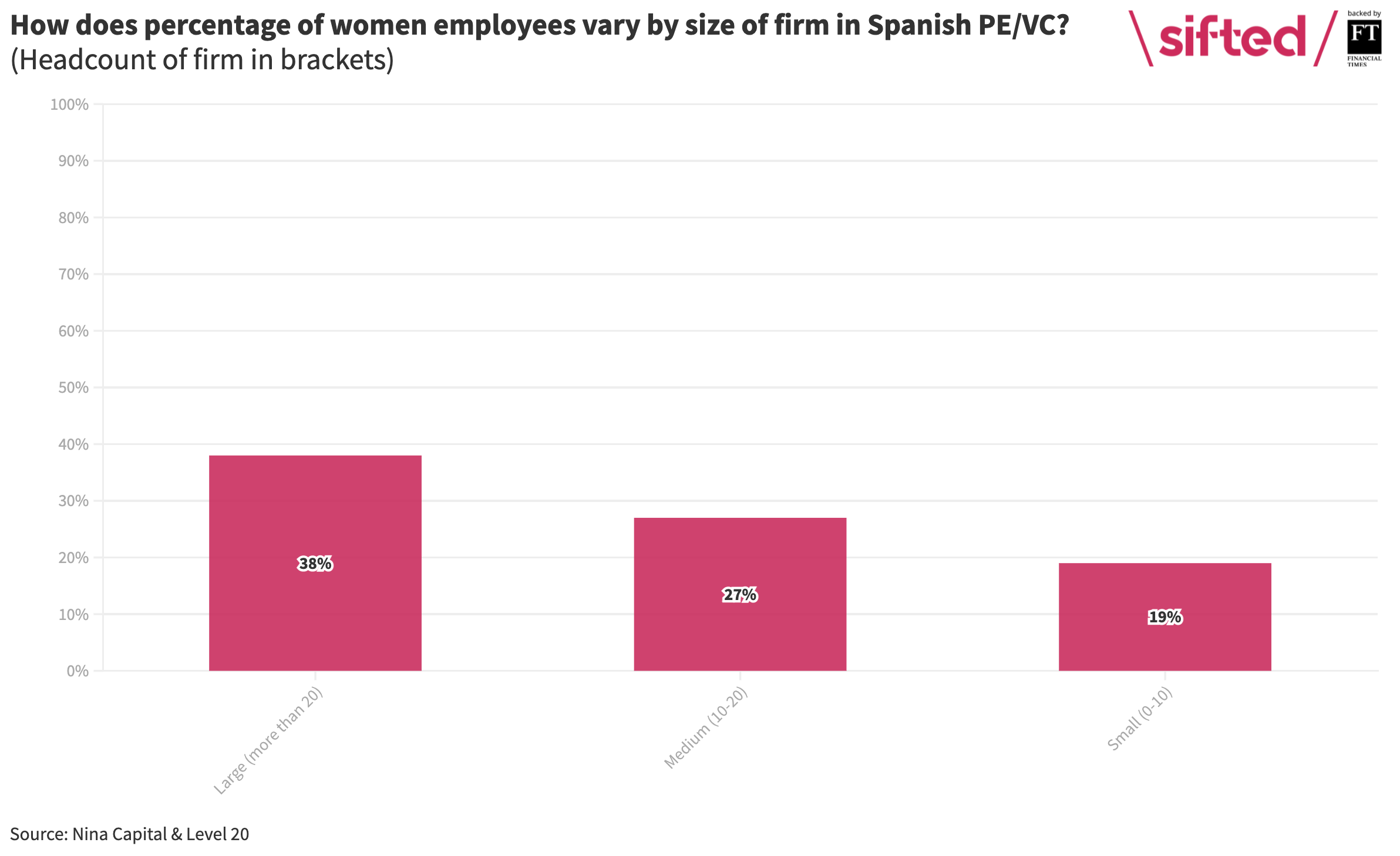

When it comes to representation of women at Spanish investment firms, the theory is also borne out, according to the report. Women held just 19% of positions at firms with 10 or less employees, compared to 38% at firms with 20 employees or more.

According to Nina Capital’s Zanchi, smaller investment firms in Spain are less likely to have formal policies when it comes to diversity and inclusion.

“Some of our interviewees cited the fact that small teams have not consciously and deliberately set out to create formal policies and written, communicated efforts to create a culture of inclusion where the senior professionals are kept accountable for creating diverse teams,” she says.

This isn’t to say that the problem is all of the investment firms’ own making. Another interviewee quoted in the report, a senior level male at a VC firm said that the pipeline of applicants for jobs makes things difficult: “In most of the cases, the ratio of CVs that we receive is around 90% males vs. 10% females.”

The Nina Capital report makes a number of recommendations based on these qualitative interviews. Among them is the need for investment firms to be more creative in their search for new talent, and to invest in diversifying their hiring pool.

It also argues for “imposing” parental leave on both men and women, and allowing for flexible work to help employees to better balance professional and personal life. Nina Capital’s report succeeds in providing a solid starting point for diversifying Spain’s investment industry, but it also underscores that there’s a lot of work still to do.