Over the course of 2021, researchers from Stanford University’s Graduate School of Business conducted an in-depth study of US corporate venture capital units. They interviewed senior team members of seventy-four CVC units, representing 78% of the active CVC units of companies in the S&P 500 index — a pretty robust sample.

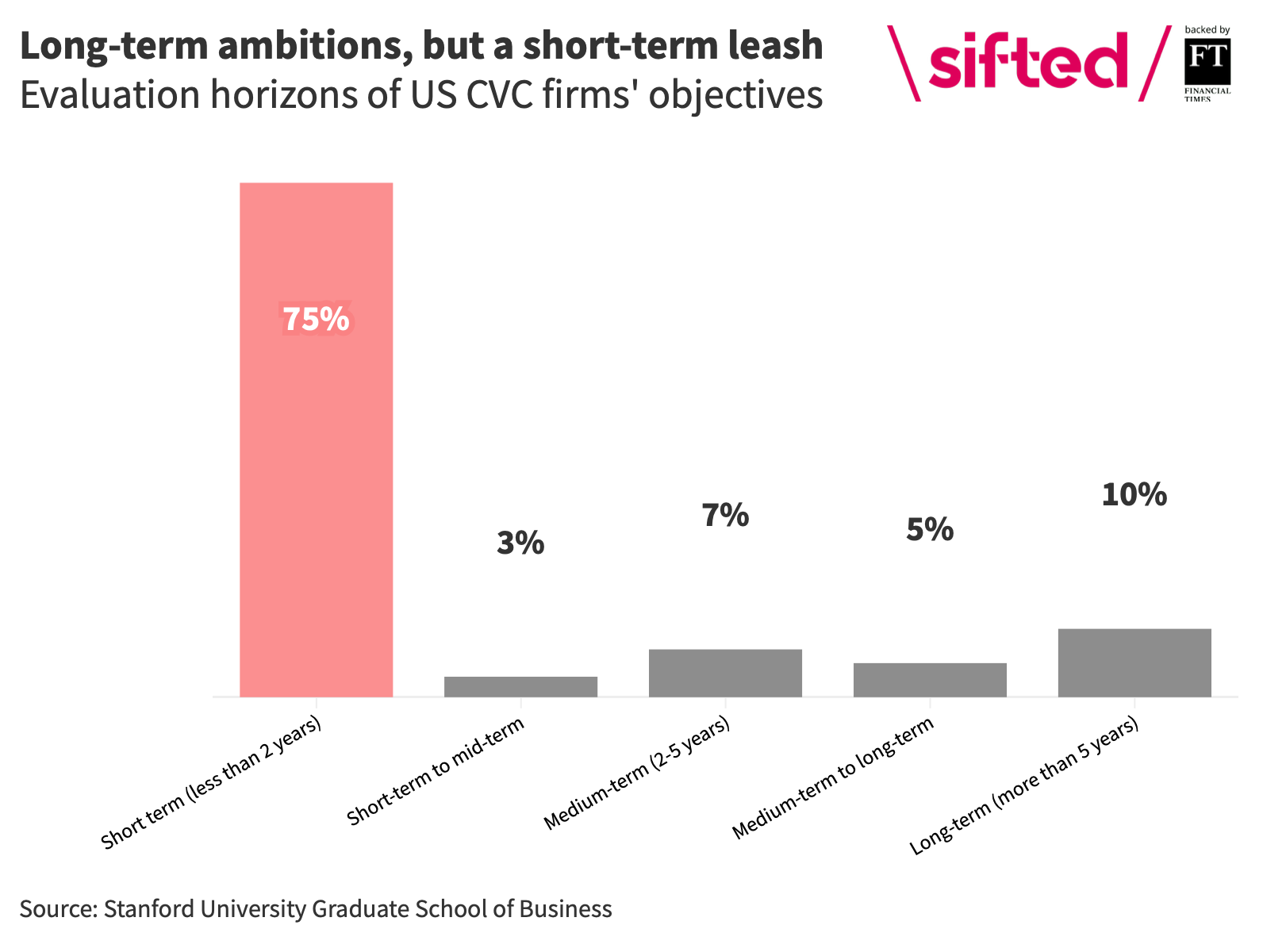

One number immediately leapt of the page for us. 75% of interviewees said that the evaluation horizon for their CVC unit was less than two years. And only 10% said their evaluation horizon was five years or more.

This seems puzzling, and really out of step with CVC units' desire to be working on similar lines to regular venture capital, which tends to invest on a 7-10 year time horizon.

Also, CVC units often tell Sifted that their primary mandate is to invest strategically — so CVC units are charged with making inherently long-term investment decisions. They often invest in unproven or emerging technologies and business models and are making bets on customer trends, needs and behaviours which may be one or two generational waves out.

CVC units are meant to help ringfence such investments, to protect them from the inherently short-term nature of the parent company's financial reporting, and the analyst scrutiny of forecasts, earnings and quarter-

to-quarter comparisons that go with it.

But this research says that internally, CVC units' objectives are being set and measured with a timeframe that seems to jar with the long-term nature of their charge.

This is likely to play out in one of two ways:

- The short-term nature of objectives and evaluation skews investment — and the team focuses, at least partly, on startups that can provide a return in the short term, regardless of whether they are the right strategic choices.

- The CVC unit makes the right plays for the organisation but is deemed to be under-performing when judged by the short-term objectives — potentially lining up clashes between boards and CVC executives, and potentially hampering remuneration (and therefore the ability to attract and retain already hard-to-find investment talent).

We've been left a bit baffled. Three immediate questions come to mind:

- Is this happening by design at these CVC units? Or is there an intention to pursue a long-term strategy, but in practice the organisation simply defaults what it knows best — short-term evaluation?

- Is this finding from the US as prevalent in the UK and Europe?

- Can anything be done about it? Can CVC units set up any mechanisms to give themselves that longer-term evaluation horizon?

Please comment below and help us shed some light on this.